Who's behind Bitcoin's skyrocketing hashrate?

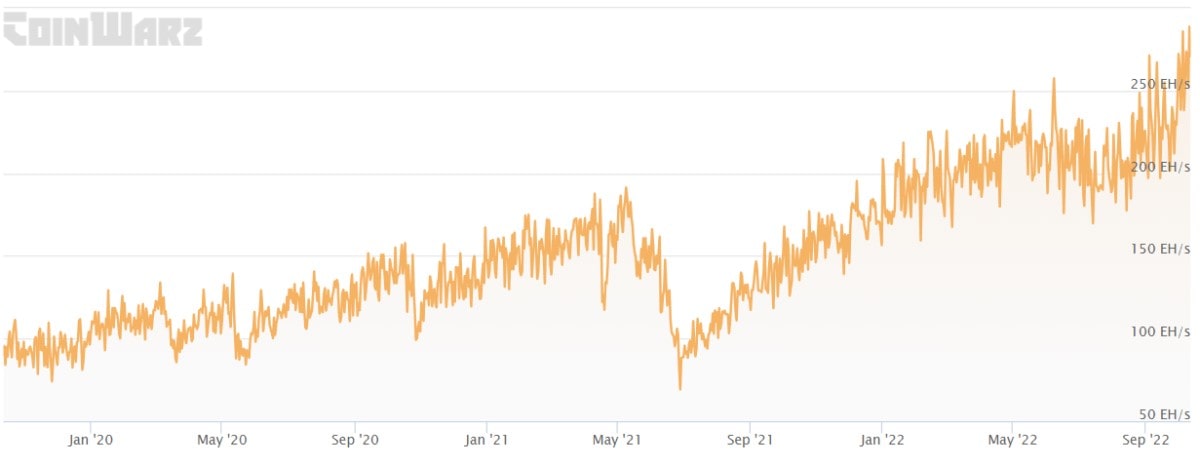

Bitcoin's total processing capacity jumped by 13.5% to 254.8 EH/s last week, and it's continuing to grow. In other words, new equipment is being connected at a rapid pace, despite the coin's relatively low price and the general decline in mining profitability.

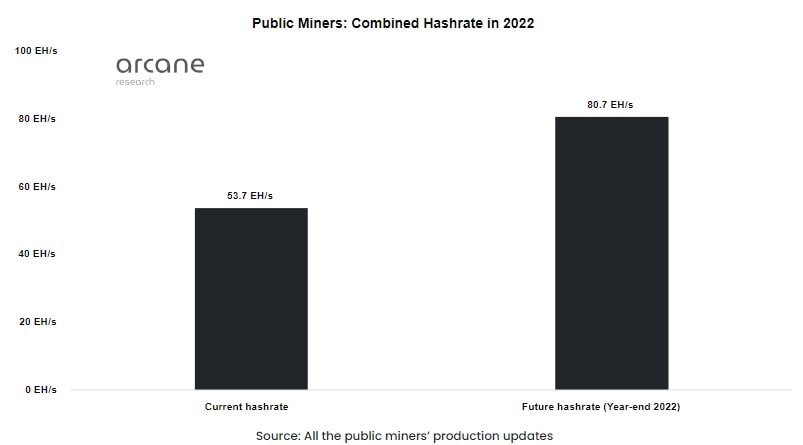

Over 20% of the hashrate, or more than 54 EH/s, is provided by public miners, mainly US companies whose shares are traded on the stock market. Despite their disastrous situation (in terms of profitability), they continue to draw capital, acquire competitors and increase production capacity. Arcane Research estimates that public miners will increase capacity by 50% to 80.7 EH/s in the last three months of 2022.

The yield per hashrate of capacity has already hit a low, falling to 4.06 BTC per exahash, and Bitcoin is close to the cost of production, which Glassnode now estimates to be $18,300.

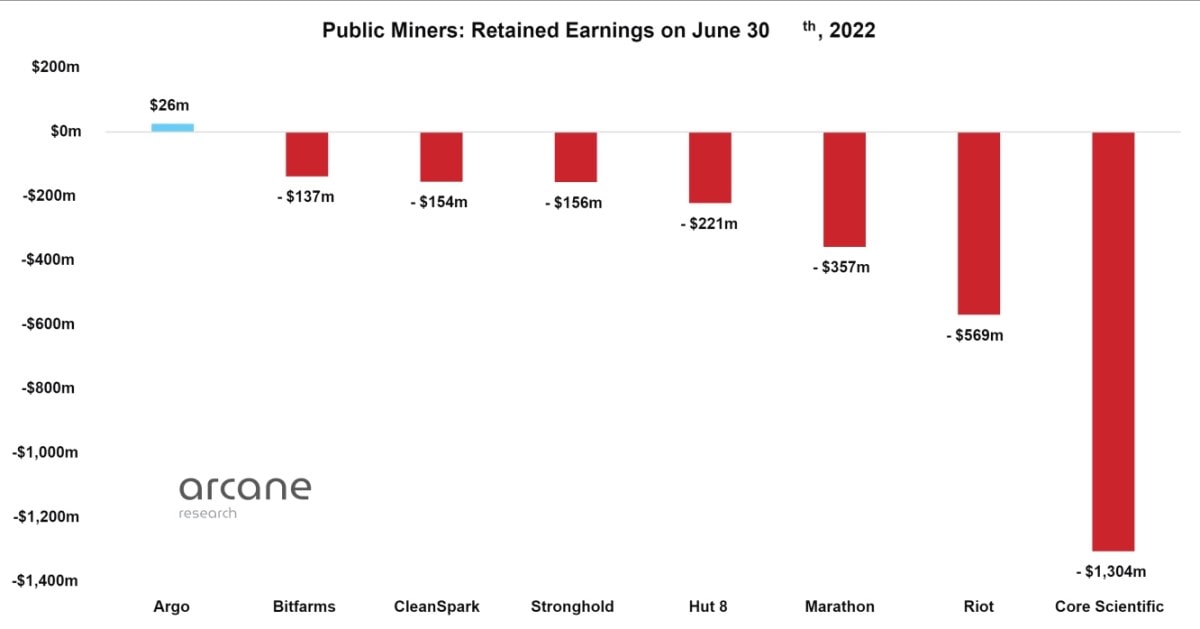

Combined with the decline in investment inflows, this leads to poor financial results for miners. For example, Core Scientific, which has the largest capacity, experienced a loss of $1.3 billion and was forced to sell 12,000 BTC in the summer, cutting reserves by 86%.

Stronghold Digital Mining was even less fortunate, having to say goodbye to the 26,000 ASICs it bought as collateral, while Compute North declared bankruptcy.

However, some players' weakness is encouraging others to act. Among publicly traded mining companies, Cleanspark stands out. It has plans to become a leader in terms of hashrate by the end of 2023, increasing its capacity from 1 EH/s in mid-2021 to 22.4 EH/s by the end of 2023. The company is doing this by buying ASICs at unprecedented discounts and swallowing up competitors. Its latest acquisition was Mawson in Georgia, which resulted in its total capacity reaching 4.7 EH/s.

Despite the half-billion-dollar losses, Riot Blockchain has an ambitious goal to triple its capacity to 12.5 EH/s in six months. Medium-sized players are also trying to keep up. Iris Energy intends to raise $100 million to acquire a struggling mining company, for example.

Declining profitability isn't putting a stop to competition between publicly traded mining companies. The opportunity to increase market share by buying weaker players and ASICs at low prices only fuels the excitement. The series of acquisitions will likely continue, with Bitcoin's hash rate approaching 300 EH/s by the end of the year.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.