While some panic, others buy up Bitcoin

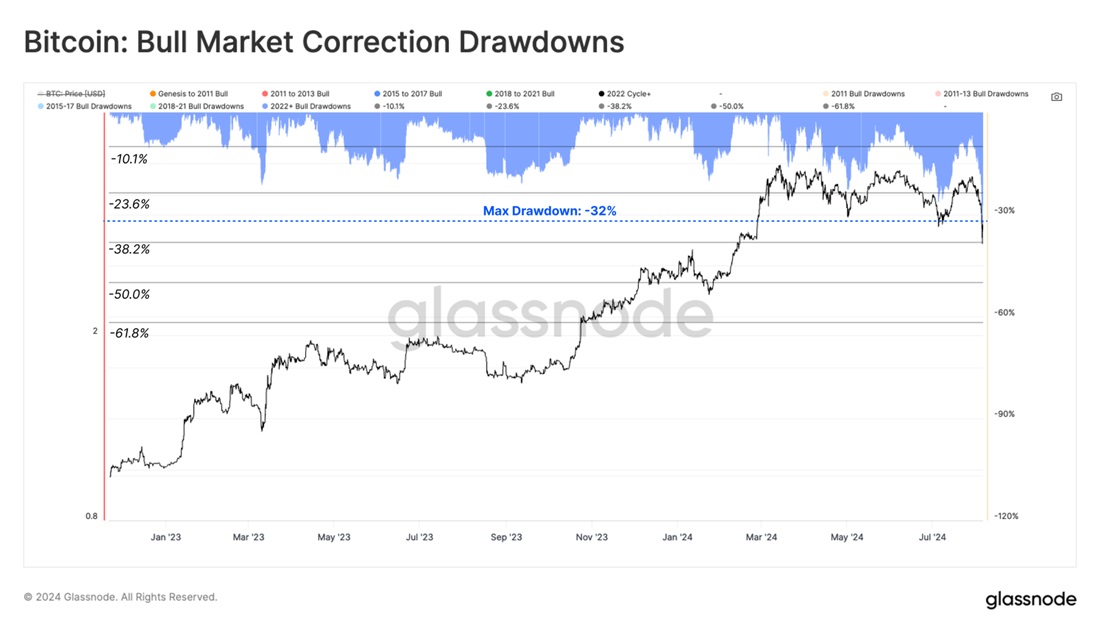

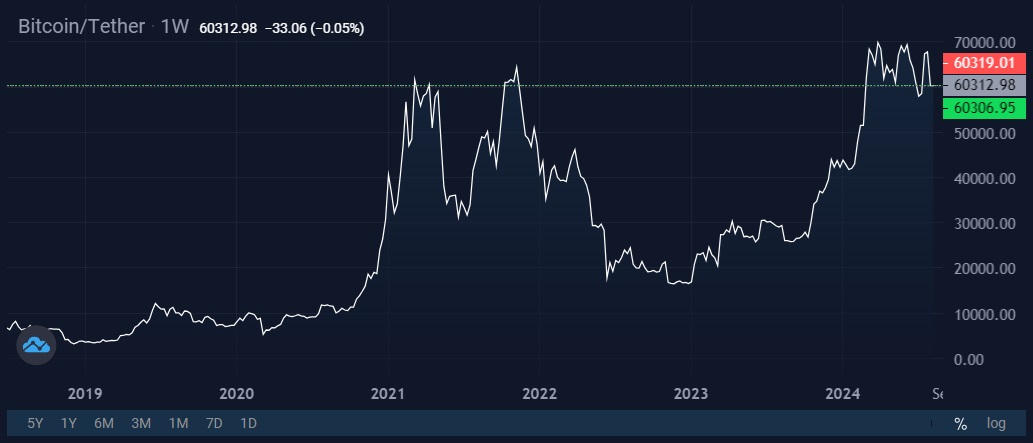

This week, Bitcoin saw its most serious correction in the current bull cycle, dropping to $50,000 per coin. That's an over 32% drop from its record high.

The sharp drop, exacerbated by talk of a US recession and the rise in geopolitical tensions, panicked some investors. On 5 August, the spot market saw realised losses of $1.4 billion. That's the 13th-largest sell-off in Bitcoin's history in dollar terms.

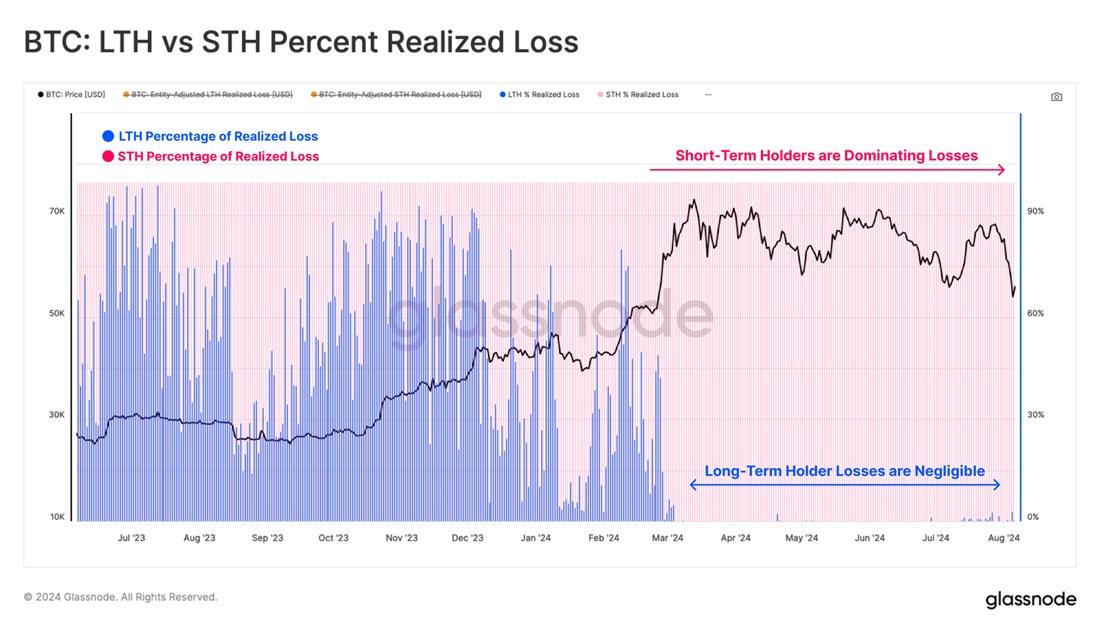

One extremely curious aspect is that only short-term holders (STH) panicked. They accounted for 97% of the losses.

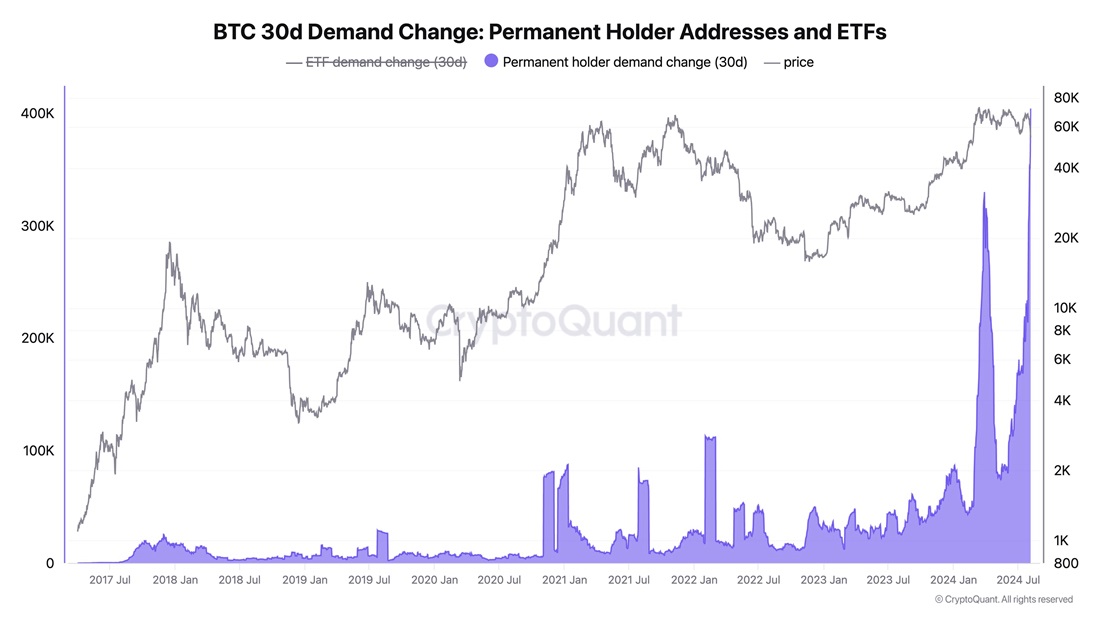

Long-term holders (LTH), on the other hand, not only showed restraint but actually increased their positions by taking advantage of relatively low prices. Over the past 30 days, the total volume of permanent holder addresses (two incoming transactions and no outgoing ones; ETF addresses are excluded) jumped to a record-high 404,400 BTC or $22.8 billion.

Traders saw opportunities and increased their net inflow into crypto exchanges. For the largest of them, Binance, the indicator this week was $1.8 billion. This once again emphasises the absence of an all-out panic since days when panic hits the platform always result in a net outflow. Unfortunately, Binance CEO Richard Teng didn't specify whether the inflow primarily consisted of fiat (which indicates buying) or cryptocurrency (which signals selling).

The key difference in behaviour between STH and LTH is their timeline for planning. The former usually don't hold coins for longer than two months, even in rising markets, and undergo sharp mood swings. LTH, however, focus on long-term trends. They accumulate coins during corrections and take profits as the asset rises to new highs.

Bitcoin's prospects remain good despite the higher risk of a recession in the United States. The government still hasn't reoriented itself to combat the deficit, and the rise in unemployment will force the Federal Reserve to return to stimulating the economy ahead of schedule. That means that new liquidity injections are coming.

As Bitmex co-founder Arthur Hayes said, "Both the Trump administration or Harris administration will print [fiat]... The Bitcoin price in this cycle is going to go very, very high. Hundreds of thousands of dollars, maybe $1 million."

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.