Crypto storm: users hurriedly withdraw Bitcoin

The SEC sued Binance and Coinbase and filed a motion to freeze the assets of Binance.US. SEC chief Gary Gensler said in an interview on Tuesday that Americans want just one digital currency: the US dollar.

"We don't need more digital currency," Gensler said. "We already have digital currency. It's called the US dollar. It's called the euro, or it's called the yen; they're all digital right now. We already have digital investments... We have not seen, over the centuries, that economies and the public need more than one way to move value," he added.

The similarity in the claims against Binance and Coinbase boils down to allegations of illegally trading securities. According to the SEC, cryptocurrencies such as Ethereum, Cardano, Solana and many others are securities. The argument further goes that it is illegal to provide staking since it is the prerogative of the securities market to generate passive income.

The lawsuits come amidst a blatantly weak regulatory framework and a lack of criteria for dividing cryptocurrencies into asset classes. Even the SEC itself does not have an understanding of how to do this, even after three years of ongoing litigation between the SEC and Ripple. In its defence, the cryptocurrency company is using a speech by one of the regulator's department heads, William Hinman, in which he recognises XRP and ETH as commodities.

There is no unanimity among regulators either, as the CFTC's lawsuit against Binance (filed in late March) calls ETH, BUSD and several other cryptocurrencies commodities. If cryptocurrencies are recognised as commodities, part of the SEC's claim against Binance and all charges against Coinbase would be unfounded.

All this points to one thing: regulators have launched a crusade against the crypto industry, backed by the Biden administration, and will push for significant restrictions on the features crypto exchanges offer. Similar to the covert restriction of banking services to undesirable companies in 2013, the current developments have been dubbed Chokepoint 2.0 by the community.

As Cardano developer Charles Hoskinson noted, the ultimate goal of the current agenda is to implement central bank digital currencies (CBDC) that would entail full control of every financial step.

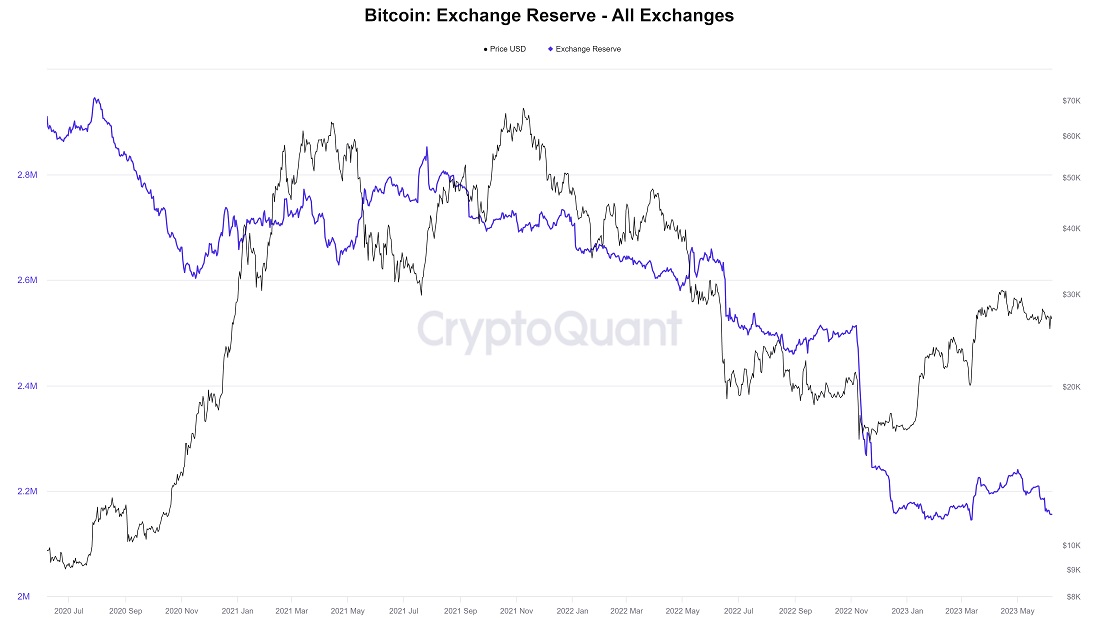

The SEC's attack led to an active withdrawal of coins to cold wallets. In the last 24 hours, net outflows from Binance exceeded $1 billion and $600 million from Coinbase. The total stock of Bitcoin on cryptocurrency exchanges reached a multi-year low of 2.15 million BTC.

There is rotation among cryptocurrencies, with trading volume in DeFi jumping 444% in the past 48 hours. Bitcoin managed to recoup its losses after the news and returned to the $27,000 mark.

The pressure on the crypto industry comes amid a record decline in the dollar's share of international reserves and settlements, as well as the US economy lying in a fragile balance between inflation and recession.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.