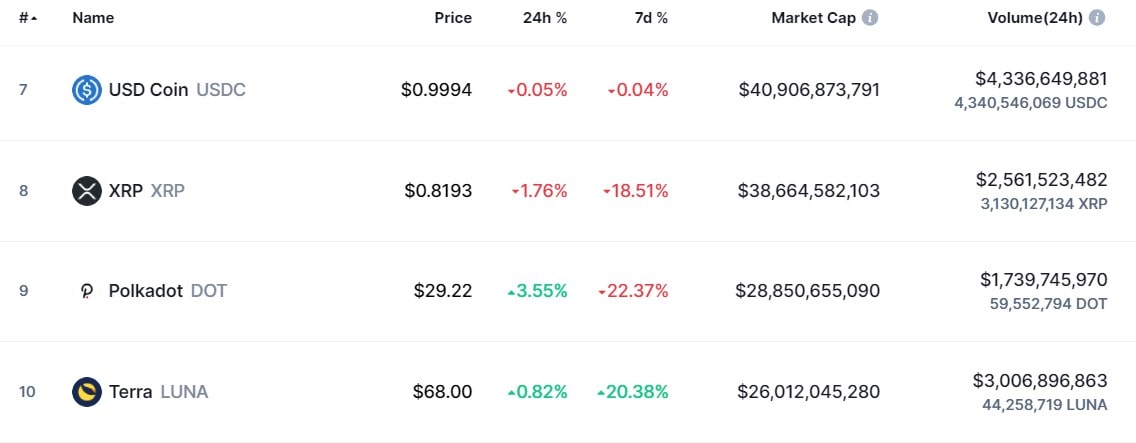

Terra enters the Top 10 by capitalisation and Top 3 by DeFi preferences

Despite the cryptocurrency market's increased capitalisation, Bitcoin continues to lose its market share, losing ground to more practical solutions. Even though it has just entered the Top 10 by capitalisation, Terra's capitalisation is only $26 billion compared to Bitcoin's $955 billion. However, the project's goals are ambitious: to become the #1 payment and exchange method.

The problem with Bitcoin is its low bandwidth and high price volatility. For example, it is unsuitable for real estate transactions because, within a few days, the price of a property could potentially rise by 1.5 times due to a correction in the cryptocurrency's price. The same thing happens with fiat in developing countries, just for a slightly longer period of time. Terra is trying to solve all of these problems by creating a supranational currency, Terra SDR, which balances market volatility. Terra SDR is positioned as an analogue of the International Monetary Fund's Special Drawing Rights or a basket of currencies.

But first of all, Terra needs to ensure the integration of the existing financial system with decentralised blockchains. This means they need to create an efficient payment system with a high degree of security, instant conversion and low commissions. This is implemented through proprietary stablecoins pegged to the US dollar, euro, South Korean won, and even the IMF's SDR. In exchange for an atomic swap, conversions take place at market rates with zero commission.

To support these mechanics, Terra uses a floating-rate currency called LUNA. The coin allows you to reward validators for carrying out transactions and provides the network with scalability and decentralisation. The algorithm for changing the money supply is responsible for the stability of the stablecoin rates. This avoids the risk of increased emission for selfish purposes, as was the case with Ripple, and the outflow of funds if the exchange rate of 1:1 is exceeded, as was the case with DAI on the Maker platform.

Terra's unique and practical Terra nature, as well as its good staking rewards with an average annual return of 7.2%, led to the blockchain reaching third place in terms of staked funds, displacing Solana and Avalanche.

Over the past six months, the value of LUNA has skyrocketed eight-fold, largely due to the rise in stablecoin usage. Among algorithmic stablecoins, UST came out on top with $8.4 billion in capitalisation. The rise of decentralised applications (dApps) and the need for 'independent' stablecoins suggest that LUNA's main growth is yet to come.

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.