The outflow from Grayscale threatens Ethereum

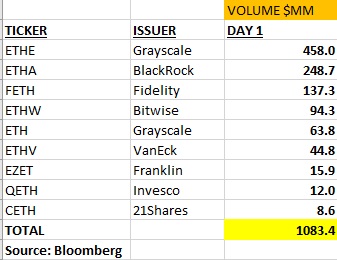

On 23 July, spot Ethereum ETFs began trading in the United States, providing access to the altcoin to more capital through standard brokerages. The new instruments' trade volume reached $1.1 billion that day.

This was 24.4% of the same indicator for spot Bitcoin ETFs, which corresponds to an optimistic forecast. However, in terms of net inflow, investments in Ethereum were six times lower than they were for Bitcoin, coming in at $107 million and $655 million, respectively.

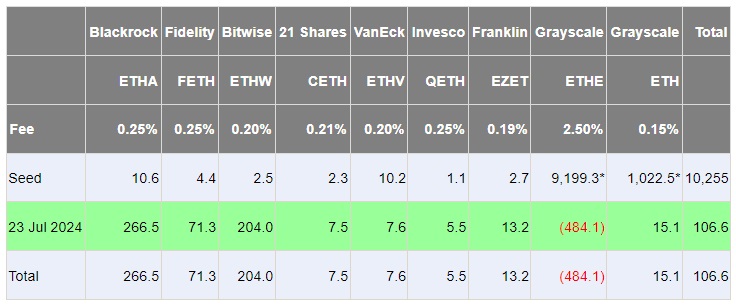

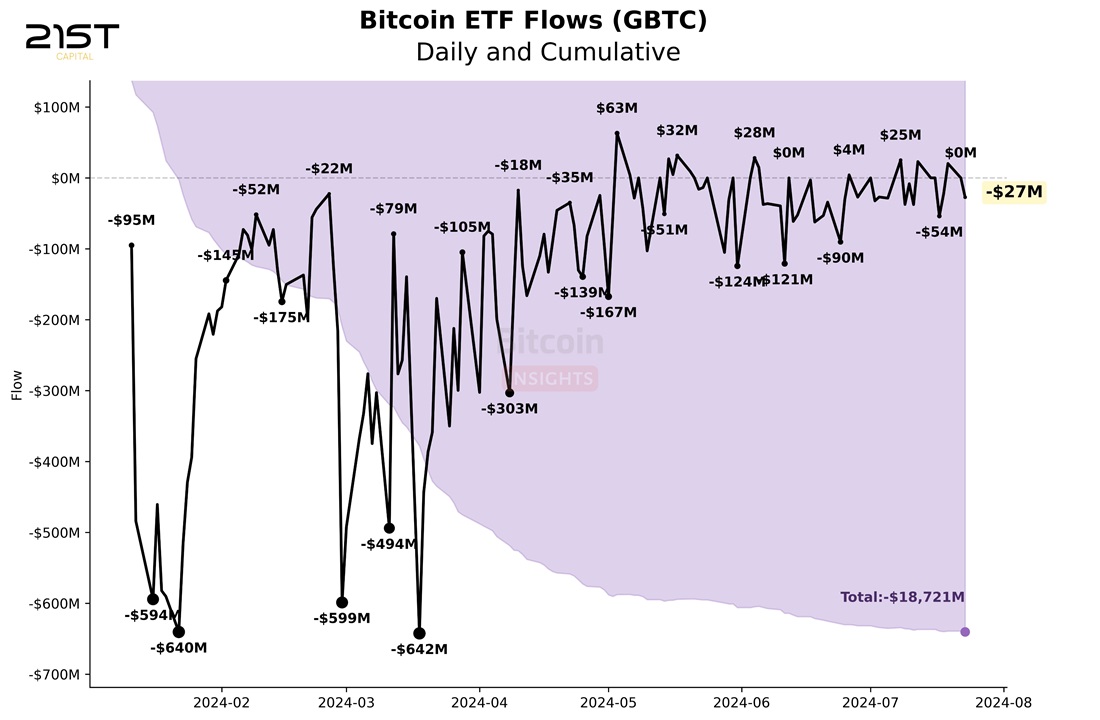

Such a big gap provoked an outflow from Grayscale, whose spot fund (ETHE) was converted from a trust fund. Previously, we have repeatedly pointed out the risks of negative impact, which is expected to be stronger than what's happening with Bitcoin funds.

Grayscale has a reserve of $10 billion in coins, which corresponds to positive forecasts for annual flows. The baseline scenario for attracting investments suggests reaching a quarter of the results that Bitcoin ETFs did, i.e., $4 billion in the first six months.

If ETHE 'bleeds' at the same pace GBTC did, investors will leave faster than new money will come into newly created ETFs by a significant margin. On the first day, ETHE lost $484.1 million, which is five times worse than GBTC.

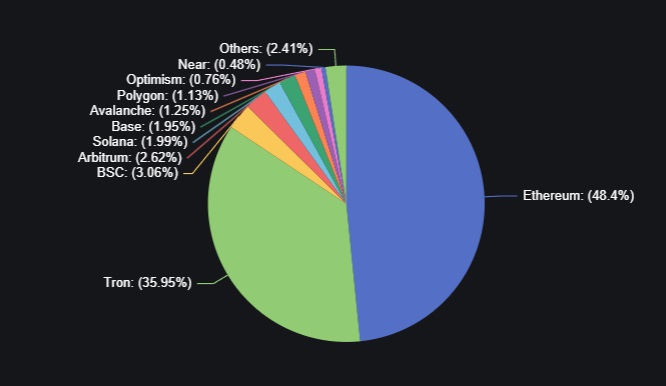

In addition to Grayscale, a number of factors could negatively impact investment interest. First of all, the lack of staking in ETFs has deprived the altcoin of the key advantage of passive income. Secondly, in terms of practical use, Ethereum continues to lose ground to competitors like Tron and Solana.

Ranking of blockchains by minted stablecoins

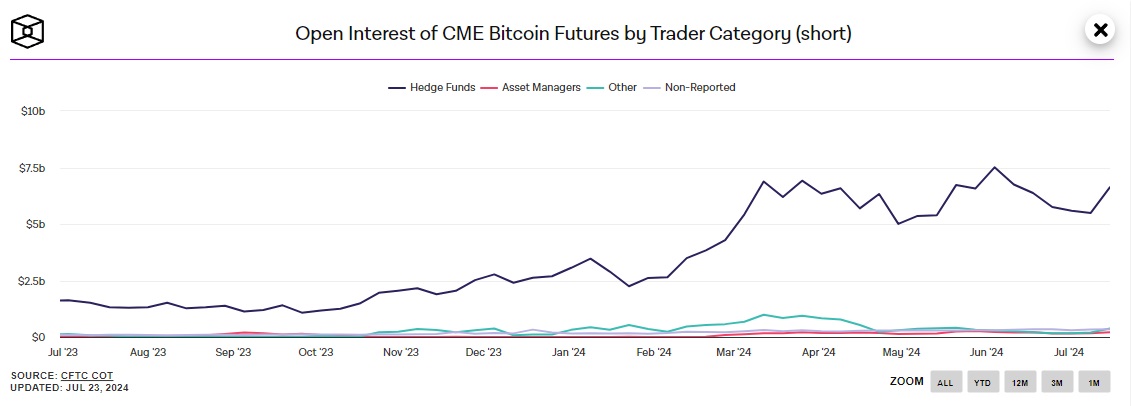

Thirdly, the relatively low funding rate will result in low demand from hedge funds. When Bitcoin ETFs were launched, the rate was 15% but rose to 70% in February. Because of this, their total short position on the CME reached $7 billion by the end of the third quarter (the hedging strategy involves buying a similar amount of coins on the spot market). For Ethereum, the rate is fluctuating between 7% and 9%, which is not enough for this group to be active.

It will be possible to assess which of the listed trends will prevail based on the results of the first week's inflow.

Preliminary analysis suggests that relatively weak investment interest and a significant outflow from ETHE will contribute to an increase in the gap between Bitcoin and Ethereum in the next three months.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.