What is Market Cap?

Newcomers to the stock and cryptocurrency markets inevitably come across the term' market capitalisation', known as market cap for short. For many, this term is unfamiliar and raises questions. What does a market cap mean in crypto? What is the market cap of a company? What does a large market cap mean? How does market cap affect crypto price?How to use the market cap to invest in crypto? And what about market cap in the cryptocurrency market? We'll answer all these questions and more.

What is market capitalisation?

First of all, let's get the crypto market cap explained.

Initially, the concept of market capitalisation originated in the stock market. After cryptocurrencies became a separate class of exchange-traded assets, the concept of market capitalisation began to apply to them, and understanding market cap in crypto has become inevitable for everyone in the industry.

In general, market cap in crypto refers to the total value of any asset present in the market. Since there's a difference between the concept of market capitalisation in the stock market and the crypto market, we'll take a look at each of them individually.

What is market cap in stocks?

Market capitalisation on the stock market is one indicator of a company's value. It allows you to find out approximately how much a given company is worth on the stock market.

How to calculate market cap crypto? To calculate a company's market cap, multiply the current price of the company's shares by the number of outstanding shares. For example, if company X trades at $10 per share and has 50 million shares outstanding, its market capitalisation would be $500 million.

What affects a company's market capitalisation?

Market capitalisation is nothing more than a current assessment of a company's value based only on the price of its shares. This, in turn, directly depends on the current ratio of supply and demand for them. Market capitalisation does not directly include such important indicators as the value of a company's assets, debt, or other factors.

It's worth noting that a company's market capitalisation tends to be higher than its assets' value (its so-called 'book value'). This is primarily because any business is primarily an idea, and its assets are just tools for its implementation. Accordingly, the actual price of an active, established business includes the value of its assets and the potential profit it can make in the future.

Why do you need to know a company's market capitalisation?

In other words, what does market cap matter in crypto? Market capitalisation is quickly calculated and acts as a convenient tool for investors to evaluate a company's size. A business's market capitalisation indicates its volatility, risk and growth potential, so investors often use the indicator to quickly assess a company's investment potential.

It's believed that the higher a company's capitalisation is, the less risky investments in it are. However, those investments have lower profit potential. Higher-capitalisation companies look more reliable to investors. It's easier for them to raise money. Thanks to investor confidence and strong financial position, their shares fall more slowly during crises. At the same time, companies with a smaller capitalisation have greater growth potential, although investments in these stocks are riskier. Such companies have a more challenging time enduring crises, and it's more expensive for them to borrow money.

It should also be noted that because the share price is constantly changing, calculating market capitalisation is an indicator of market value only at the time of calculation.

What do large, medium and small market caps mean?

Market capitalisation is roughly divided into several categories depending on the size:

- Mega-cap companies include the largest companies in the world that are market leaders. Apple, Amazon and Facebook are examples of such companies. Investments in mega-cap companies are the most reliable but have relatively small potential profitability. This is the preferred choice for the most risk-averse investors.

- Large-cap companies are usually industry leaders. The shares of such companies show a relatively stable price and are usually not prone to significant growth. Conservative, risk-averse investors choose them.

- Mid-cap companies. The shares of these companies are much more volatile and often have fairly large upside potential. They are chosen by investors who are ready to take on certain risk in exchange for the opportunity to make money on market value growth.

- Small-cap companies tend to be either relatively young companies or companies that have lost value for some reason. Shares in these companies are a somewhat risky investment target. However, at the same time, they make it possible to rely on young companies in new, promising fields of activity. And in a few years, these newcomers may well become leaders. Older companies that have lost value can also regain their former positions.

- Micro-cap companies, also called 'penny stocks', have both the greatest potential for profit and the highest risk. The most risk-prone investors opt for such companies, though doing so must be preceded by research.

Types of companies by market capitalisation.

Company type | Market cap |

Mega-cap | More than $200 billion |

Large-cap | $10 billion to $200 billion |

Mid-cap | $2 billion to $10 billion |

Small-cap | $300 million to $2 billion |

Micro-cap | Less than $300 million |

What is market cap in crypto?

Now, let's discuss the market cap in crypto meaning.

Market capitalisation on the cryptocurrency market is the total value of a cryptocurrency. It's calculated by multiplying the number of coins of a given cryptocurrency in circulation by the coins' current price.

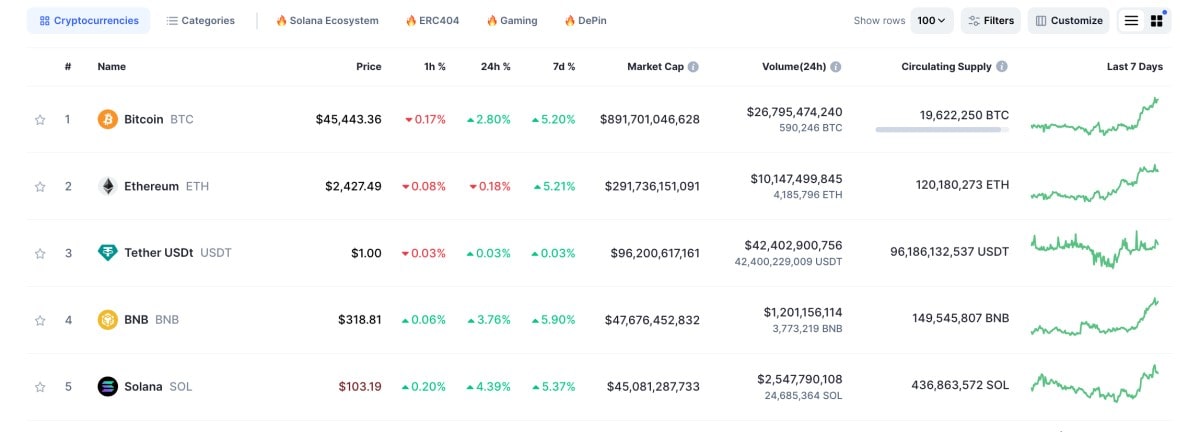

The most famous online resource for tracking cryptocurrencies' market capitalisation is coinmarketcap.com.

The cryptocurrency with the highest market cap is Bitcoin. At the time of writing, Ethereum and Tether hold second and third places, respectively.

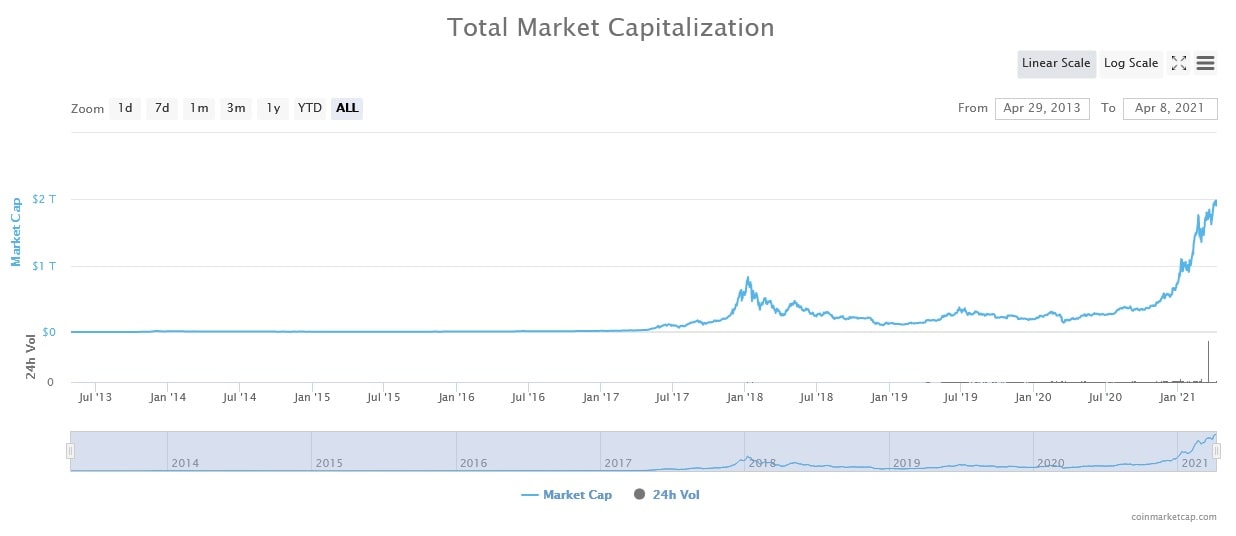

What is the total market cap of the cryptocurrency market?

Total market capitalisation is the aggregate value of all crypto assets in the market combined, including Bitcoin and all altcoins. This indicator is important because it indicates the industry's size as a whole and often serves to compare the entire cryptocurrency market with other economic sectors, such as precious metals, stocks or individual fiat currencies.

What affects a cryptocurrency's market capitalisation?

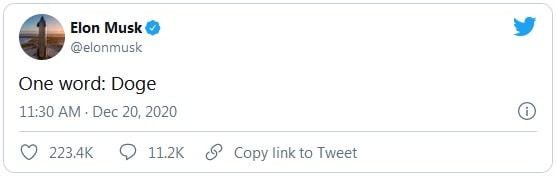

If the market capitalisation of cryptocurrencies is a product of their volume and price, what affects one of these indicators also affects the market cap. For example, the number of many crypto coins in circulation is increased by mining, the most famous example of that being Bitcoin. A cryptocurrency's price depends on the ratio of supply and demand, which, in turn, depends on many other factors. These range from government actions regarding cryptocurrency regulation to influential persons' published opinions in the crypto industry.

Why is market cap important in crypto?

Cryptocurrencies' market capitalisation is a vital crypto market indicator that investors and traders should monitor. As with the stock market, a cryptocurrency's market capitalisation affects its volatility. The higher the market cap of a coin is, the more difficult it is to manipulate its price. To influence the price of Bitcoin, you need to buy or sell hundreds of millions of dollars of it. At the same time, cryptocurrencies with low market caps often experience price spikes.

What is considered low market cap crypto? Low market cap cryptos have a market capitalisation of less than $1 billion. They are generally considered riskier investments as they have not yet demonstrated their value to the market. Additionally, a cryptocurrency with a market cap ranging from $50 million to $300 million is categorised as a micro-cap.

Although even cryptocurrencies with very high market caps have higher volatility than stocks, their price is still much more stable than that of cryptocurrencies with a low market cap.

In addition, the market cap of a cryptocurrency strongly influences its recognition and, as a result, its adoption. Cryptocurrencies with the highest market cap are much more frequently mentioned in the media and much more accepted as a means of payment.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

FAQ

What does market cap mean in crypto?

Cryptocurrency market cap signifies the overall value of all the coins that have been mined. It is determined by multiplying the total number of coins in circulation by the present market price of a single coin. Investors rely on the market cap as a crucial metric for assessing various cryptocurrencies' comparative magnitude and worth. It offers valuable indications regarding a cryptocurrency's potential for growth and its relative stability or risk compared to others. However, the market cap in crypto can experience substantial fluctuations due to their volatility.

How does market cap affect crypto price?

Market cap plays a significant role in influencing the price of a cryptocurrency. The dynamics of supply and demand are pivotal factors. When there is high demand for a cryptocurrency, its price tends to increase. Conversely, an oversupply without a corresponding rise in demand can lead to a decrease in price.

The market cap can impact the psychology of buyers and sellers, subsequently affecting the crypto price. A large market cap can signal dominance and reduce the potential for market manipulation, making traders and investors more inclined to invest in the cryptocurrency with the highest capitalisation.

Cryptocurrencies with substantial market caps are often perceived as more established and successful than those with smaller ones. This perception of value can influence investor behaviour and consequently impact the cryptocurrency's price.

How to calculate the market cap of crypto?

The cryptocurrency market cap is determined by multiplying the current price per coin by the total supply of coins in circulation. This calculation provides the total value of all coins in circulation and is commonly used to compare and evaluate different cryptocurrencies based on their relative size and value.

Does market cap matter in crypto?

Market cap can give an initial estimate of a cryptocurrency's value. A high market cap often signals a stable asset. Stability here means no volatility; instead, it suggests that the cryptocurrency is less prone to market manipulation or drastic price changes.