Whales and exchange-traded funds sell off Bitcoin

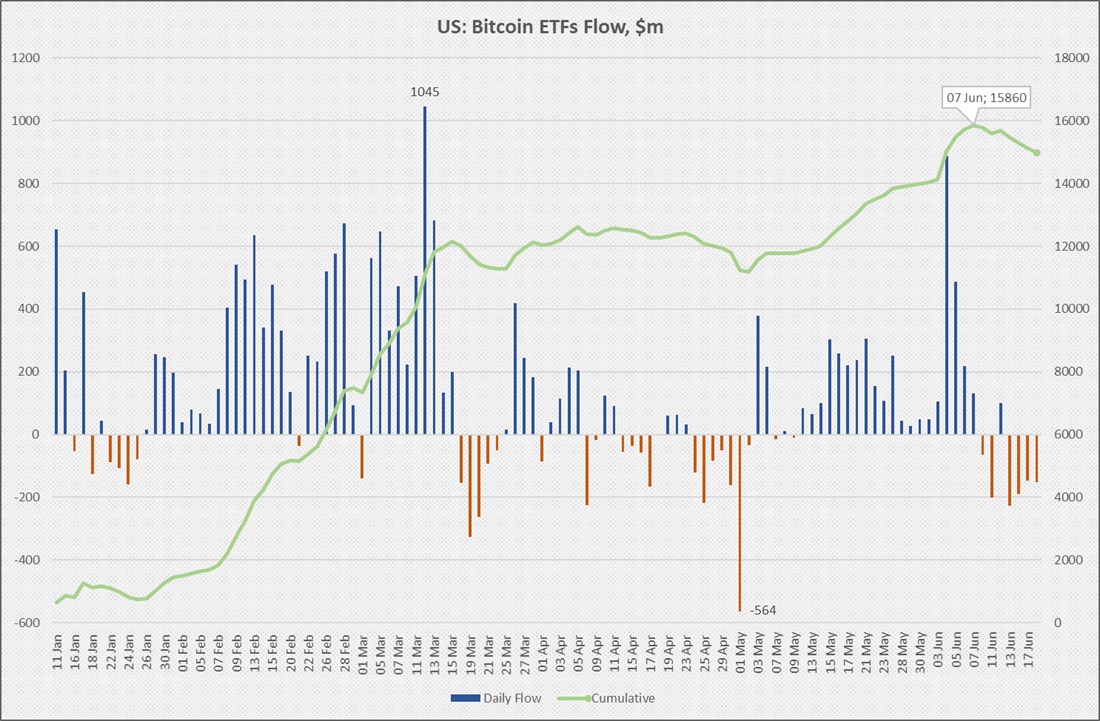

US spot Bitcoin ETFs have seen four consecutive days of outflows, shedding $879 million since 7 June to a current level of $15 billion.

The funds fall in the category of short-term holders (STHs) with less than six months' presence on the market. The exception is Grayscale's GBTC, which was converted from a trust fund. This is important to remember to avoid the risk of counting it twice.

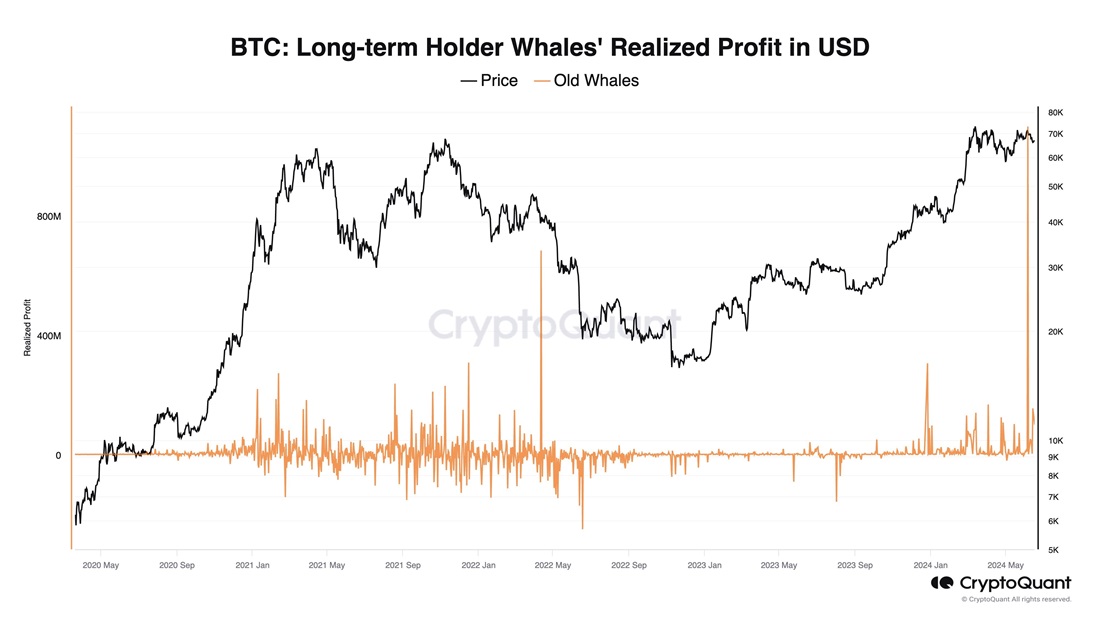

Over the past two weeks, long-term whale funds sold $1.2 billion of Bitcoin, of which GBTC accounted for $370.7 million. By doing so, whales and exchange-traded funds have combined to create $1.7 billion of pressure in the last fortnight.

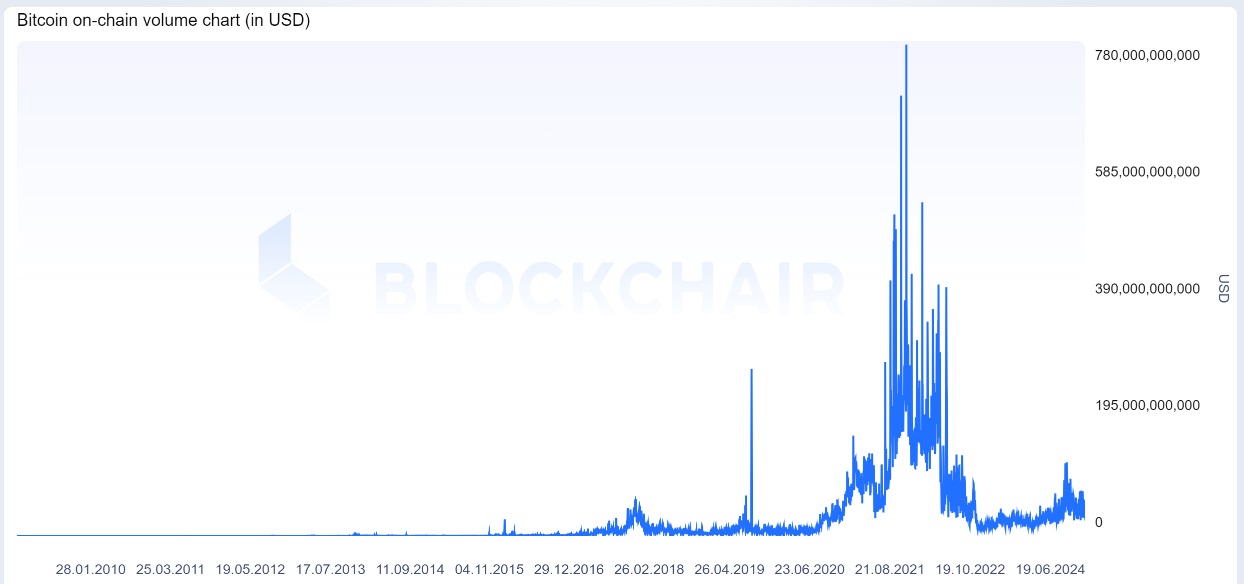

A lot or a little? This creates some resistance to further growth in the context of low network activity, as seen in the decline of active addresses and reduced volume of transfers via the network.

However, the amounts in question are not big enough to set off a full-scale downturn.

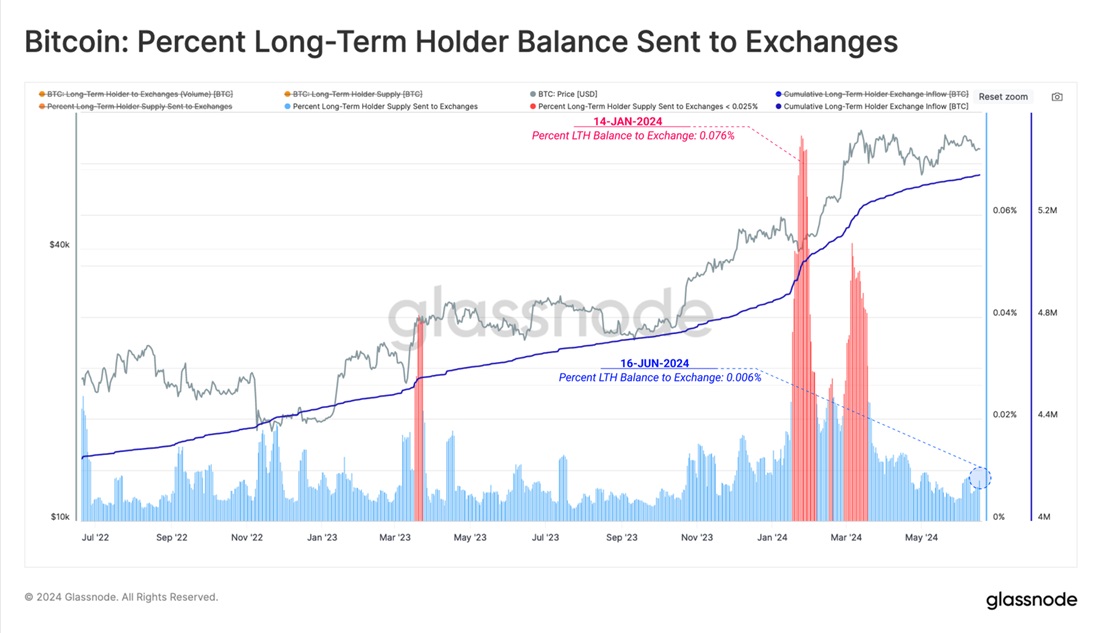

Long-term holders' (LTHs) commitment to an accumulation strategy will continue to provide strong support for prices. A glance at the graph of daily LTH coins sent to crypto exchanges makes this clear. The figure has fallen from an average of 0.05% of total reserves in January and March to just 0.006% at present.

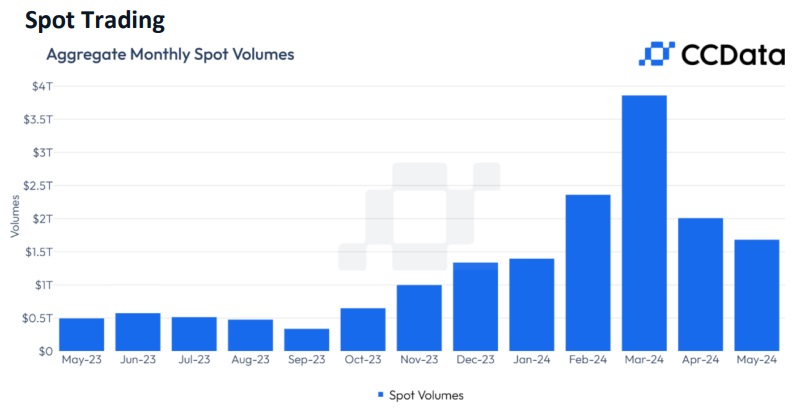

In any case, the $1.7 billion sales are tiny compared to total spot market trading volumes, which stood at $1.6 trillion in May.

News of large sales by whales or sustained outflows from exchange-traded funds casts a shadow and adds to investors' nervousness. However, this news should be viewed in the context of overall trends and sentiments.

For example, Jenny Johnson, head of Franklin Templeton, which has assets under management of over $1.3 trillion, believes that the first wave of demand for spot ETFs will soon be followed by a second wave. She predicts that the second wave will include more institutional investors. The ongoing outflow of coins to cold wallets and reduction of incoming supply due to halving put Bitcoin on track for a new record before the end of the year.

StormGain Analytics Group

(A platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.