Terra (LUNA): is there life after death?

Last week, we discussed the dramatic demise of the Terra blockchain, which, until as recently as April, was among the Top 10 with a market cap of $40 billion. The network was unable to maintain the exchange rate of its algorithmic stablecoin, UST, which resulted in its balancer coin, LUNA, being completely devalued in the space of just a few days. Furthermore, it is still not yet known whether the team used the entirety of its $3.5 billion in cryptocurrency reserves to save the system.

Parity between UST and USD was maintained by either reducing or increasing the supply of LUNA. Because demand for UST remained high on account of its 20% annual staking yield, LUNA exhibited strong growth and became the only Top 10 coin to reach a new all-time high in 2022.

The company has promised that it will soon release a detailed report on the reasons behind its recent collapse.

Several analysts believe that the precursors for the collapse were already in place well before the May crisis, while the decision to tie UST to the company's reserves was a sign of the system's inherent fragility.

UST is an algorithmic stablecoin whose issuance was initially only pegged to the price of LUNA. This is what differentiates it from centralised stablecoins (e.g., Tether), where the exchange rate's stability is maintained by reserves held in bank accounts. Terra took the unusual step of bolstering its algorithmic UST with $3.5 billion in cryptocurrency reserves.

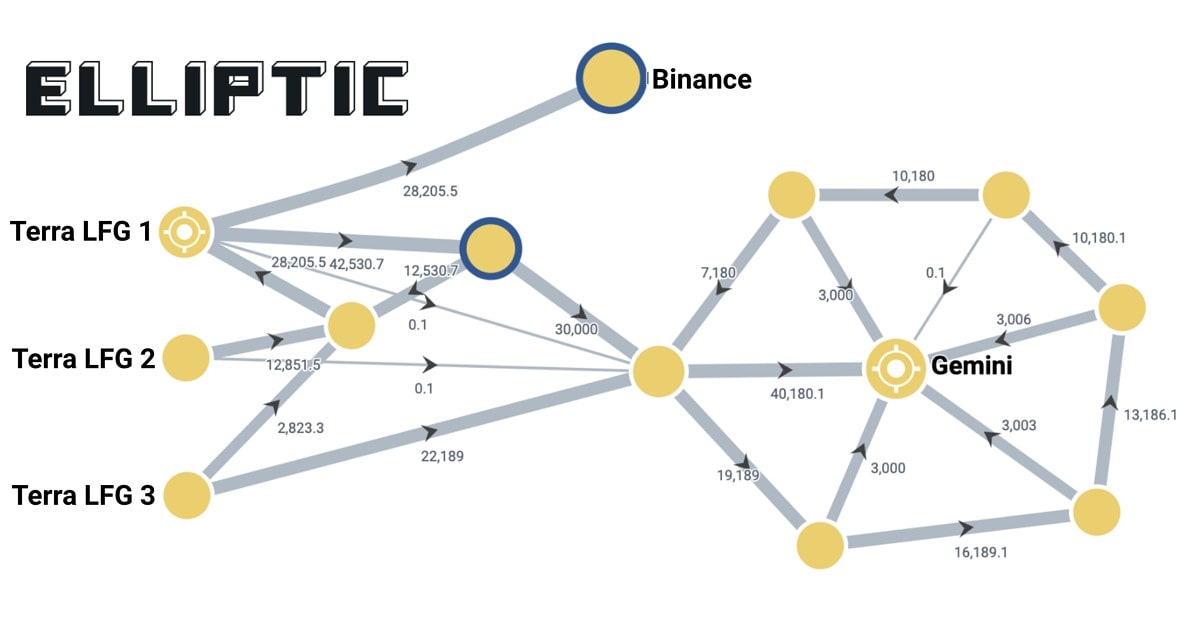

The company was forced to prop up the UST exchange rate by selling Bitcoin once LUNA started to fall. Either the reserves were simply insufficient, or they were not used in full. Analytics firm Elliptic traced the course of the coins and revealed that 28,000 BTC were sent to an account on the Binance cryptocurrency exchange, while 52,000 BTC were sent to a Gemini account.

However, they were unable to track where their assets went next. Terra could have used its own funds to prop up UST, or it could have transferred them to unknown accounts. If the company maintains its reserves, this will present an opportunity for the project to relaunch.

On 13 May, Do Kwan laid out a recovery plan that involved forming a new fork in the Terra blockchain and distributing 1 billion tokens among LUNA and UST holders who can provide photographic proof of their ownership prior to UST losing its peg to the US dollar.

Open critics of this route include Binance CEO Changpeng Zhou and leading Terra validator Jiyun Kim. Zhou noted that "forking does not give the new fork any value", calling upon the company to buy up the coins and burn them. Meanwhile, Kim, whose pool has shrunk from $1 billion to $3 million, has proposed that the community rally together and create an entirely new blockchain.

The lack of a consensus within the Terra team means the chances of the network relaunching are significantly lower than they otherwise might be. In addition, Do Kwon may soon be under investigation following official complaints to the authorities by a number of disgruntled investors.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.