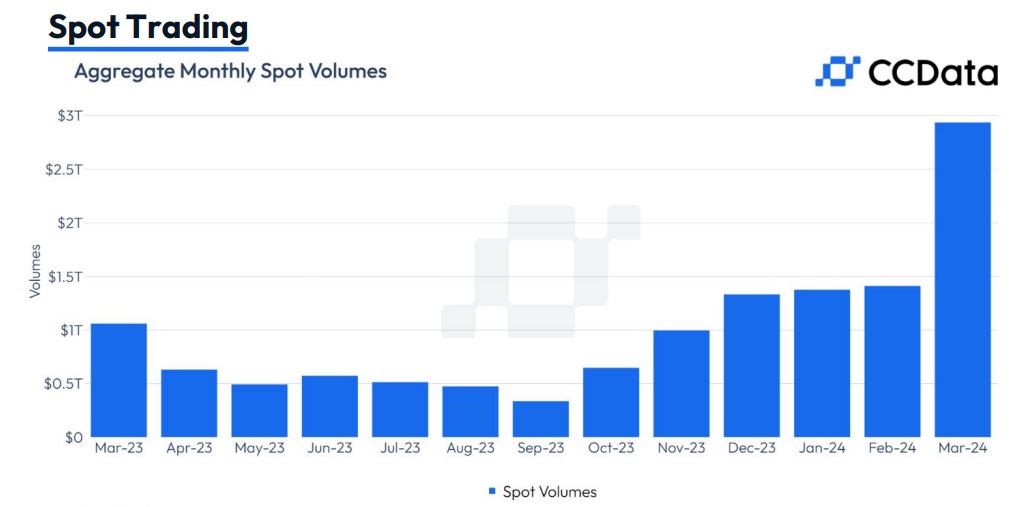

Spot crypto trading volumes at a three-year high

Cryptocurrency spot trading volume jumped 108% to $2.9 trillion in March. This is the best performance since May 2021.

This activity is due to Bitcoin setting a new all-time high and an influx of investors eager to participate in the new rally.

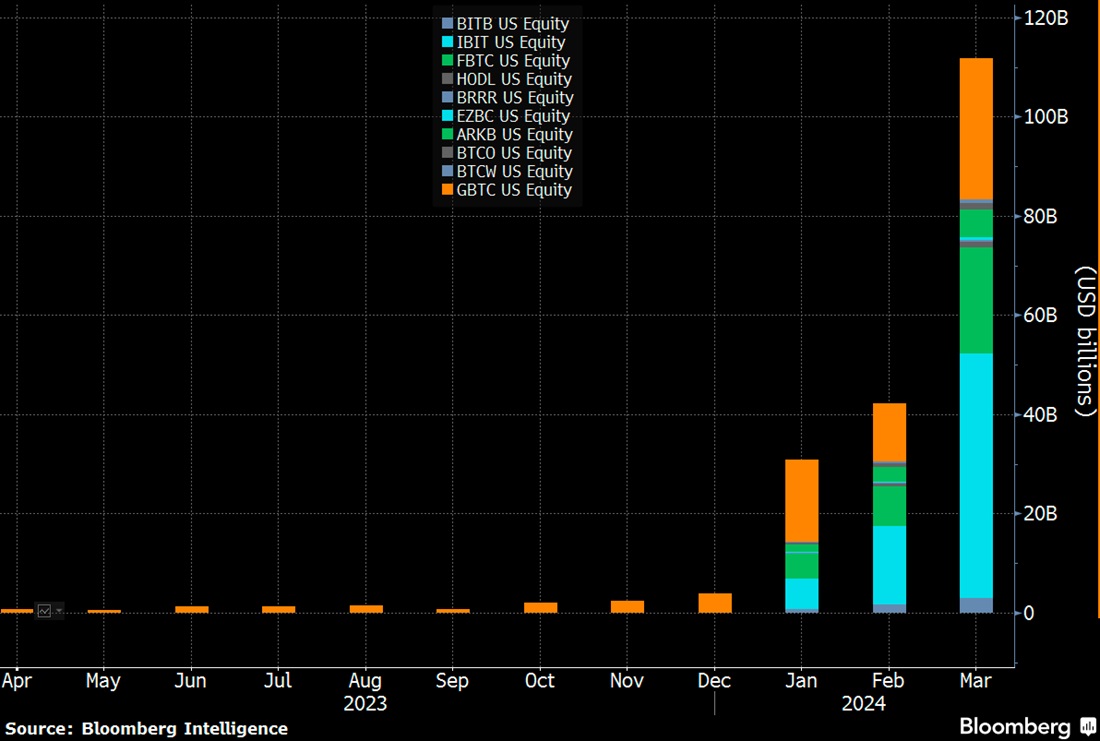

Spot Bitcoin ETFs played a leading role in the explosive growth, attracting $12.3 billion in investments in less than four months. Trade volume on them is growing month by month, reaching $111 billion in March.

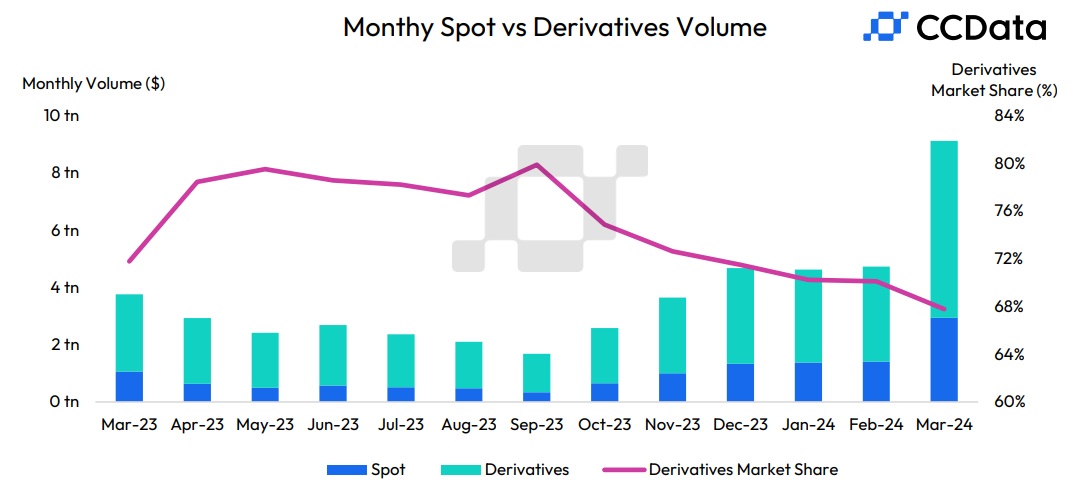

Trade volume in derivative contracts also grew significantly, gaining $6.2 trillion. Compared to February, that was an 86.5% increase. Meanwhile, the share of this segment fell to 67.8%, the lowest level since December 2022.

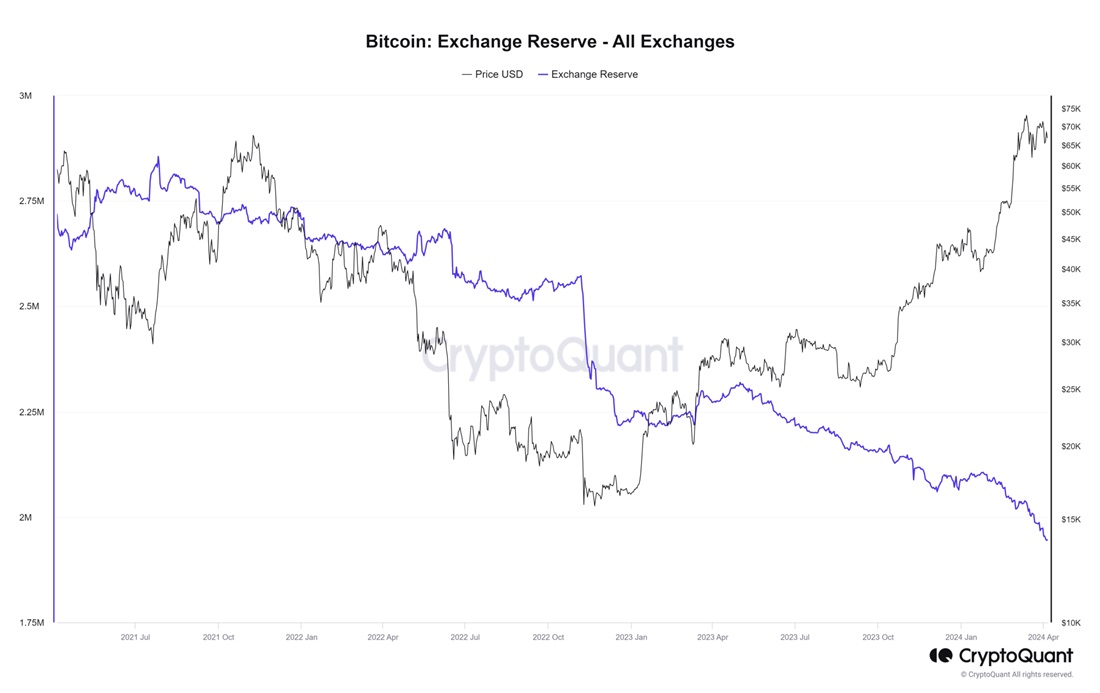

The rise in the share of spot trading is predominantly driven by investors' desire to move cryptocurrency to cold wallets after buying it. As a result, cryptocurrency exchanges' reserves have fallen by 7.6% to 1.945 million BTC since the end of January. This indicates that trading participants expect Bitcoin's price to rise further.

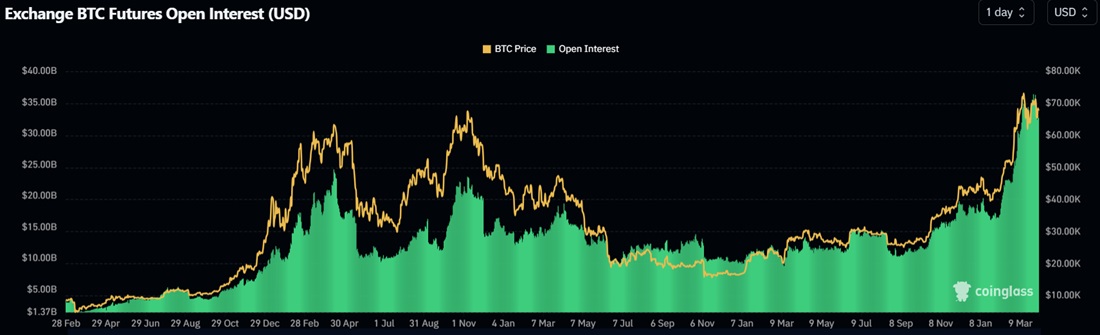

On 29 March, open interest in Bitcoin in the futures market set a new record of $36.3 billion. Notably, the Chicago Mercantile Exchange continues to outperform Binance at $11.7 billion and $8.4 billion, respectively. This suggests increased interest in Bitcoin from institutional players.

The cryptocurrency market continues to gain momentum as measured by trading activity. It's possible that new records will be set in April due to the market's reaction to Bitcoin's halving event and the expected increase in volatility.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.