A trick up its sleeve: How the SEC can prevent Bitcoin ETFs from expanding

The SEC unwillingly approved ETFs when there was simply no other option due to a court favouring Grayscale in an appeal. But the agency's position hasn't changed. In the letter that accompanied its decision to launch ETFs, the regulator mentioned that Bitcoin is used by terrorists and fraudsters, among others.

This isn't another condemnation but rather a reminder to ETF management companies of the seriousness of the situation when it comes to raising investment capital. In 2019, the SEC adopted the Regulation Best Interest standard (Reg BI), which requires brokers, dealers, managers and financial advisers to act in the client's best interest.

This is a rather blurry set of rules that provides a lot of leeway in enforcement matters. Potential complaints could include questions such as:

- Can a client be advised to invest in a financial instrument preferred by fraudsters?

- Were alternatives presented to the client? Did they perform worse than "speculative" Bitcoin?

- Did the client suffer losses from the "volatility" of Bitcoin that the SEC warned about in its accompanying letter?

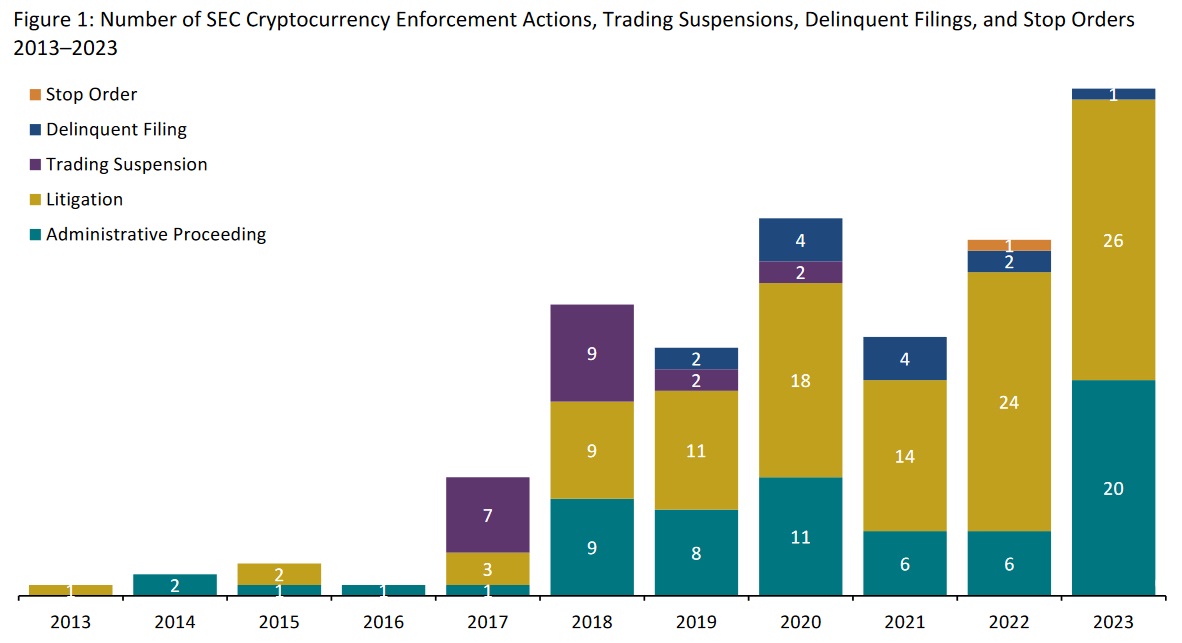

Some experts believe that the SEC will certainly use Reg BI for active involvement in crypto investments. To estimate the chances of that happening, it's enough to look at the statistics for claims and lawsuits filed by the SEC. There were 20 such instances in 2021, 33 in 2022, and 47 in 2023. In total, the SEC has issued $2.9 billion in fines against the crypto industry over the past 10 years.

Claims against Coinbase, Binance, Kraken, Ripple, and a number of other market participants are currently pending in court. And if Reg BI is applied, another 10 companies offering spot ETFs may join the list.

Since the ETFs were launched, the cryptocurrency is down nearly 20%.

As such, those who invested when the ETFs were approved are now suffering proportional unrecorded losses. It only takes one complaint from a client against a management company that presented a "bad" investment idea to get the SEC enforcement machine spinning with renewed vigour.

That doesn't mean that Bitcoin will be dealt a new blow when the regulator plays this card, but the expected effect of the ETF launch will be greatly exaggerated.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.