Stablecoins are losing significance

Stablecoins are the bridge between fiat money and cryptocurrencies. When trading crypto, traders would inevitably turn to stablecoins, which ensured the growth of this segment as demand for Bitcoin increased.

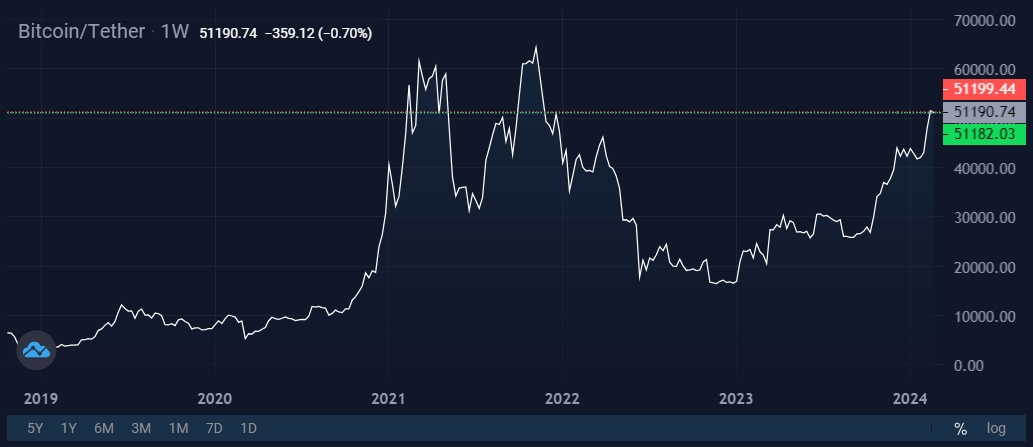

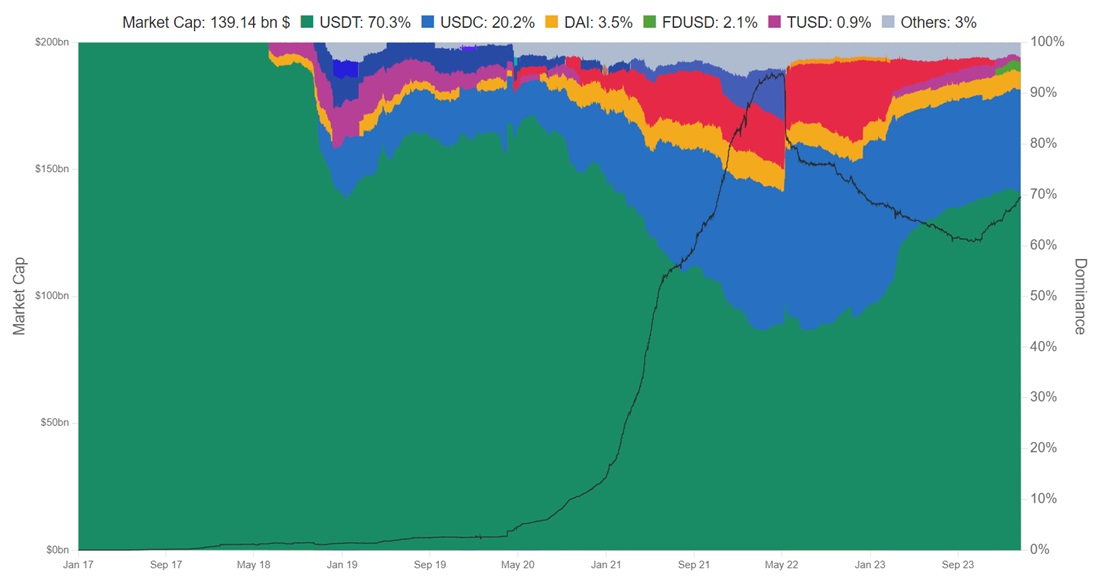

For example, during the 2020-2021 bull run, Bitcoin grew six-fold, while the capitalisation of stablecoins increased 33 times to $166 billion over the same time.

The emergence of spot ETFs has weakened this relationship, as many traders and investors have gained access to cryptocurrency through brokers. There's no longer a need for stablecoins when Bitcoin is of purely investment/speculative interest.

A bizarre event occurred on 20 February, when the trading volume of VanEck's HODL fund shares jumped more than 10-fold to $400 million in a day, and the number of trades rose from 500 to 50,000. Eric Balchunas of Bloomberg suggested that a recommendation from a popular blogger on Reddit or TikTok caused the hype.

The remarkable thing here is that such a surge demonstrates retail investors' strength and ease of entry. Previously, they would storm a crypto exchange. Now, these movements are seen in ETFs.

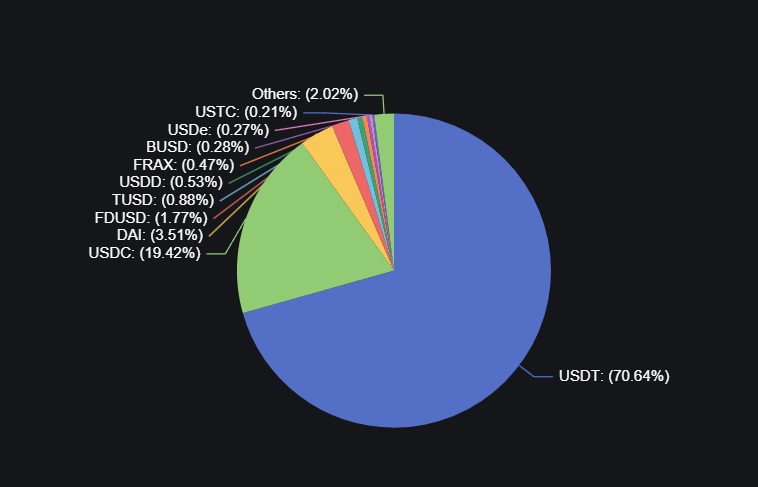

Speaking about the loss of significance of stablecoins, it's worth mentioning internal problems. Last year, USDC almost lost part of its reserves due to the bankruptcy of a US bank, and USDT is still being challenged due to the lack of a transparent audit and the presence of commercial papers in its reserves. These are the market's leading coins, with a combined share of 90%.

Two days ago, Circle (the issuer of USDC) refused to further mint on the Tron blockchain, which is headed by scandal-plagued Justin Sun. Last year, the SEC sued Sun and the Tron fund for illegal and manipulative securities trading. Given the impending proceedings, Circle probably decided to withdraw from this network.

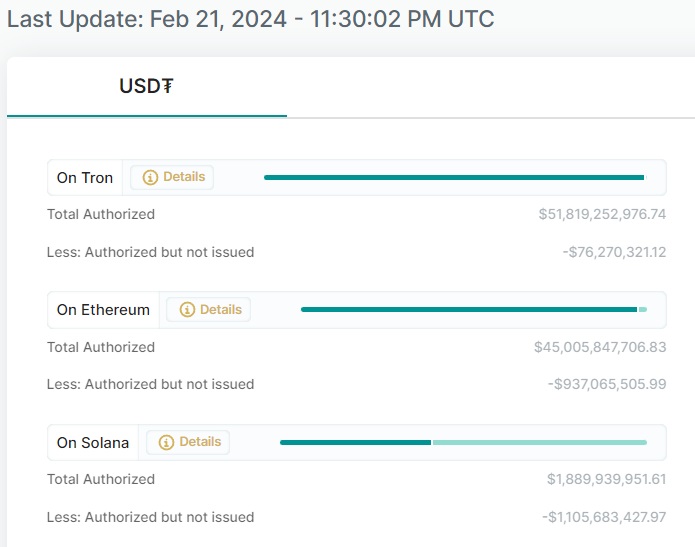

However, Tether's (the issuer of USDT) connection with Tron is getting stronger every year, and there are now more USDT minted on this blockchain than on Ethereum: $52 billion vs. $45 billion, respectively.

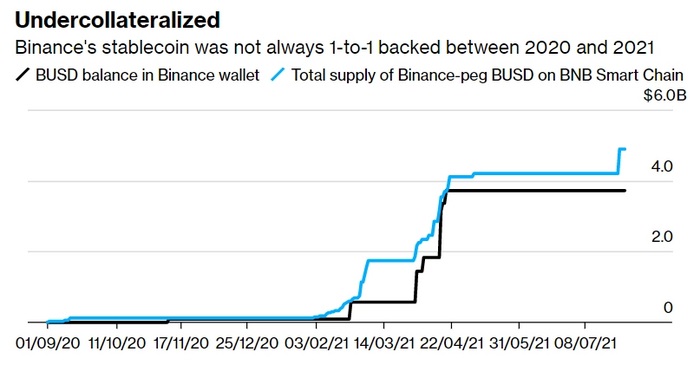

Last year, Paxos was the #3 issuer, issuing BUSD for Binance until the NYDFS Department of Finance filed a pre-enforcement action notification. The problem was that Paxos was minting BUSD on Ethereum while Binance issued the stablecoin in parallel on the BSC network. This caused a gap of over $1 billion between reserves and supply. Both companies decided to stop supporting BUSD starting in 2024.

It's little wonder that in such conditions, more and more market participants prefer to avoid stablecoins. Legislators are also busy. In the EU, from mid-2024, the MiCA legislation will be implemented, including regulation of stablecoin transparency. Meanwhile, in the US, a similar bill is being discussed in relevant committees.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.