Three Reasons Why Bitcoin Has Risen by 16% in Five Days

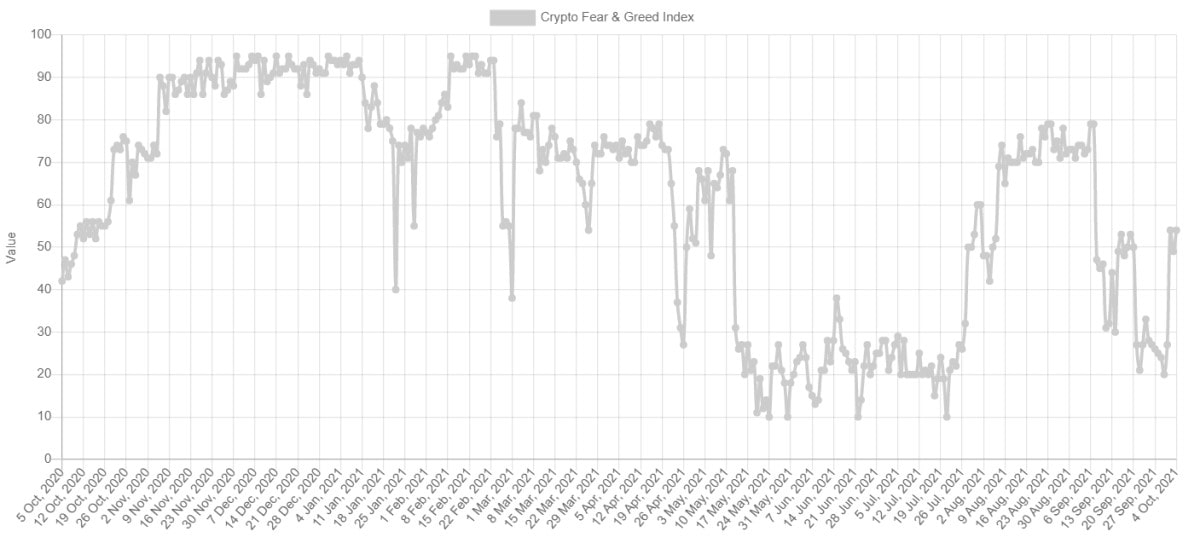

Last Wednesday, we talked about the reasons why investors were opting out of high-risk assets. New forecasts have emerged that now claim that cryptocurrencies and the stock market are approaching a crash. For example, Robert Kiyosaki, author of the best-seller Rich Dad, Poor Dad, has already predicted a full-scale crisis to happen this month. The growing intensity of emotions at the end of September has led the Greed & Fear index to fall to nearly the previous lows it’s seen in 2021, when Bitcoin was trading at around $30,000.

However, in the last six days, those fears have decreased, and Bitcoin has risen by 16%.

First, President Biden and Congress managed to moderate the situation by agreeing to a temporary funding extension to avoid a government shutdown.

Second, Fed Chairman Jerome Powell declared that the regulator didn’t have plans to ban cryptocurrencies. Stablecoins are a different matter: their issuance and backing should be subject to regulatory scrutiny. The same applies to DeFi. On the contrary, Bitcoin, as a decentralised asset not affiliated with any company, doesn’t require such scrutiny.

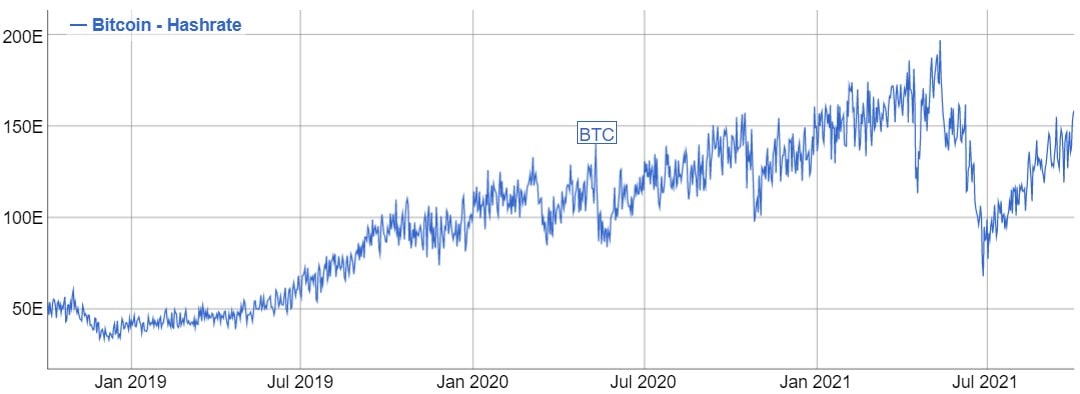

Third, Iran’s authorities have lifted restrictions for cryptocurrency mining for licensed market participants. The ban was introduced because of the overload on the electrical grid, something that many worried was merely a pretext. However, miners have once again received access to electricity at one of the cheapest rates in the world. Bitcoin’s hashrate has already exceeded its September highs.

The factors listed above certainly don’t eliminate the risk of a new financial crisis or a crash for most assets, as Kiyosaki has predicted. However, the recent spike in Bitcoin’s price has led to the liquidation of short-position futures worth $35 million. Currently, the coin’s contingency of climbing well above $50,000 is higher than the probability of a financial crisis occurring in October.

What do you think? Let us know in the comments!

The StormGain Analytical Group

(a platform for trading, exchanging and safeguarding cryptocurrencies)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.