Interest surges: Bitcoin network fee hits a one-year high

Four US banks have gone bankrupt, and a dozen more are struggling. For example, PacWest shares collapsed by 50% in the past day, and Western Alliance saw a 40% drop. According to polls by Gallup, the world's largest polling agency, half of US citizens are worried about the safety of their bank accounts.

As the Fed continues to tighten monetary policy, which reduces the value of a number of assets on banks' balance sheets and the demand for banking services, the likelihood of further shocks is high.

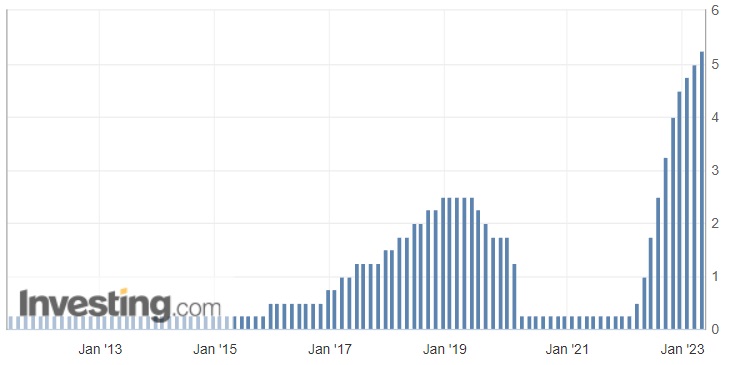

US Federal Reserve key interest rate, %.

One way to insure against a depreciating dollar and the risk of a total loss of funds beyond the FDIC's insured amount ($250,000) is to buy Bitcoin. The cryptocurrency's decentralised nature protects against an attack on the asset.

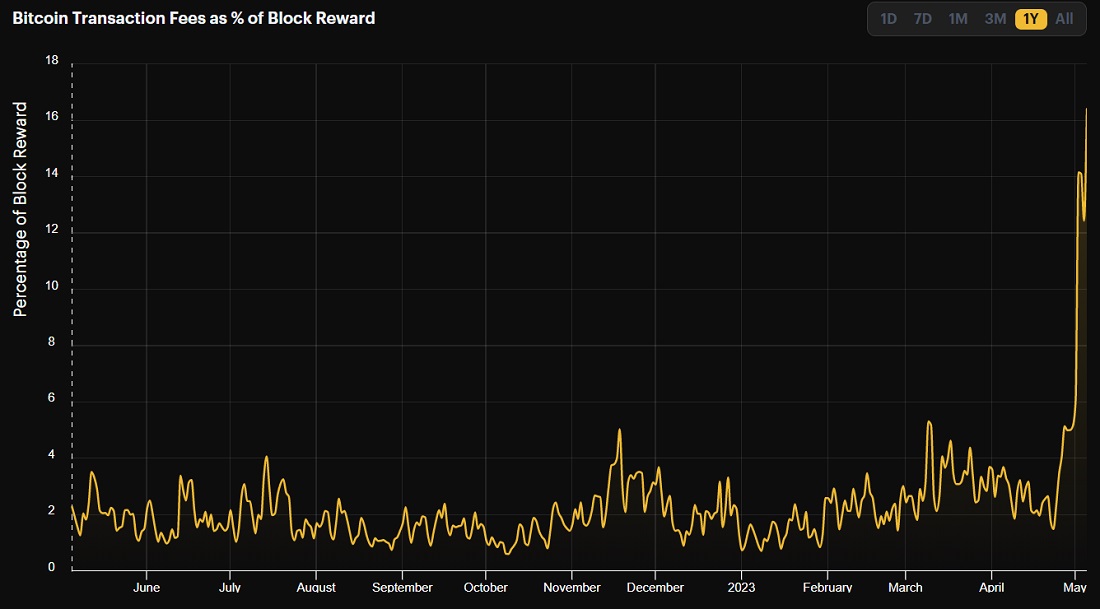

The network's average speed doesn't exceed seven transactions per second, so those wishing to make a transfer are increasing the amount of fees paid to complete their transaction as soon as possible. Due to a surge in interest, the average fee on the Bitcoin network has increased 2.5 times in the last week to a one-year high of $7.20. The share of commissions in miners' remuneration jumped from 5% to 16%.

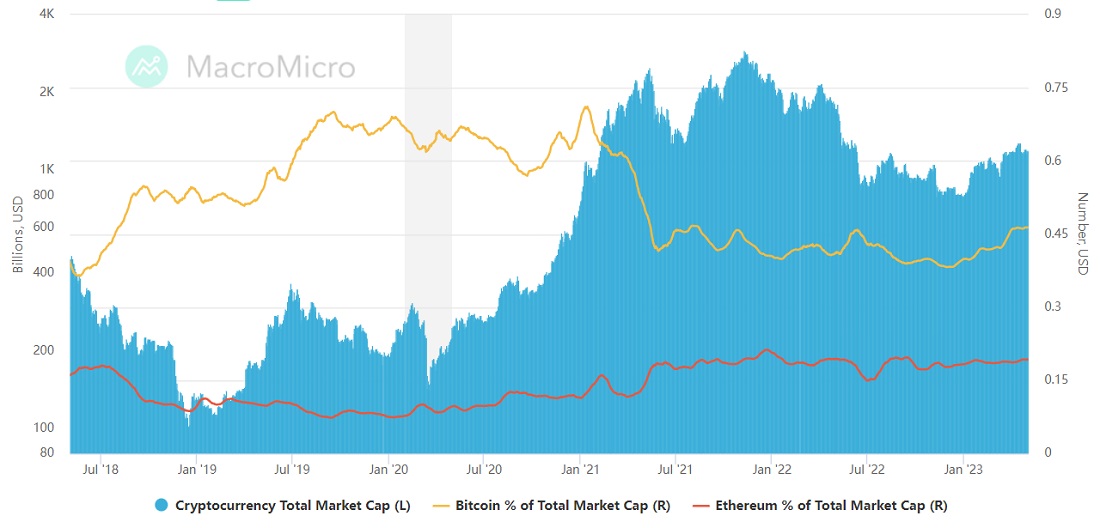

Some analysts consider Bitcoin to be a "store of value" similar to gold. For the same reason, there has been a surge of interest following the bank collapses in the United States, with Bitcoin's share of other crypto assets rising from 40% to 46% in 2023.

Bank crises aren't all the woes facing the US economy this year. As early as 1 June, the government could announce a technical default on debt obligations, as money is being spent faster than it's coming in. Congress needs to increase the debt limit, which currently sits at $31.4 trillion.

Geoff Kendrick, an analyst at Standard Chartered Bank, believes that the probability of a default is low, although if it occurs, he predicts that Bitcoin's price could rise to $50,000.

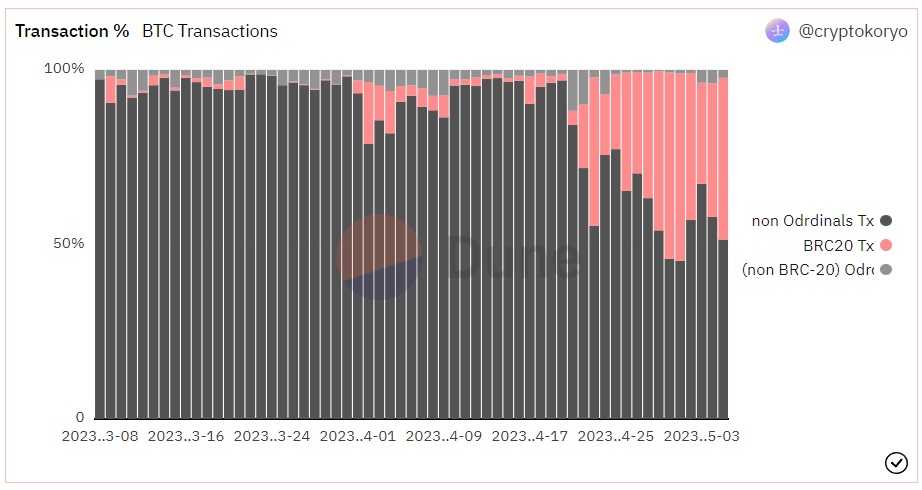

In addition to demand for Bitcoin among new market participants, the emergence of the Ordinals protocol and BRC-20 standard have had a significant impact on the rise in commission. Put in simpler terms, they can be deemed similar to NFTs on the Bitcoin network that allow digital items to be exchanged. PEPE, which has also had some buzz around it lately, is a BRC-20 token, as well. In recent days, the tokens have accounted for nearly half of all transactions on the network due to speculative hype.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.