Crypto's record-breaking October

Despite ongoing stagnation in the wider cryptocurrency market and near-zero activity among institutional investors, October still saw several new records set.

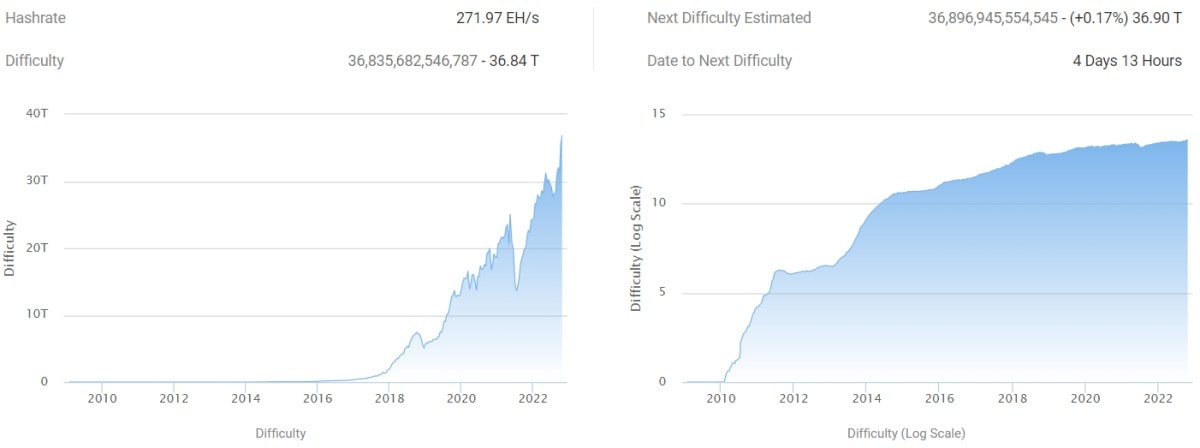

Bitcoin hashrate and mining difficulty

The 'industrial' mining sector is winning the market turf war as companies with a more balanced financial model continue to gobble up market share from under the noses of their less fortunate counterparts.

In a note to investors last week, top publicly traded miner Core Scientific stated that it could be facing bankruptcy. It currently has more than $1.3 billion of cumulative losses, and Bitcoin's decline in H1 2022 has now led to a severe cashflow deficit. It was unable to get itself out of its current predicament despite taking out numerous loans and selling off part of the biggest reserves in the public mining sector, some 15,000 BTC.

In direct contrast to Core, CleanSpark is buying up ASICs at unprecedentedly low prices, both from the machines' manufacturers and from bankrupt colleagues. During the bear market, companies have purchased an additional 26,500 ASICs, with 3,843 of these most likely purchased from Argo Blockchain. The average markdown on last year's prices stands at around 85%.

Because several miners are still increasing their capacity, the hashrate and network difficulty rose 20% over October to hit a new all-time high.

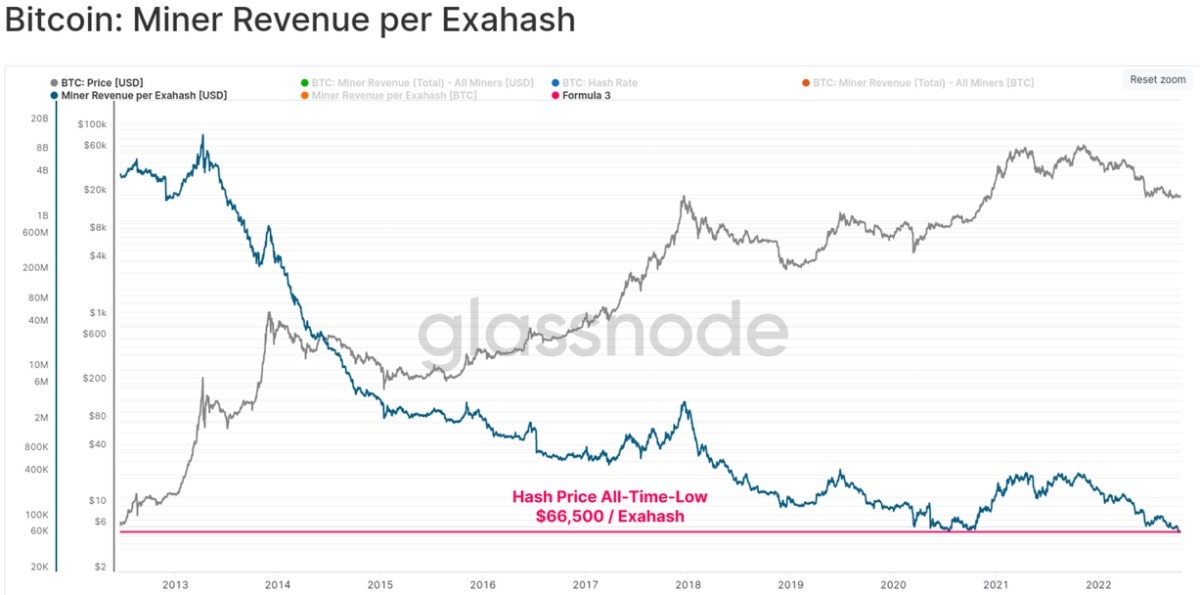

Bitcoin mining profitability

And since mining difficulty is rising in a climate of low prices, mining profitability also hit a new all-time low. Revenue per exahash thus fell to $66,500 in October, which augurs more tumultuous times ahead for the mining market.

Hacktober

If all that wasn't enough, hackers made sure yet another record was broken in October. According to data from Peckshield, last month saw malicious actors gain unauthorised access to $3 billion worth of coins, of which they were able to make off with $760 million. To put that into perspective, only $1.6 billion worth of assets were compromised over the entirety of 2021.

The worst hit was the Binance BSC blockchain, which had 2 million BNB (worth $586 million at the time) pilfered by hackers. Following timely action to freeze the network, the amount actually stolen was thankfully limited to just $100 million.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.