Why the 0.75% rate hike signals Fed weakness

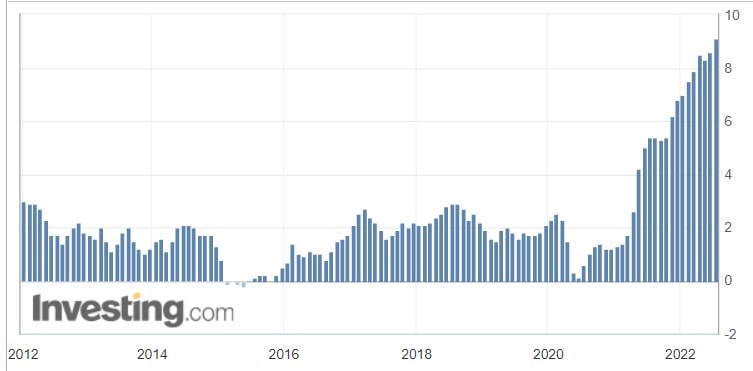

The Fed pursues two main goals when conducting its monetary policy: to foster maximum employment and maintain moderate inflation. Everything looks good with unemployment, with the unemployment rate below 4% throughout the current year. However, inflationary pressures continue to mount, forcing the Fed to sign off on its own impotence.

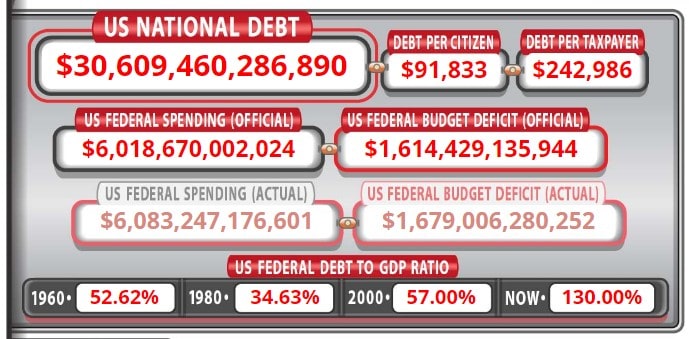

Regulators use rate hikes to curb inflation by making borrowing more expensive and thereby decreasing money circulation. The downside of high interest rates is an economic slowdown and increased debt servicing costs. The latter is no less painful for the US, which has a national debt exceeding $30 trillion.

According to the Ministry of Finance, during the last fiscal half-year, debt servicing costs rose by 30% to $311 billion. Each increase in the key rate leads to higher interest payments, forcing the government to either make budget cuts in other areas or raise the government's debt ceiling. According to preliminary estimates, the US will have to pay $8.1 trillion in interest payments over the coming decade.

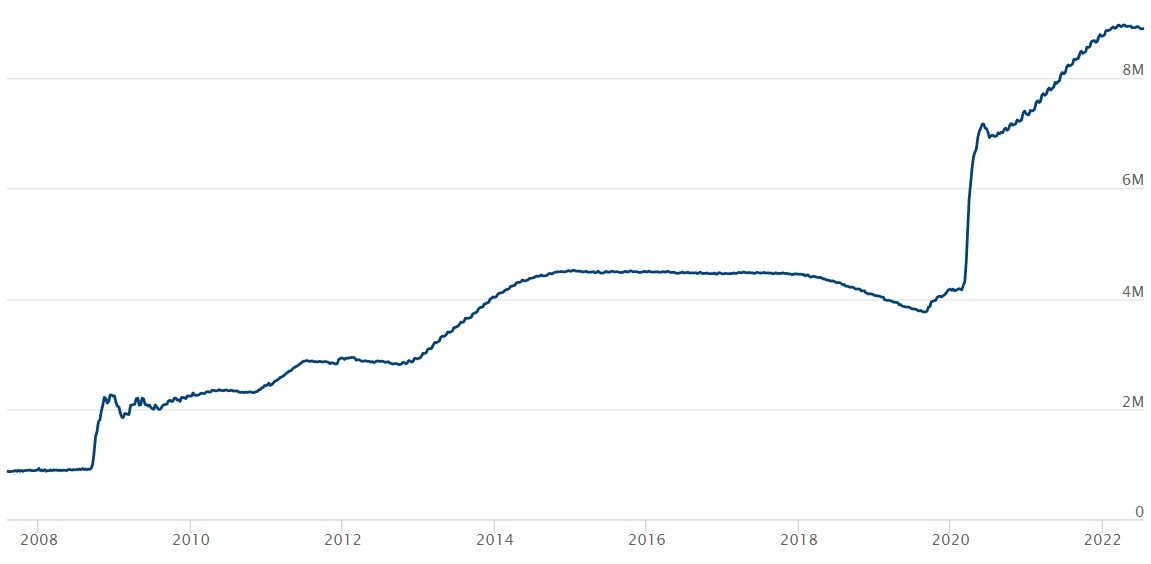

The second problem for the Fed when raising the interest rate is that the financial sector accounts for a lofty 20% of GDP (depending on how it's calculated). A sharp increase in the interest rate can cause panic in financial markets, which subsequently impacts the real economy. For the same reason, despite the regulator's claim that it would start reducing its balance sheet starting in June, this did not occur. The balance sheet now stands at $8.9 trillion, up from $4.2 trillion in February 2020 and $0.9 trillion in August 2008.

Many people were expecting the Fed to raise the interest rate by 1% because the rising inflation rate requires more aggressive action. However, the smaller increase of 0.75% suggests that inflation has been deemed the lesser of possible evils. A number of analysts suggest that the Fed will stop raising rates in November and, in 2023, will return to its quantitative easing programme, i.e., buying up assets and increasing its balance sheet.

The regulator's soft stance is good news for risky assets. Bitcoin is up 8% in less than a day.

The US economy, on the other hand, is not looking so great. If restraint measures prove insufficient, inflation will skyrocket, and the risk of recession will increase. US President Joe Biden and his administration are now resorting to populist rhetoric, calling for a rejection of the academic approach to defining a recession and claiming that two consecutive negative GDP quarters do not indicate one has hit. The Q2 2022 GDP report released on 28 July showed a 0.9% contraction. This is perfectly in line with the approach taken by Fed Chairman Jerome Powell, who, until recently, referred to inflation as a "transitory phenomenon".

StormGain Analytics Team

(crypto trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.