Overview of crypto ETFs through January 2024

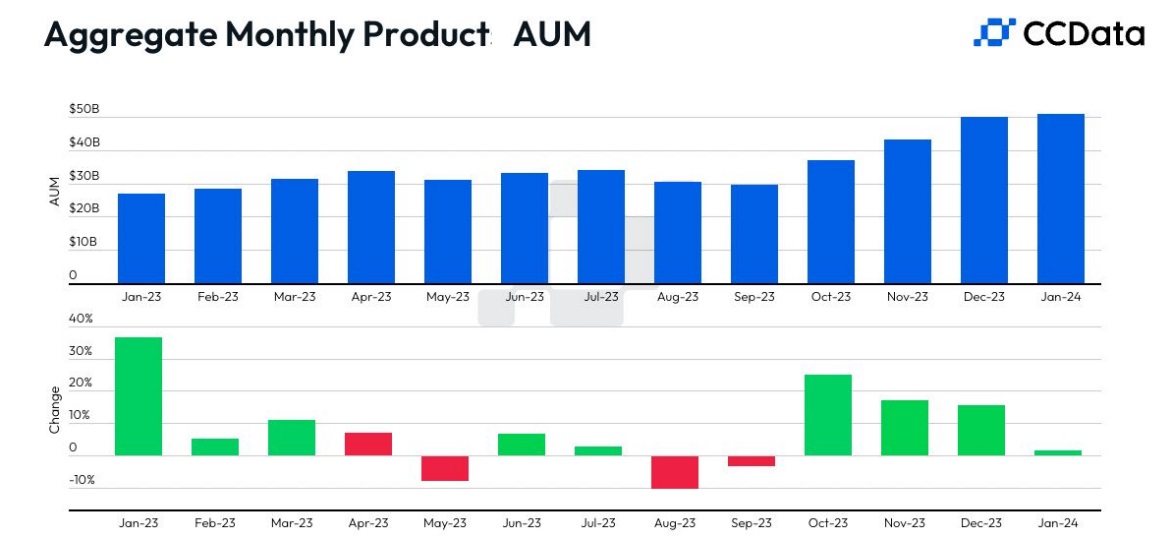

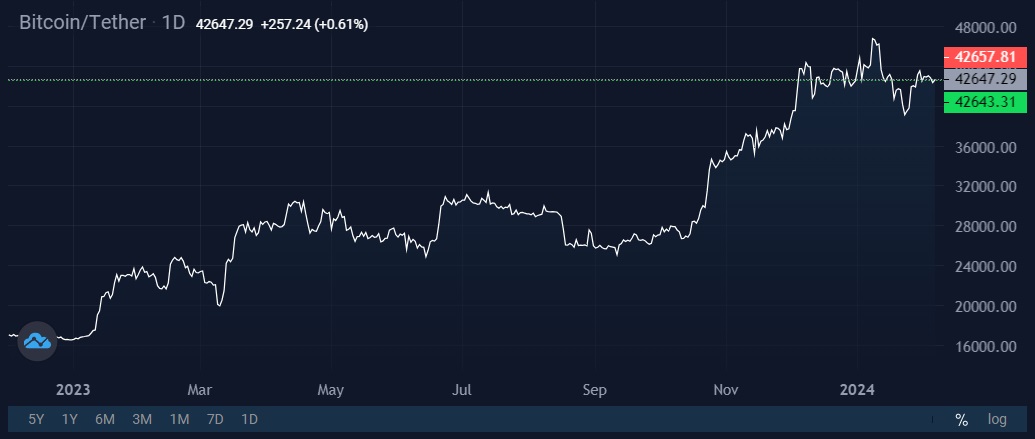

In January, the launch of spot ETFs shook markets, and Bitcoin became the second-place commodity (the SEC assigns it this status) after gold in terms of the volume of collected investments. The crypto ETFs' current total capitalisation is $50.7 million, growing by 1.5% in January.

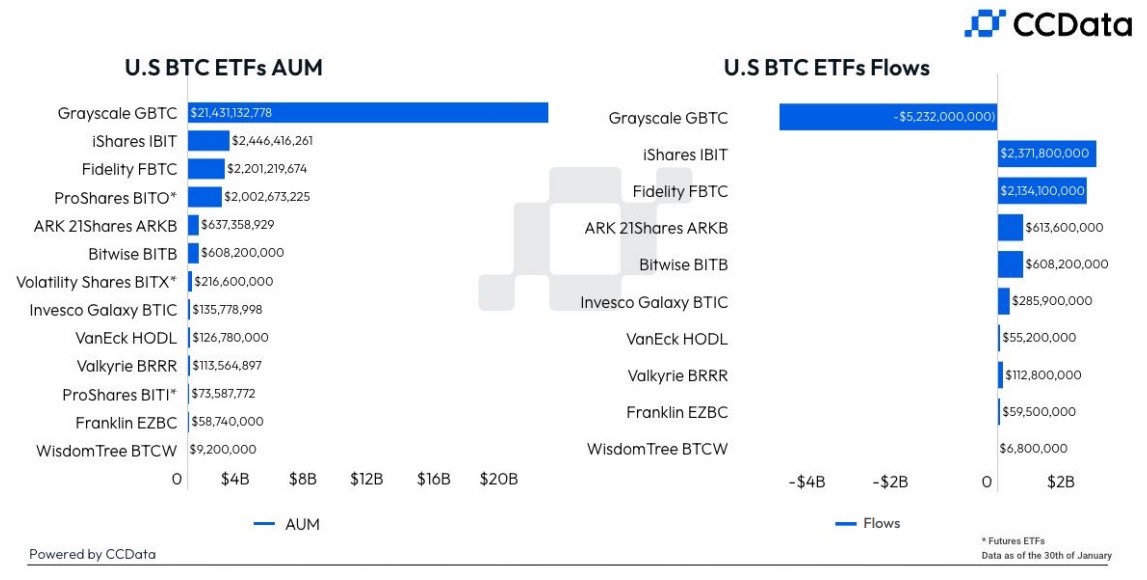

This modest gain is due to a large outflow from the Grayscale fund (GBTC), which was converted to a spot ETF from a trust fund. Ahead of the conversion, investors bought more than $3 billion worth of shares in 2023 alone, trading at a significant discount to the underlying asset. After the conversion, over $5 billion flowed out of the fund.

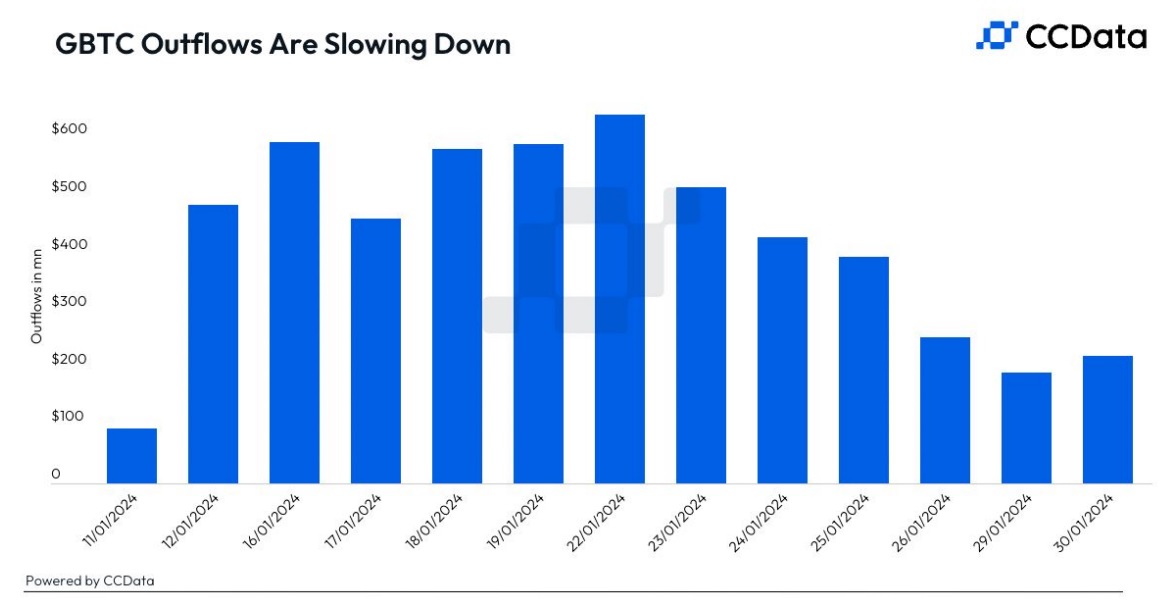

The second reason is Grayscale's 1.5% fund management fee. Other spot Bitcoin ETFs have a management fee of between 0.2% and 0.3%. The peak withdrawal from GBTC, $641 million, occurred on 22 January. After that, the negative trend began to decline. At the end of the month, it stayed below $250 million.

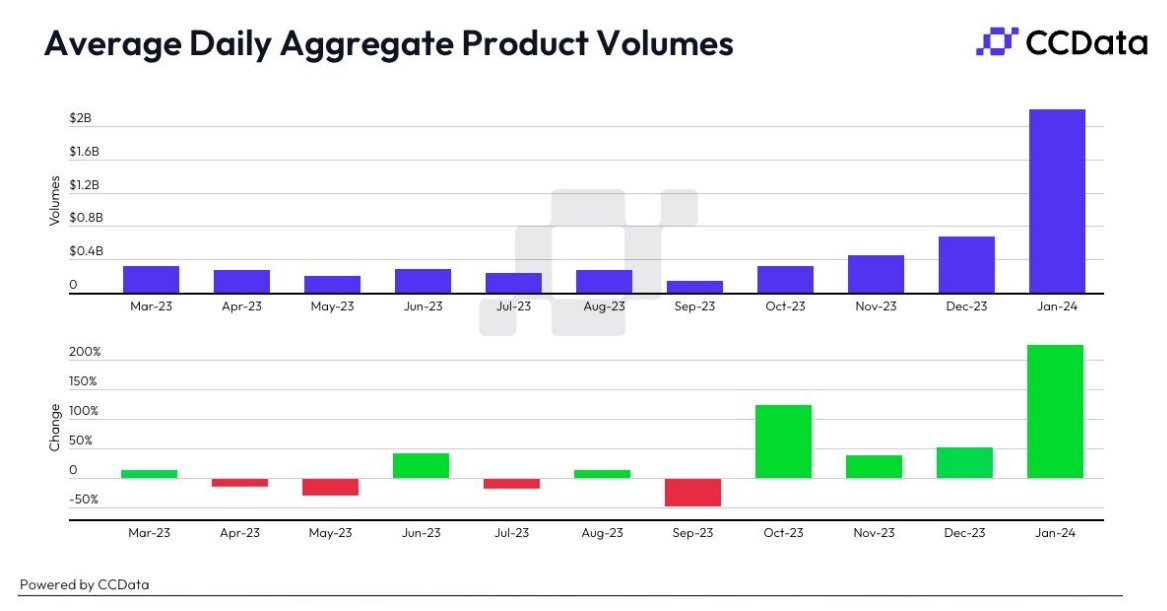

The large outflow from GBTC has blurred the picture of what institutional interest in Bitcoin looks like. In addition to net inflows, trading volume and open interest can be used to show this interest. The average daily trading volume jumped 224% in January to $2.2 billion.

Open interest in derivatives contracts on the Chicago Mercantile Exchange (CME) remains near record-high levels.

January was exciting, but hopes for Bitcoin's growth didn't pan out due to the capital outflow from GBTC and miners' desire to get rid of part of their reserves.

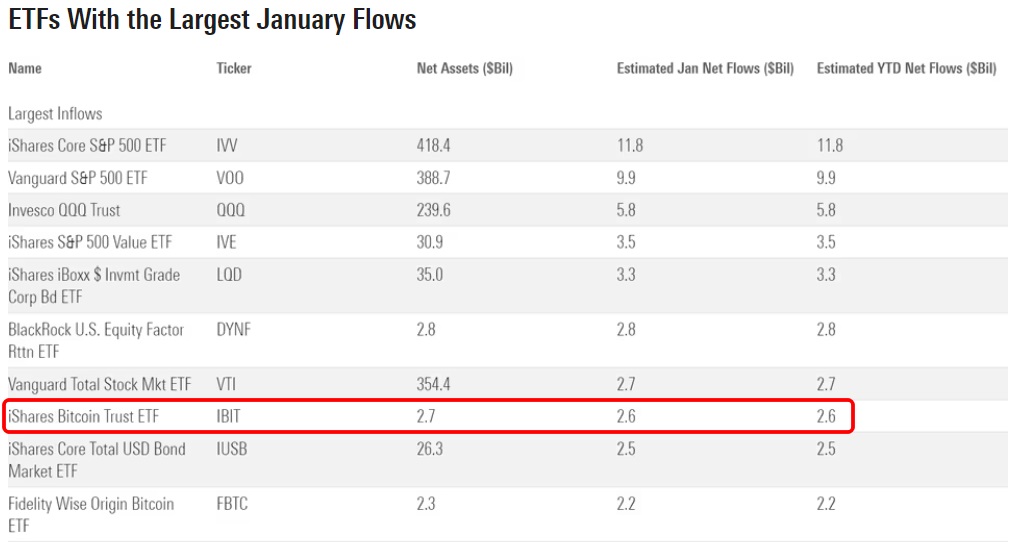

However, long-term trends point to significant interest in the cryptocurrency. BlackRock's fund saw nearly $3 billion in capital inflows in January, putting it at eighth according to this metric among all exchange-traded ETFs traded in the United States.

The most conservative estimates suggest that Bitcoin ETFs will attract $10 billion in investments in 2024, seeing the biggest effect from their launch in Q4.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.