US investors may be banned from participating in ETH staking

On the day of Ethereum's move to the new protocol, Garry Gensler, chairman of the US SEC, promised to seek to label all coins on PoS blockchains as securities. This threat, along with the upcoming unlocking of 16.5 million ETH worth $27 billion in March, has already resulted in the altcoin lagging behind Bitcoin during the January rise.

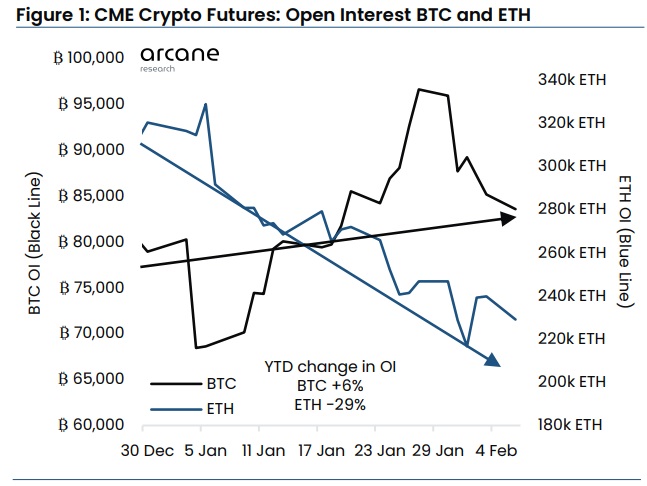

Because of growing fears of ETH's collapse, open interest in futures in 2023 dropped by 29% on the CME. Meanwhile, interest in BTC contracts saw a 6% increase.

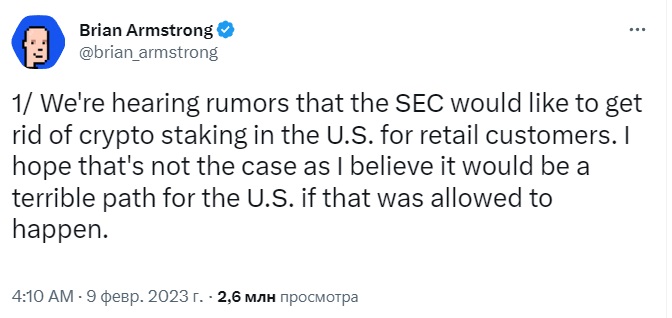

It seems as though the regulator is ready to take its first step towards tightening cryptocurrency regulation on PoS coins, starting with banning retail investors from participating in staking. Coinbase CEO Brian Armstrong shared the rumours, describing this twist as "a terrible path for the US…" and "a matter of national security". The SEC refused to comment on the speculations.

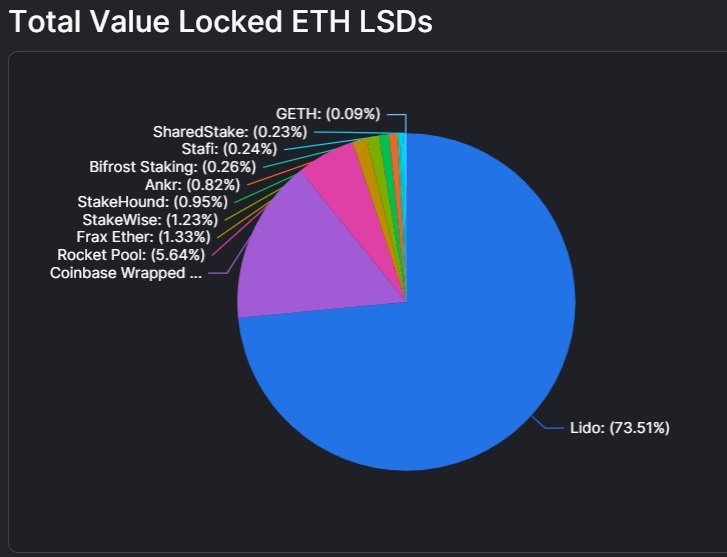

Banning staking in the US would lead to a natural outflow of capital to alternative jurisdictions. The restriction will primarily affect smaller investors, who will be forced to turn to liquidity aggregators because of the need to stake blocks of 32 ETH (~$52,000). The LDO management token of the Lido Finance platform has already reacted positively to the "terrible path", jumping 10% overnight.

Lido is the global leader in Ethereum staking with a 29.3% share, and if we consider liquidity pools alone, that share rises to 74%.

It's difficult to predict how far the SEC is willing to go in its crackdown on PoS coins, but the threat hanging over them will restrain investment flows coming from US investors. In the medium-term perspective, Ethereum is likely to keep lagging behind Bitcoin.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.