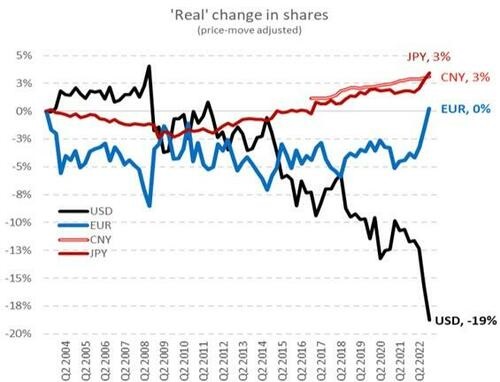

The share of the US dollar in global reserves drops from 73% to 47%

In 2022, the dollar's share in global reserves contracted ten times faster than it had over the previous 20 years. Analysts at Eurizon believe the reason for this was the application of mass sanctions. They opined that, "Without the need for us to take sides in this debate on Ukraine, it seems reasonable to speculate that the main driver of the collapse in USD's reserve status in 2022 may have reflected a panicked reaction to property rights being jeopardised. What we witnessed in 2022 was sort of a 'defund-the-global-police' moment."

As a result, the dollar's share in global reserves fell from 73% in 2001 to 55% in 2021 and 47% in 2022.

Meanwhile, China's yuan rose to 3% in global reserves, while international blocks, such as BRICS and ASEAN, are holding negotiations on lowering their use of the dollar in international settlements.

The shift away from the dollar is a long process, but the trend is now intensifying. As economist Peter Schiff said in an interview with Commodity Culture, "I think the current financial crisis which just started is going to ultimately deliver the death blow" to the US dollar's global reserve currency status.

One reason for the new crisis is the United States' move to tighten its monetary policy, which is having a destabilising effect around the world. China's Ministry of Foreign Affairs spokesman, Wang Wenbin, criticised the US Federal Reserve last week, saying:

The massive interest rate hikes by the US Federal Reserve since last year have significantly increased global financing costs and exacerbated disorderly international capital flows. This has not only led to the bankruptcy or takeover of some banks in the US and Europe but also made things more difficult for emerging markets and developing countries... We urge the US and other developed countries to prudently assess the spillover effects of their economic and financial policies, stabilise market expectations in a timely manner and avoid creating adverse shocks to global financial stability.

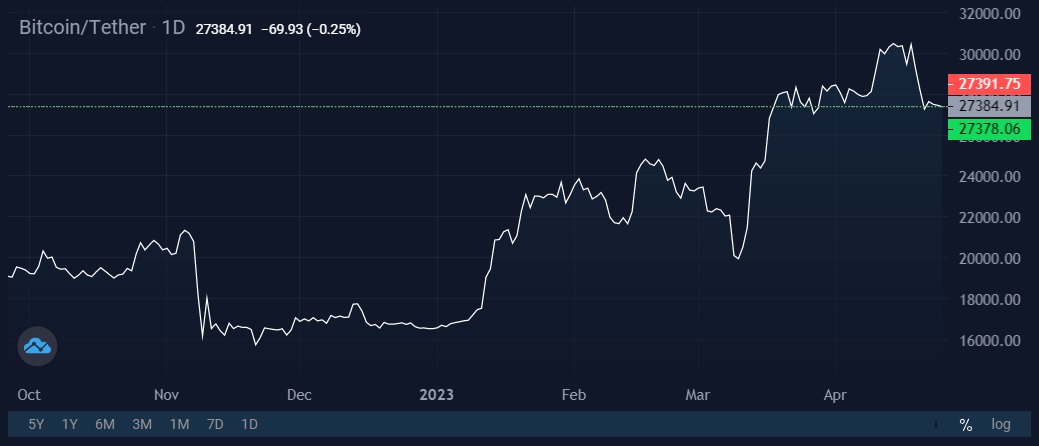

When it comes to moving away from the dollar, developing countries have several alternatives. El Salvador, for example, chose Bitcoin to be its legal tender in 2021. That allowed citizens who emigrated for work to send money to relatives with minimum commission. In 2019, the volume of these money transfers accounted for one-fifth of the country's GDP, or $6 billion. Of that, nearly 10% went to international payment systems in the form of fees and commission.

The Reserve Bank of Zimbabwe plans to launch a gold-pegged digital token to reduce inflationary pressures and the national currency's falling exchange rate. Previously, the country experimented with the US dollar as a unit of account, but the disadvantages outweighed the advantages.

As developing countries' efforts to move away from the US dollar gain momentum, Peter Schiff may be right about the current crisis putting the nail in the coffin of the US dollar's hegemony.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.