Public miners spent $600M on ASICs in December

This year, miners returned to the arms race with a vengeance, bringing the total computing power of the network to 540 EH/s. This represents an increase of 2.2 times.

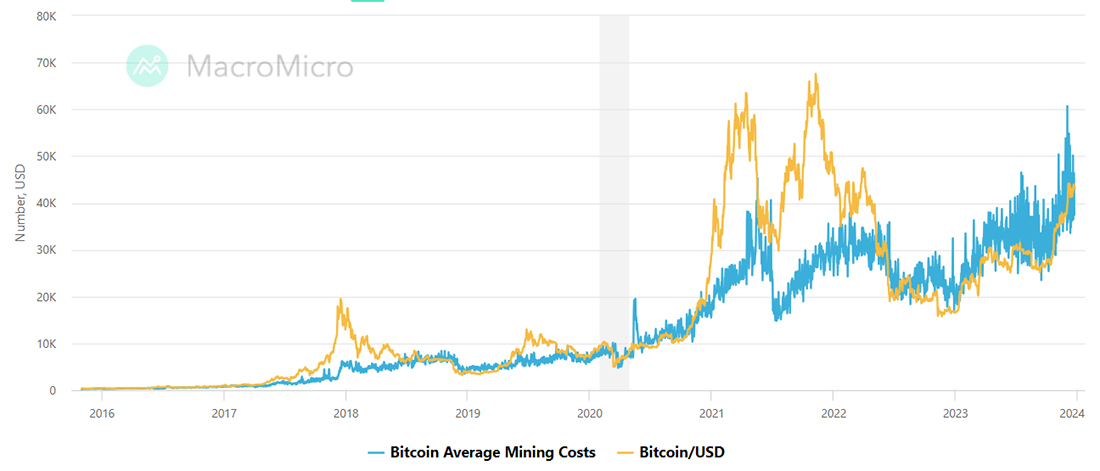

Due to a similar increase in complexity, the yield per terahash only rose from $0.06 to $0.09, and the average mining cost is keeping pace with the price.

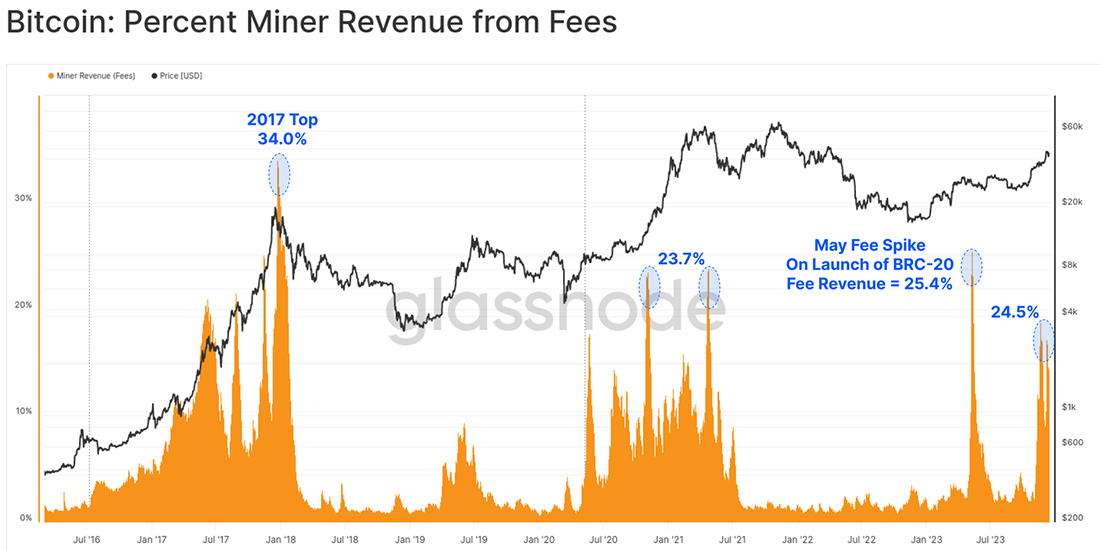

Moreover, the growth in profitability was largely down to the high demand for transactions and significantly increased commission charged. In May and December, miners were able to make up to 25% profit from their work.

As they continue to increase their capacity, miners are counting on a significant surge in the BTC price in 2024, which is expected once spot ETFs are approved. Estimates range from $60K all the way up to $120K.

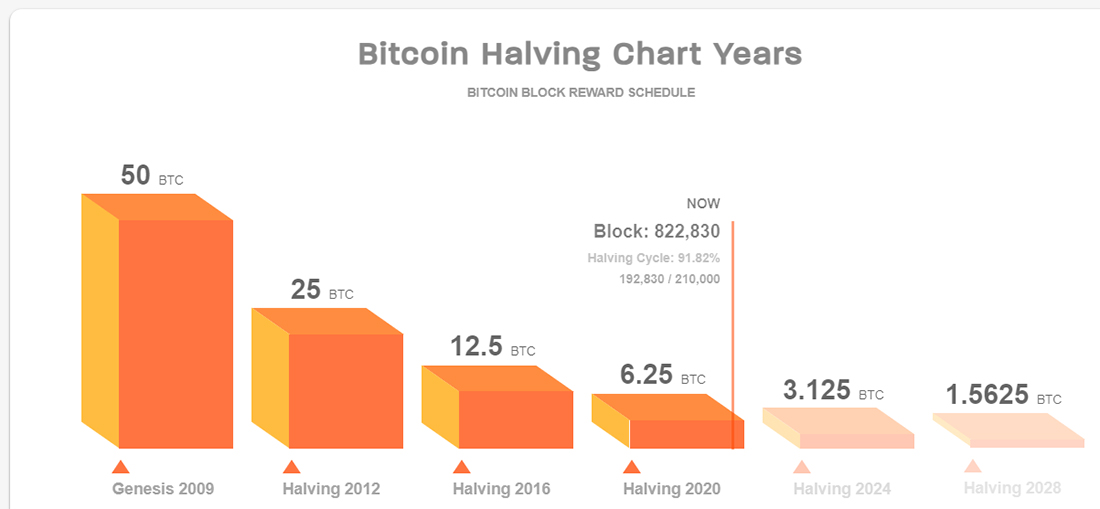

If these hopes are not met, crypto miners risk facing a fresh crisis, as the reward for finding a block will be halved to 3.125 BTC in April 2024.

According to the Financial Times, $600 million of the $1.3 billion spent in total by public miners on buying ASICs in 2023 took place in December. With BlackRock alone having met with the SEC six times in the past two months over its application, crypto miners consider the chances of spot ETFs being approved next year to be very high. The soonest this could take place is January 10, 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.