ETF monthly inflow covers a whole year of miners' operations

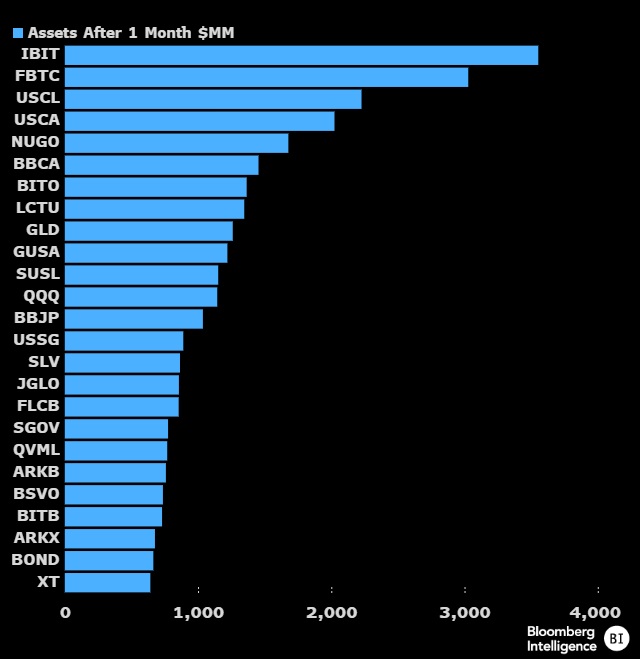

Demand for newly created ETFs is meeting the wildest expectations. In the first month of operation, they've accumulated $10 billion in investments. BlackRock and Fidelity's ETFs are the fastest growing among the 5,535 ETFs launched in the United States in the past 30 years.

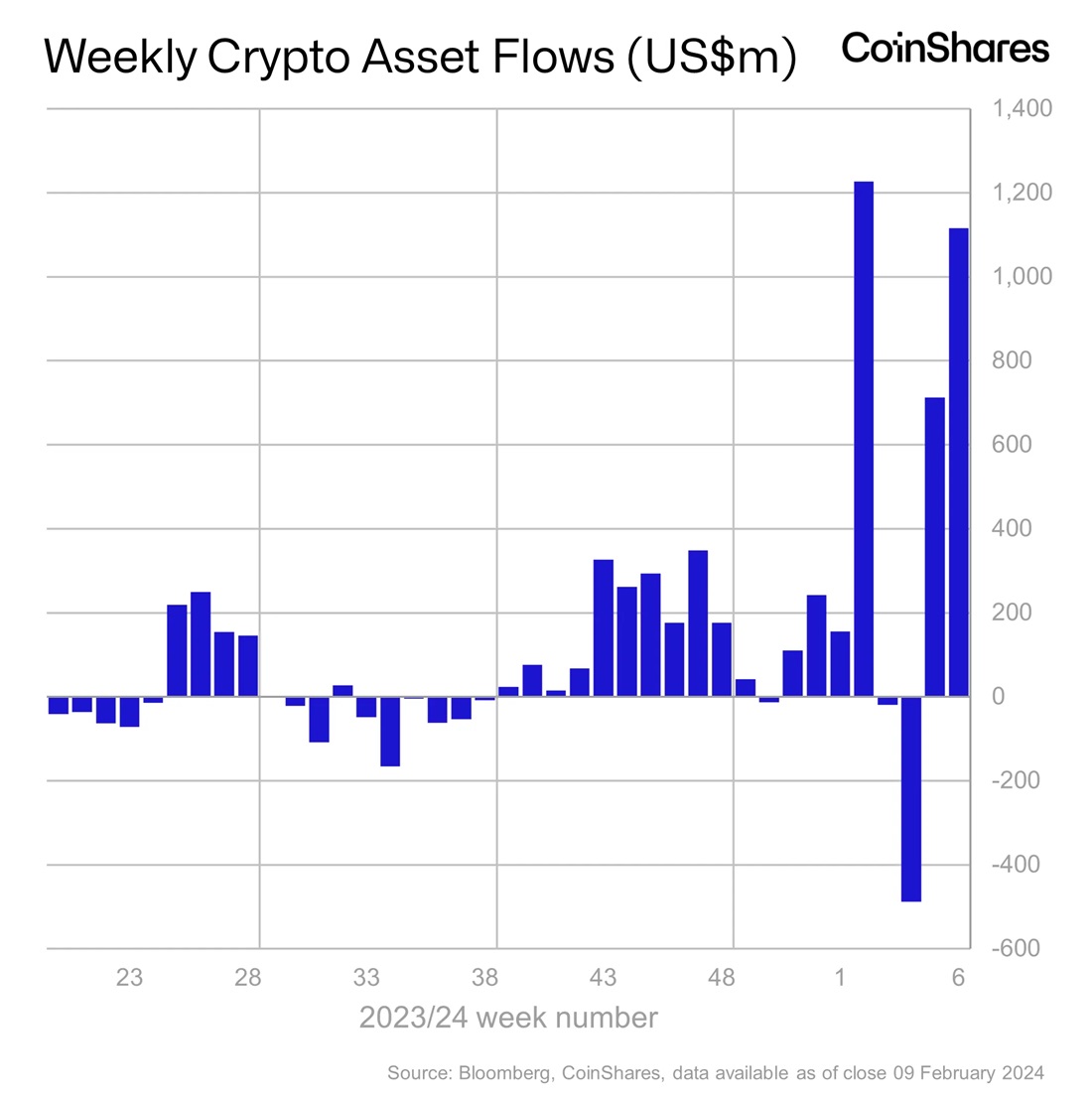

Last week, $1.5 billion was invested in crypto funds when excluding Grayscale, which is experiencing an outflow of funds from its GBTC ETF not related to Bitcoin's investment appeal. This is the second-largest result since the ETFs launched.

The cryptocurrency's price has surpassed the significant $50,000 market, meaning it's already compensated for the negative impact of GBTC and miners' desire to lock in profits ahead of Bitcoin's halving event.

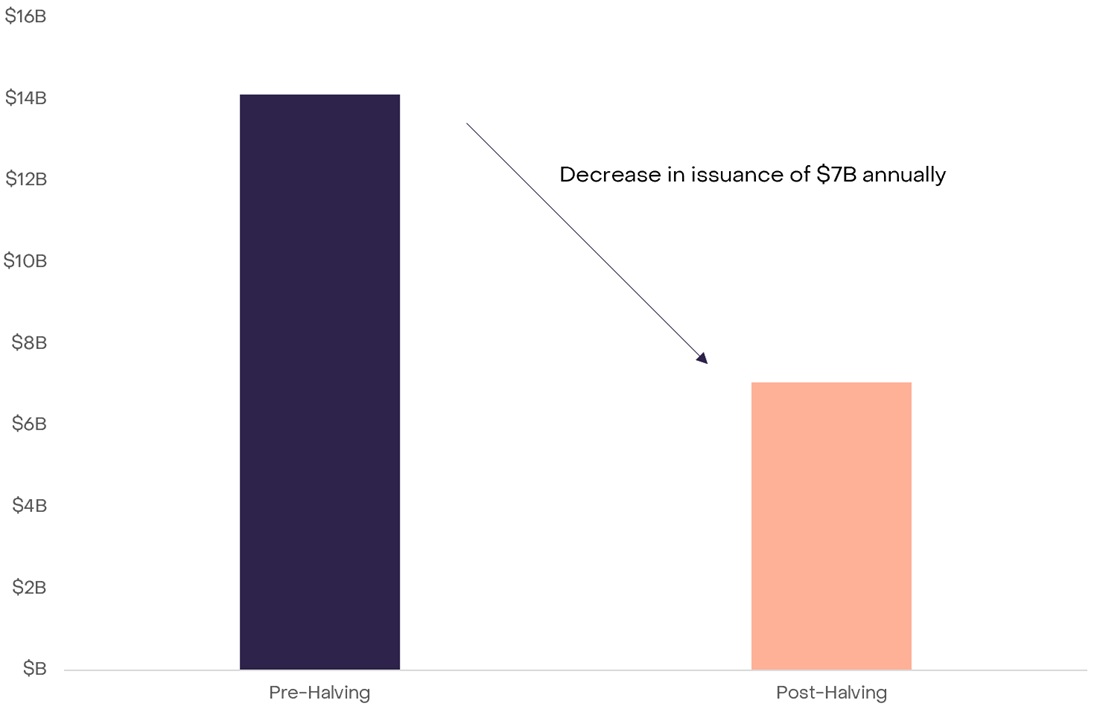

The halving event has a strong deflationary influence by cutting the issuance of new coins in half. If the annual pressure from new supply is estimated at $14 billion, after halving, it will decrease to $7 billion (these calculations were made for a Bitcoin price of $43,000).

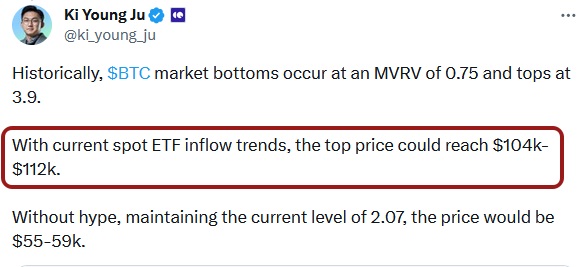

That means that one month of spot ETFs on the market was enough to make up for miners' annual production after halving. If the current pace is maintained, ETFs alone will create a powerful gap between supply and demand, which will result in the rise of BTC's price. The analytical agency CryptoQuant extrapolated the trend to the end of the year to arrive at a maximum target price for Bitcoin in 2024, which is between $104,000 and $112,000.

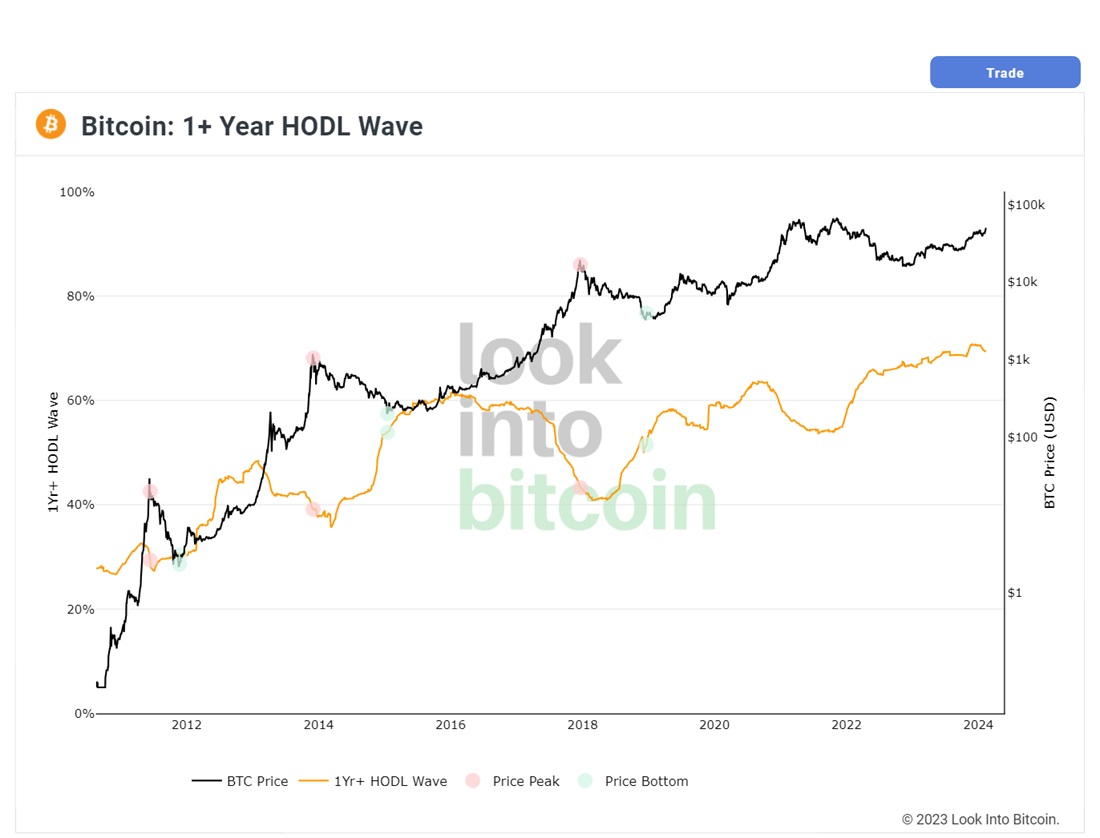

In addition to ETFs, long-term holders' reluctance to part with Bitcoin at current prices is another catalyst for BTC's rising price. A total of 69% of coins haven't moved in over a year.

Market participants' high estimate for Bitcoin's long-term prospects can also be seen in the relatively low share of derivative contract exchanges versus spot deliveries and the lack of excitement in margin trading.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.