Reasons for the crypto decline

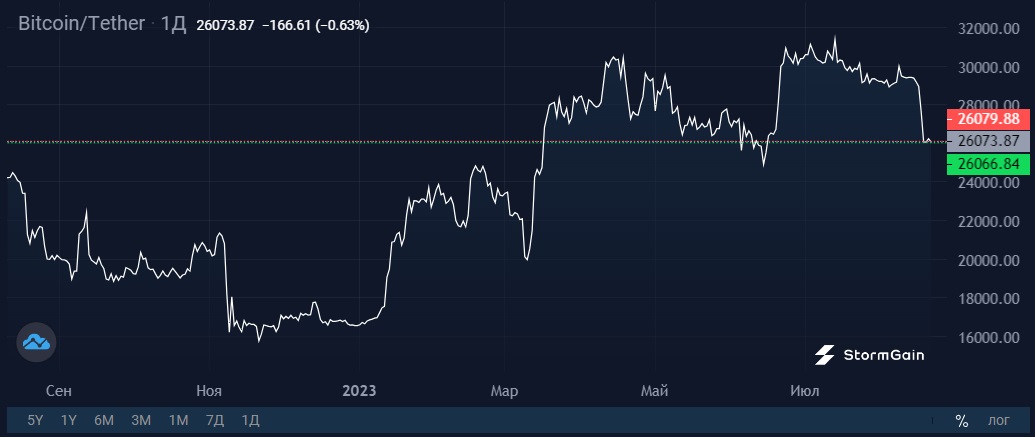

Last week, the cryptocurrency market saw a 10% drop to $1.1 trillion. On 17 August alone, traders lost over $1 billion on all instruments, a record decline since FTX's collapse.

Two events triggered that: SpaceX writing off $373 million in crypto assets and the release of the Federal Reserve's FOMC meeting minutes for its 25-26 July gathering (nearly a month after the meeting took place). The first one can be ignored since SpaceX's write-off took place in 2021-2022. The information became public only now because the company isn't public and, as such, isn't obligated to disclose capital flows.

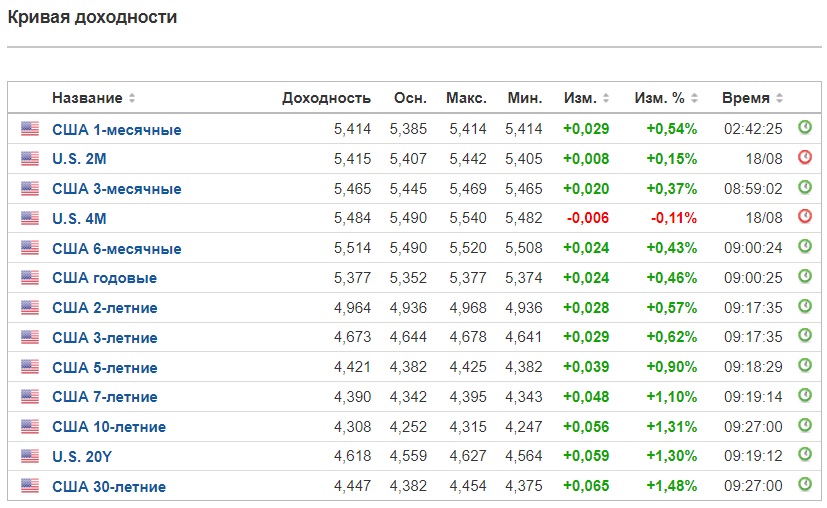

The second news is more alarming for investors. In the released minutes, the majority of FOMC members expressed the possibility of a further key rate hike in 2023. In mid-summer, most financiers assumed the Fed would not move to further tighten its monetary policy since inflation is approaching the target range of 2.0% to 2.5%.

A high interest rate raises Treasury bond yields, leading to a natural capital outflow from risky assets. This can be observed in the cryptocurrency and stock markets. The latter was also affected by the minutes' release.

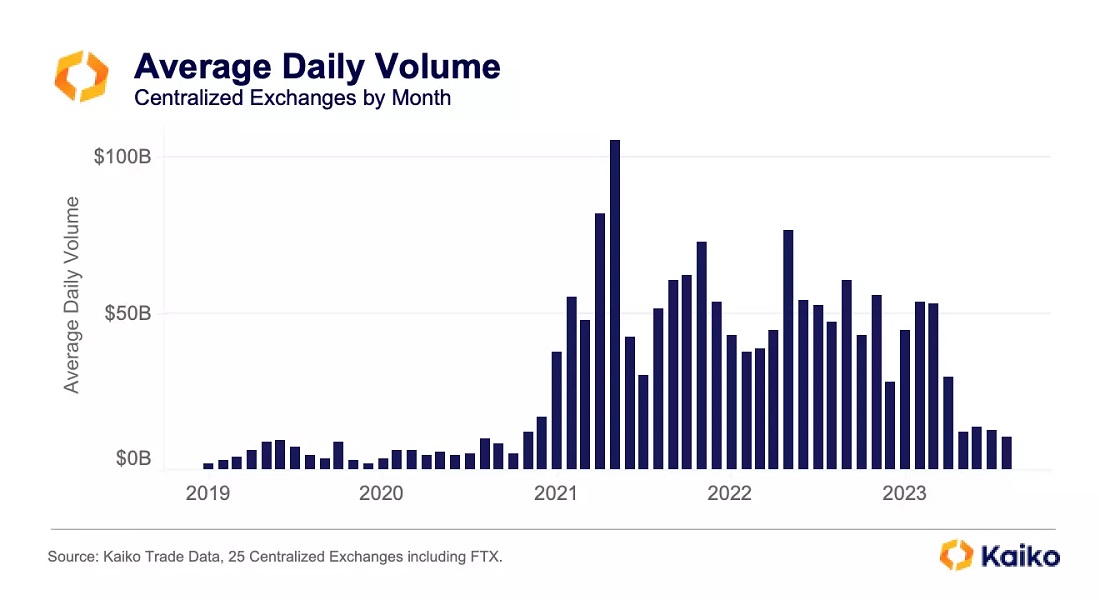

We've described the triggers. The reason for the cryptocurrency market's strong reaction was the formation of a prolonged consolidation, low trading volume in the spot market and excessive optimism among traders who use leverage.

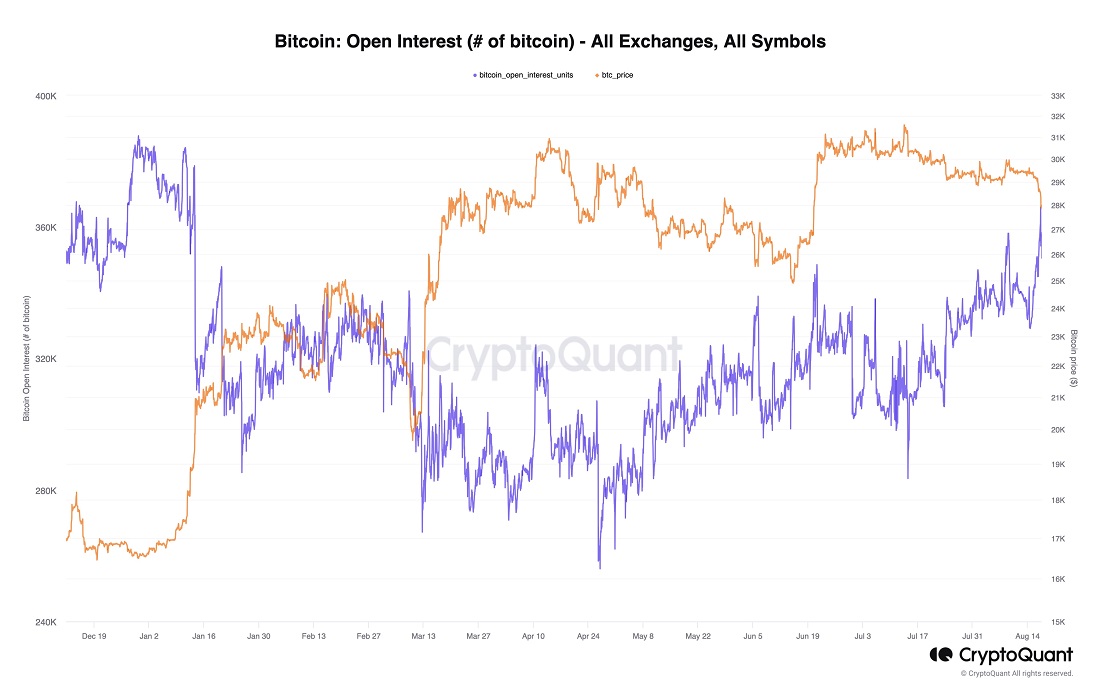

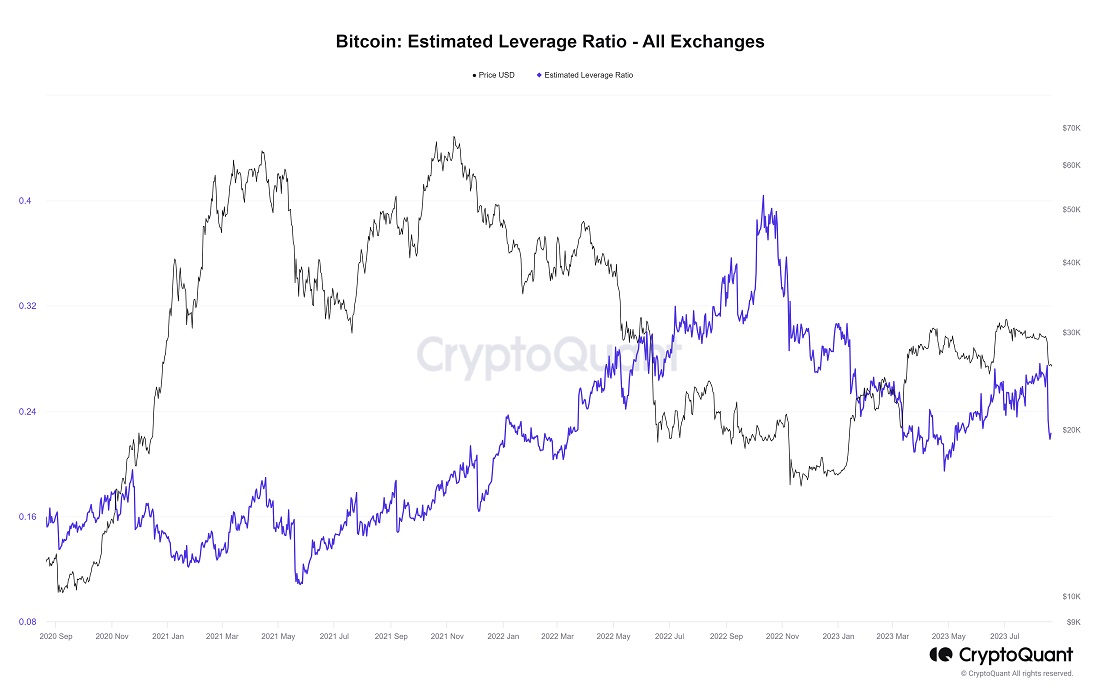

Traders' interest in crypto led to the anticipation of higher prices due to the possible approval of Bitcoin and Ethereum spot ETFs. Open interest in the futures market continued to rise despite weak price action.

Meanwhile, the spot market has been quite lethargic at times.

A domino effect occurred because of traders' excessive optimism about higher prices. When the price fell, buyers closed positions (sold), which pushed the price down even more amid relatively low demand.

After some of the margin buyers left, the leverage ratio dropped to values last seen in April.

Later this week, we'll know whether the negative reaction to the release of the Fed minutes was justified when Fed Chairman Jerome Powell speaks at a symposium in Jackson Hole, Wyoming. Investors expect Powell to unveil the regulator's strategy for the upcoming six months.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.