Hidden Threat: Tether is reluctant to disclose its reserves structure

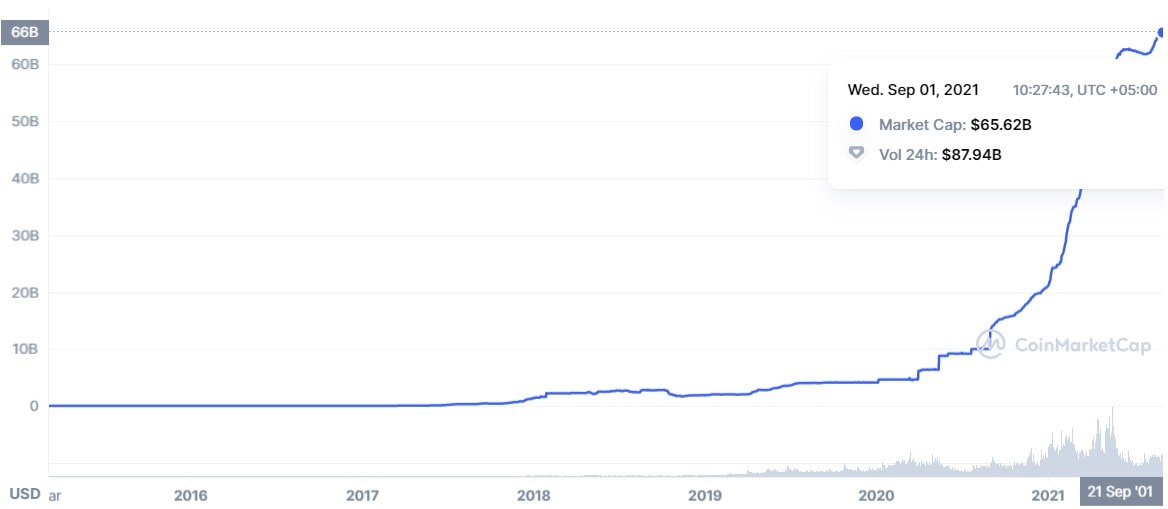

Tether is the leading bridge currency between fiat money and crypto assets. It boasts a market capitalisation of $66 billion and a daily turnover of $88 billion. The stable operation of crypto exchanges depends on the financial state of affairs at the namesake company because an overwhelming majority of exchanges use Tether as their base currency. According to the company’s initial claims, every USDT is backed by one US dollar. However, audits have proven this claim to be untrue. Now, the company is trying to hide the what things are actually like from the public..

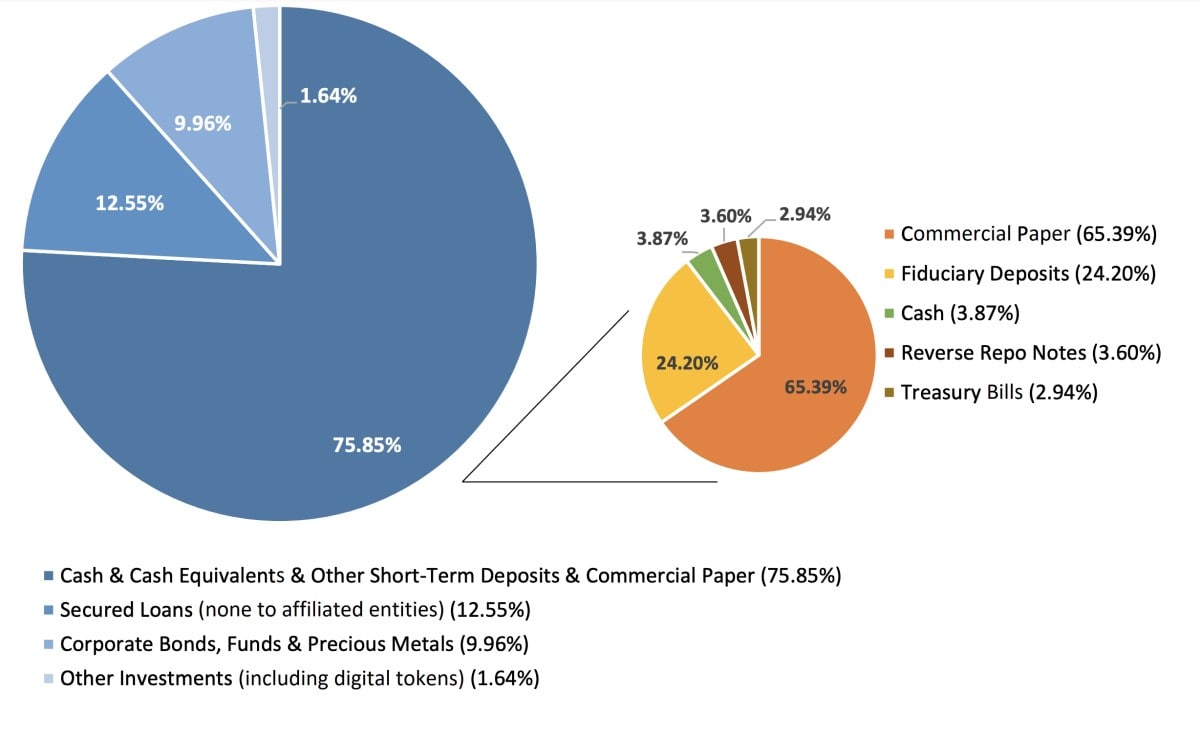

This year, the New York Attorney General’s Office (NYAG) finished its investigation into Tether. As result of a pre-trial settlement, Tether has agreed to pay out $18.5 million and report on its reserves to the authorities regularly (read more about this in our article). After that, it was found that half of the USDT reserves were composed of undisclosed commercial papers, and only less than 4% were held in fiat funds.

Tether’s fiat reserves exceed its liabilities, but their structure raises a lot of questions. For example, in the event of a crisis, the inability to convert USDT to USD at a 1:1 rate will cause a rapid fall in the stablecoin’s valuation and damage confidence in crypto exchanges. As a result, cryptocurrencies will go through a bigger correction than the one that occurred in May 2021.

It’s not surprising that the community keeps a close watch on the developments in the Tether case, but the company doesn’t feel comfortable under such scrutiny. On 31 August, representatives from the organisation filed a request to the New York Supreme Court to the NYAG from releasing access to information about the company.

...we vigorously oppose the notion that proprietary information of our company, or any company in our community, should be made public simply to satisfy Internet trolls or other detractors.

Now, the disclosure of the details and commercial papers that constitute half of USDT’s backing will depend on the Supreme Court’s decision. If the assets turn out to be of low quality, it will damage confidence in the token and cause a backlash on the cryptocurrency market.

The StormGain Analytical Group

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.