National currencies' declines raise interest in Bitcoin

For over 120 days, Bitcoin has consolidated around $20,000, despite the US Dollar Index's 7% increase and weakness exhibited by most national currencies. The cryptocurrency's persistence has led to increased fiat-to-Bitcoin exchanges in recent months.

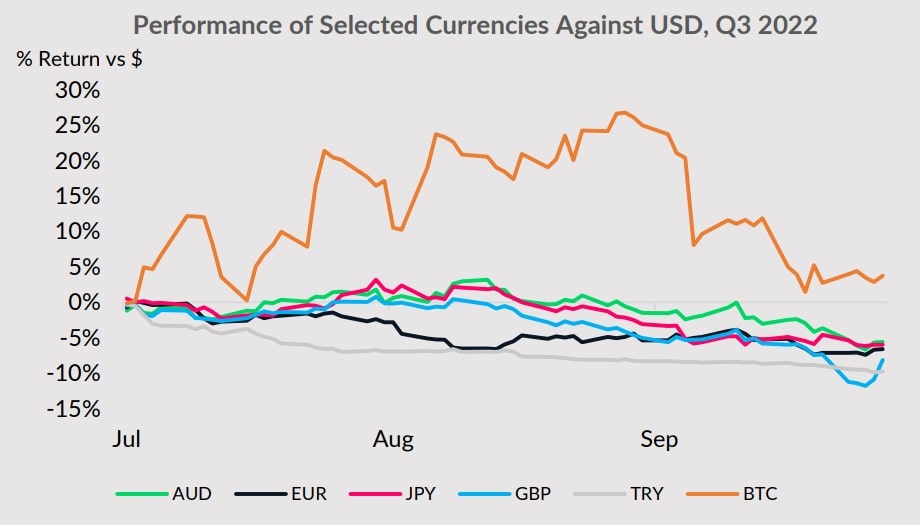

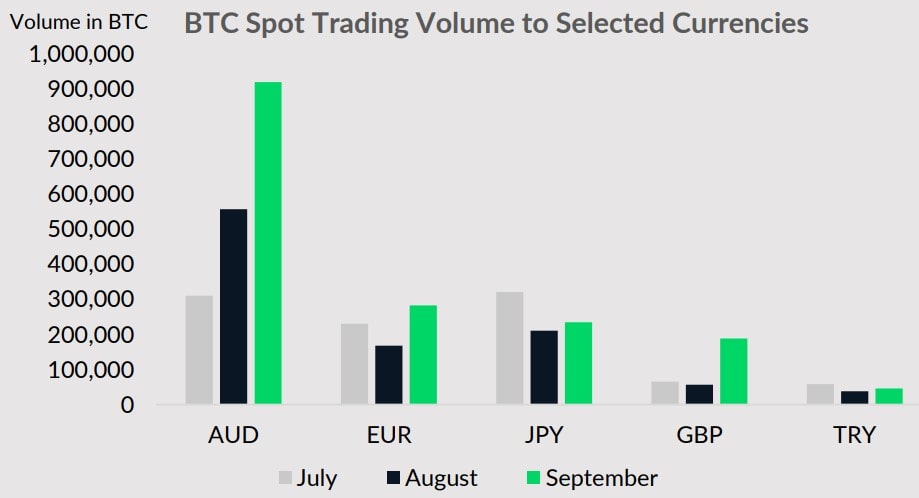

Q3 results show Bitcoin experiencing nominal growth versus the US dollar, while the British pound fell by 8.2%, the Australian dollar by 5.6%, the Japanese yen by 6.0%, the Turkish lira by 9.8% and the Euro by 6.6%. This divergence caused a surge of interest in the cryptocurrency. As a result, in September, the Bitcoin/GBP pair more than doubled in trading volume, and the Bitcoin/AUD pair increased by 65%. BTC per month.

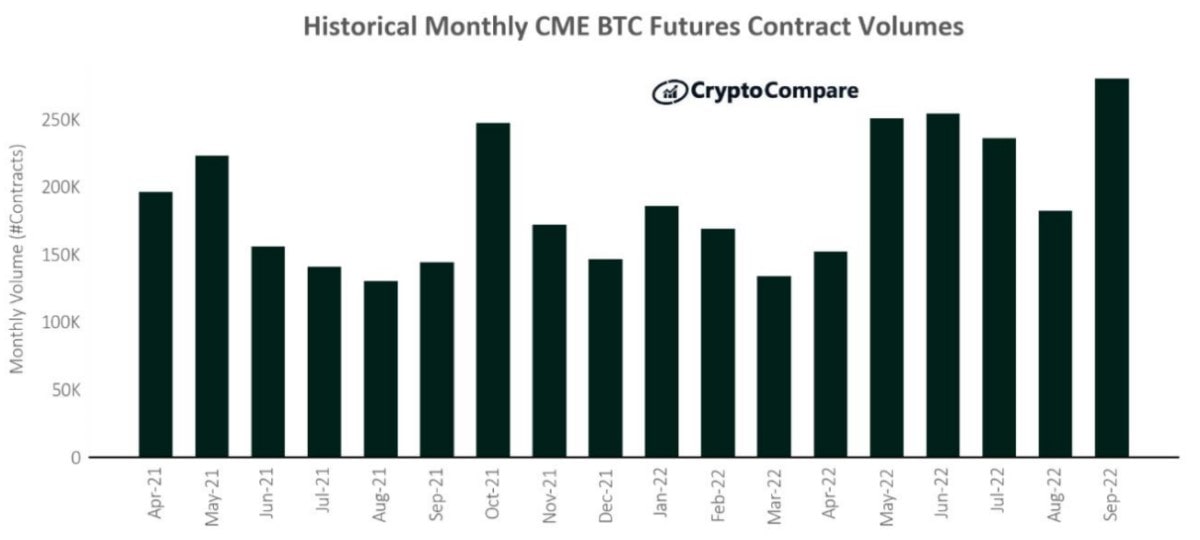

After a summer stagnation, the Chicago Mercantile Exchange (CME) saw an increase in interest in Bitcoin futures, rising by 53.6%, or 279,852 more contracts versus August, which is a record for the last 18 months.

Interest in Bitcoin is growing amidst ongoing inflation across the global economy and the expected rate hike by the US Federal Reserve in early November. The central bank's current efforts aren't producing meaningful results, as consumer price growth in the country remains strong (8.2% in September), and core inflation rose by 6.6% to its highest level since 1982.

This year, the Fed's key interest rate rose from 0.25% to 3.25%, bringing up rates on mortgages, consumer loans and business loans in its wake. Treasury bonds have also seen their yield rise. All this leads to investors wanting to sit out the storm with reliable instruments, even if they don't have the highest yield. An outflow of capital is being seen from high-risk assets to bonds, as well as from various countries to the United States.

Against this background, the stability and relatively low cost of Bitcoin look increasingly more attractive every day. If Bitcoin can hold up against the Fed's November rate hike, it will spark a new wave of interest in the digital asset.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.