Winter is coming: the SEC strikes a blow to staking

The precedent has far-reaching implications for the cryptocurrency industry. The collapse of FTX (including its US division) exposed the regulator's inability to mitigate financial risks. The problem can be solved in two ways: by improving regulatory rules or by restricting citizens' access to cryptocurrencies. The SEC has chosen the latter.

Just yesterday, we shared Coinbase CEO Brian Armstrong's concerns about a possible ban on access to staking. And just a few hours later, the Kraken exchange announced that it was closing the service and paying a $30 million fine.

Proof-of-Stake (PoS) coins offer investors the opportunity to generate passive income from staking. This makes it possible to pass the Howey Test from 1946 to determine if an asset is a "security". The criteria include:

- Investing money

- In a common enterprise

- With a reasonable expectation of profits

- To be derived from the efforts of others

On the day of Ethereum's move to the new protocol, SEC Chairman Gary Gensler promised to apply the new status to all PoS coins. Because it is legally challenging to pull this off, the regulator has taken the easiest route: banning access to staking for US citizens.

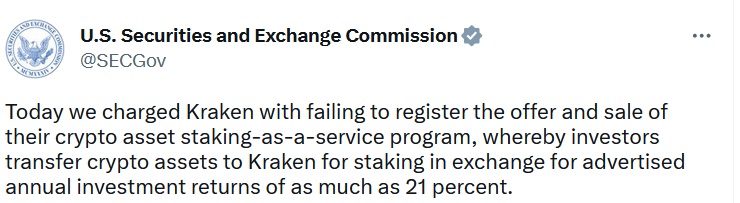

Kraken was the first to receive a notice to this effect and a $30 million fine. The crypto exchange has been accused of failing to register a service to generate passive profits for investors. The irony of the situation is that the SEC hasn't developed or presented a mechanism for such registration. SEC Commissioner Hester Peirce has publicly criticised her employer, calling it lazy.

Coinbase is undergoing a similar inspection. It's likely to face a similar outcome: a fine and a ban on retail investors participating in staking.

Ethereum will be the first to be hit by the SEC's ban, as Kraken and Coinbase's joint share in the staking exceeds 20%. The altcoin lost 2% against Bitcoin overnight. The main pressure will come with the Shanghai hardfork (expected to take place around March) when US users will get their ETH back.

This tightening of the screws goes hand in hand with court cases and investigations into Tether, Ripple, and Paxos (which is responsible for USDP and BUSD liquidity), as well as the development of a law covering stablecoins. According to Bloomberg analyst Mike McGlone, cryptocurrencies could face "their first real recession".

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.