Miners Stockpiling Ethereum in Anticipation of Protocol Shift

Ethereum’s transition to a proof-of-stake (PoS) algorithm is expected to take place in early 2022, after which validators will start to be responsible for processing transactions. To earn passive income on the Ethereum network, you’ll no longer need graphic cards or ASICs. Instead, you’ll just need to stake coins in blocks of 32 ETH (~$96,000). Many miners are already getting preparing for the change and staking their ETH

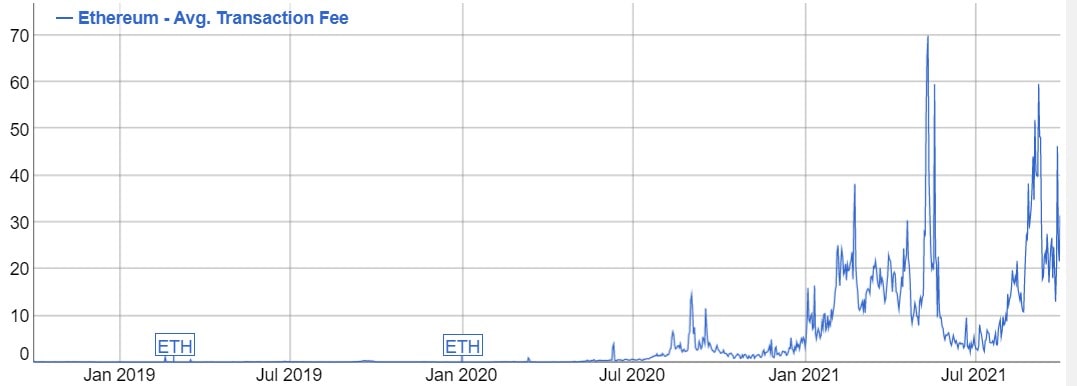

The leading altcoin has a capitalisation of $354 billion and is still one of the most promising in terms of growth. However, in September, it somewhat lost ground in terms of the rate of growth to its ‘killers’, Solana (+23%) and Avalanche (+52%). Currently, Ethereum’s operation depends on miners, and the limited speed of the proof-of-work (PoW) algorithm is leading to higher transactional costs. This opens the path for alternative projects, such as Solana, which boasts an average network fee of $0.00025 and operational throughput of 60,000 transactions per second

Nevertheless, Ethereum boasts a lot of authority and support, with 7,000 nodes and 90,000 validators versus Solana’s 600 nodes and 1,000 validators. After the transition to PoS and Ethereum 2.0’s complete deployment, the network’s capacity could reach 100,000 transactions per second.

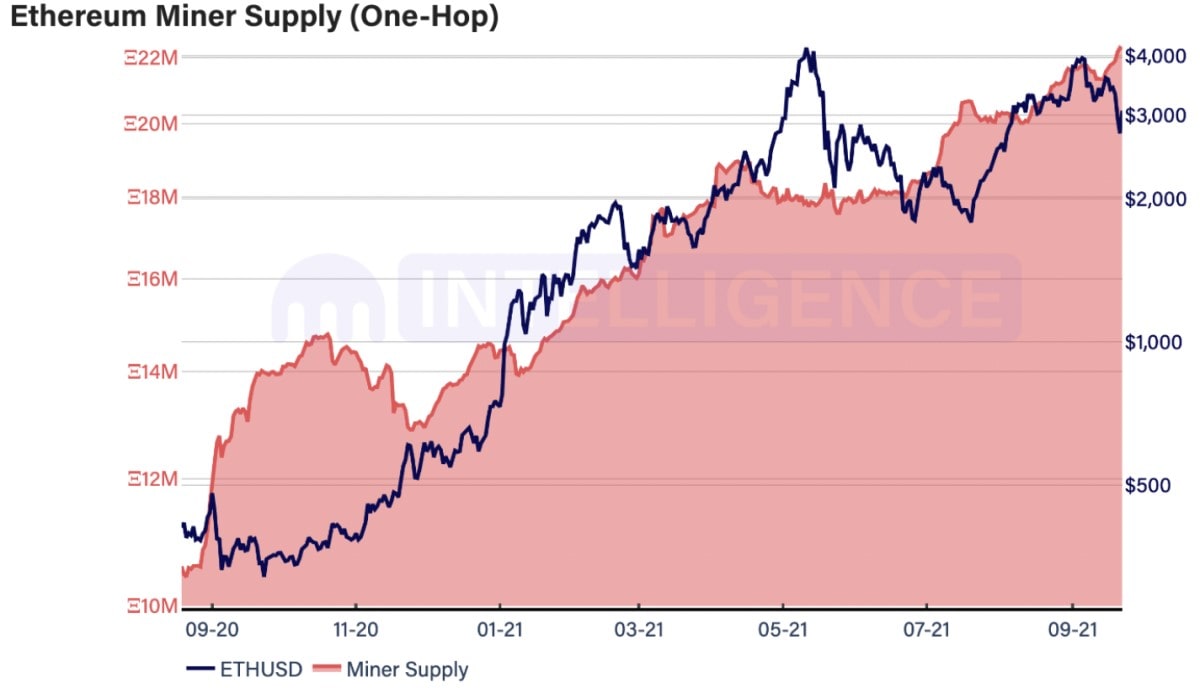

For these reasons, miners aren’t getting rid of their mined Ethereum at current prices but instead are continuing to increase their reserves and stake coins. According to estimates by Tom’s Hardware, after the London hard fork, miners’ revenues fell by 15% because of the nullification of the auction-based fee. That said, they didn’t try to compensate for their losses by selling off their coins. On the contrary, since improvements were implemented, miners have collectively added 2 million more ETH, raising the figure to 22.3 million ETH or 1/5 of the network’s total supply.

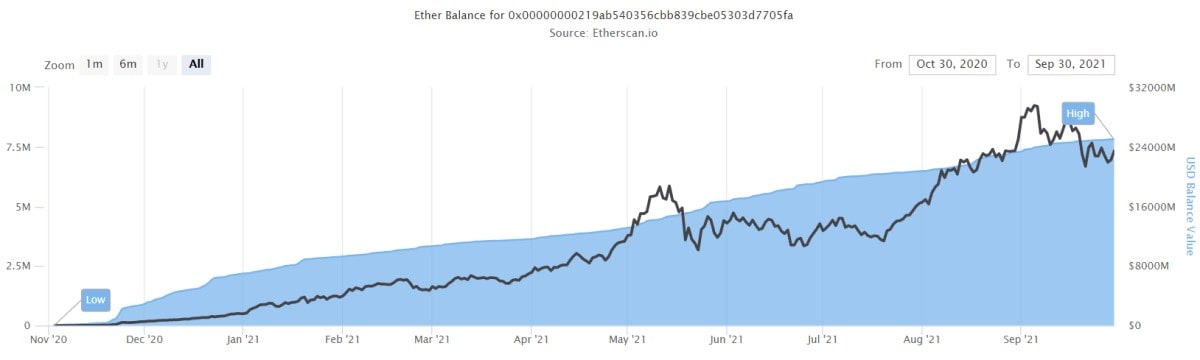

Users continue to stake their ETH in anticipation of the transition to a new protocol. They’ve already staked a total of 7.8 million ETH, which is equivalent to $23.5 billion. These funds can become available for withdrawals only after the transition to PoS, which is why many users are refraining from staking their coins at a higher rate.

According to the roadmap, before the two chains merge, the Ethereum network only has to go through one last hard fork, Altair, which is scheduled for the end of October. Reportedly, the transition to PoS should happen early next year. If everything works out smoothly and the deadlines don’t shift again, Ethereum has a strong possibility of seeing its price increase and even competing for leadership with Bitcoin itself.

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.