88% of short-term Bitcoin holders are in the red

Yesterday, we covered the reasons for Bitcoin's abrupt decline caused by a drop in spot trading and overuse of leverage by derivatives traders. The decline was painful, but it doesn't stand out statistically among other weekly drops and is way below the tragic events in the crypto industry in terms of scale.

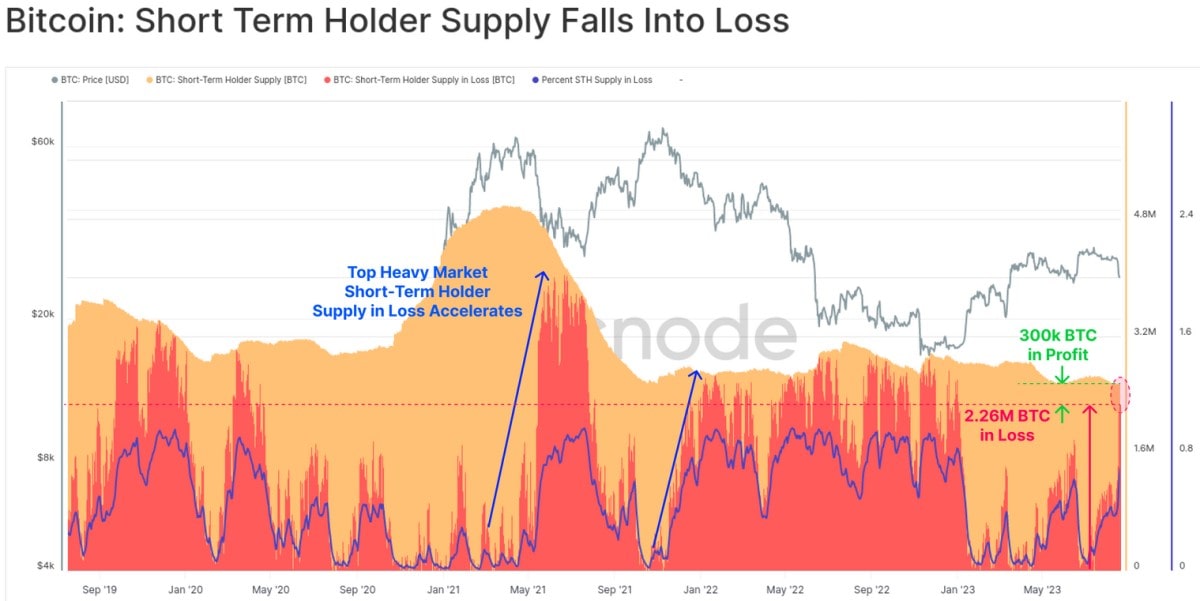

Short-term holders (STH) whose coins haven't moved for less than six months were dealt the hardest blow. Their unrealised losses amount to 2.3 million BTC or 88.3% of the retained supply.

These players aren't the most patient ones, so the absence of positive dynamics in the coming days might push some of them to sell off their holdings. This may once again put pressure on Bitcoin.

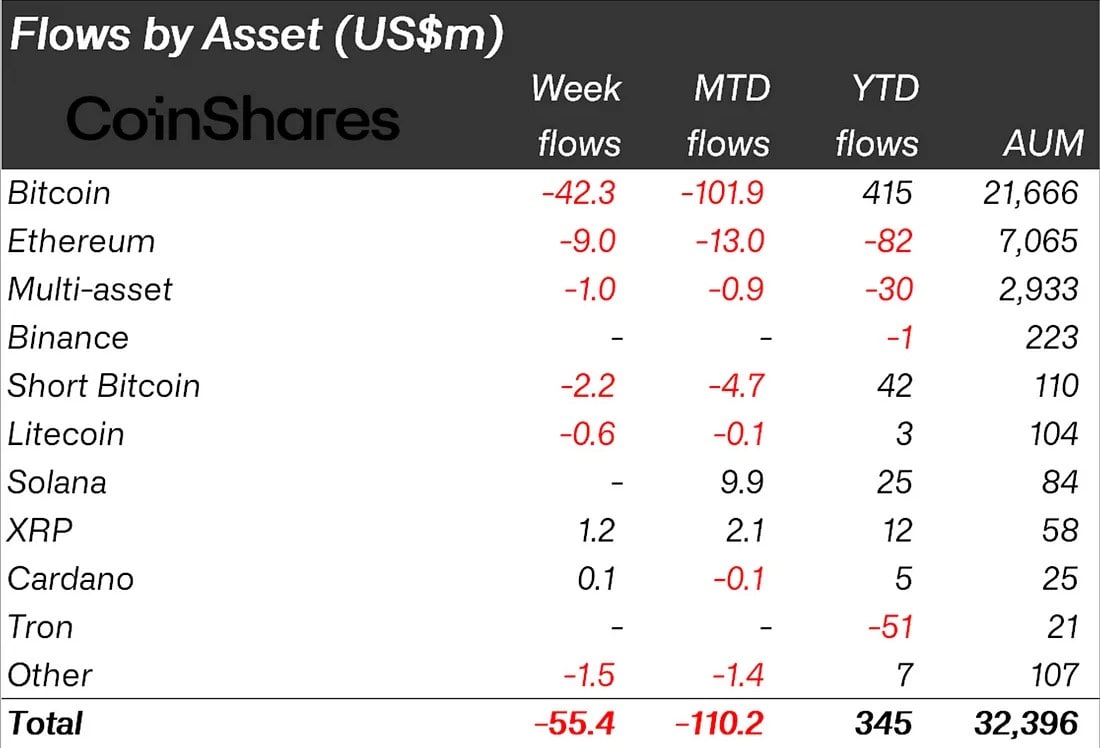

Institutional investors weren't optimistic either when evaluating the past week. They cut their positions in Bitcoin funds by $42.3 million.

Some of the major players are now sceptical about the decision on Bitcoin spot ETFs as the SEC continues its attack on the crypto industry in the legal field. The other day, a court granted the filing of an interlocutory appeal in the Ripple case.

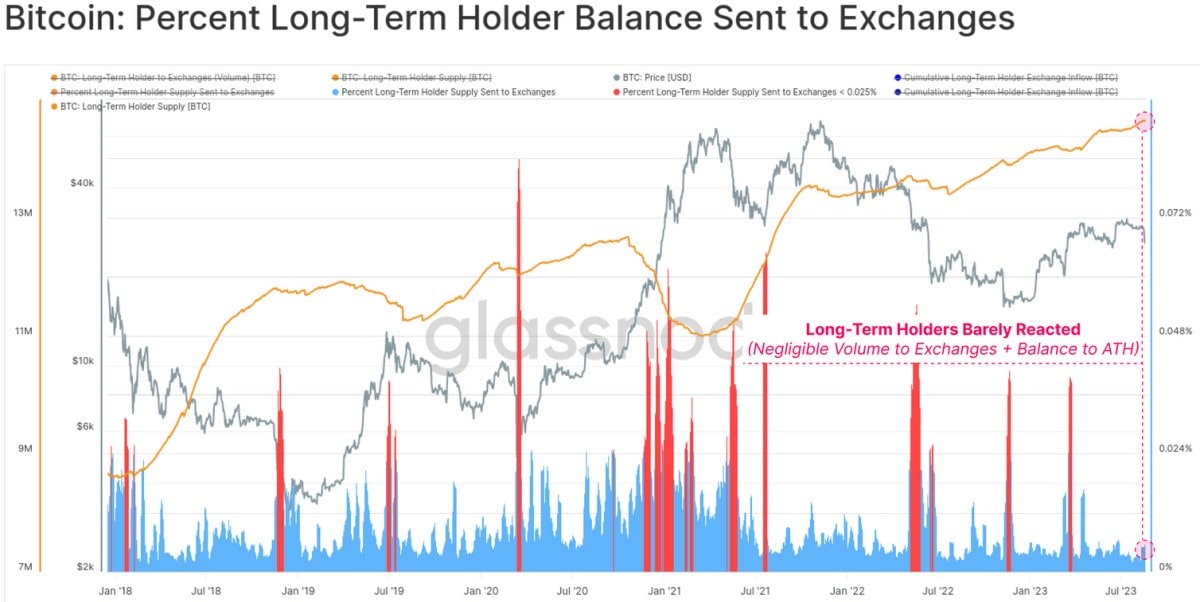

However, not all market participants agree that the crypto industry's future will be grim. Long-term holders, i.e., those whose coins have remained unmoved for over 155 days, increased their reserves last week.

LTH has barely increased its supply to crypto exchanges (blue histogram), while total inventory continues to set records, approaching 15 million BTC. MicroStrategy is the largest among public hodlers, having bought 12,333 BTC in Q2 and growing its total reserves to 152,800 BTC (approximately $4 billion).

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.