Why the response to halving will be similar to the reaction to ETFs

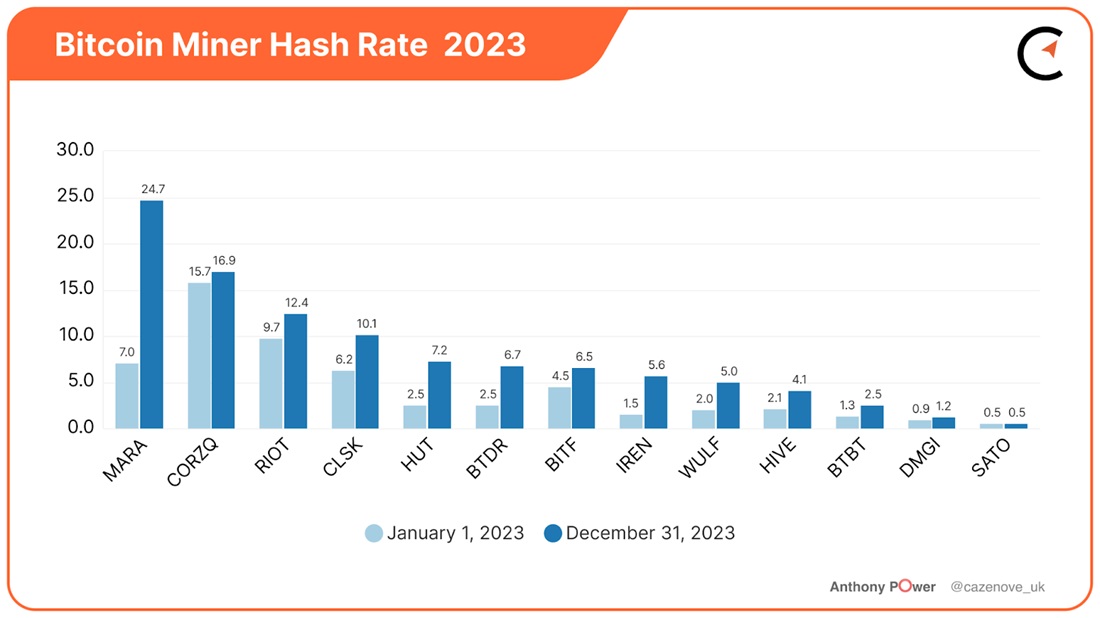

In 2023, miners doubled their production capacity. The total hashrate of the Bitcoin network increased 2.1 times to 515 EH/s.

Among publicly traded miners, Marathon Digital took the first place by growth rate, increasing its capacity by 3.5 times to 24.7 EH/s. Iris Energy, which saw 3.3-fold growth, and HUT 8 (2.9-fold growth) also showed excellent results. Marathon Digital ranked first in relative and absolute terms, overtaking 2022 leader Core Scientific.

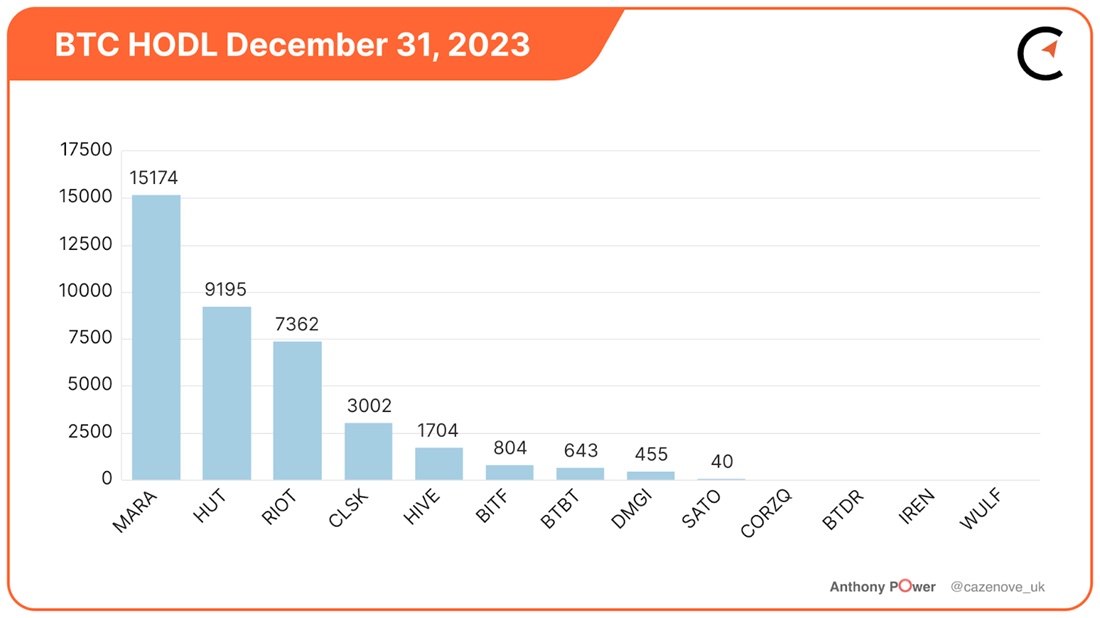

The former is also distinguished by its retention strategy: its reserves amount to an industry record of 15,200 BTC (~$654 million). Having learned the lesson of 2022, most miners are accumulating with caution. Core has undergone reorganisation after filing bankruptcy under Chapter 11 and is now dumping coins on the market without delay.

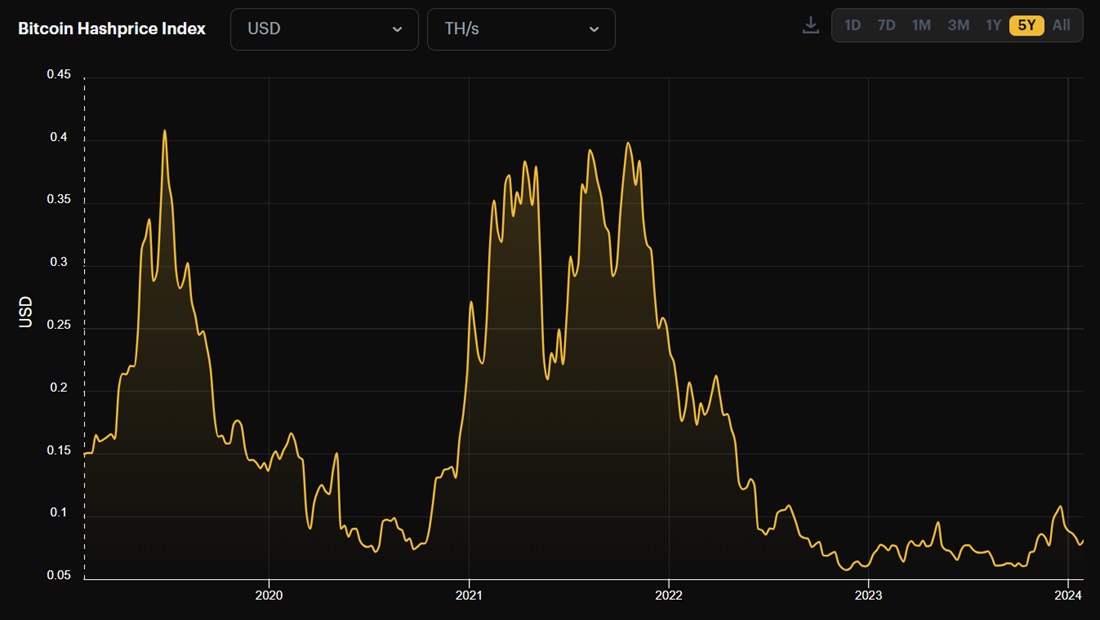

The ongoing arms race has resulted in little to no growth in yields per terahash of capacity over the past 12 months despite Bitcoin's solid surge.

Meanwhile, the halving event is less than three months away. If the coin's value doesn't show significant growth, most miners will face a severe lack of liquidity, which will force them to sell off their reserves more actively.

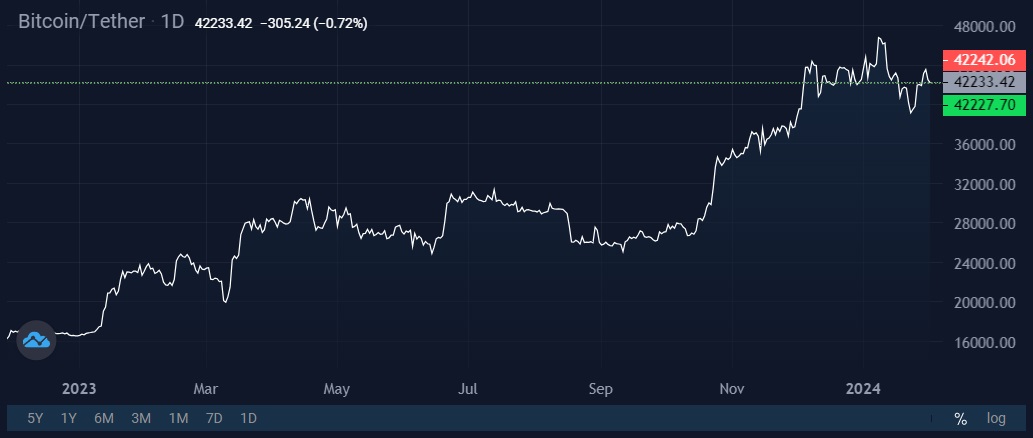

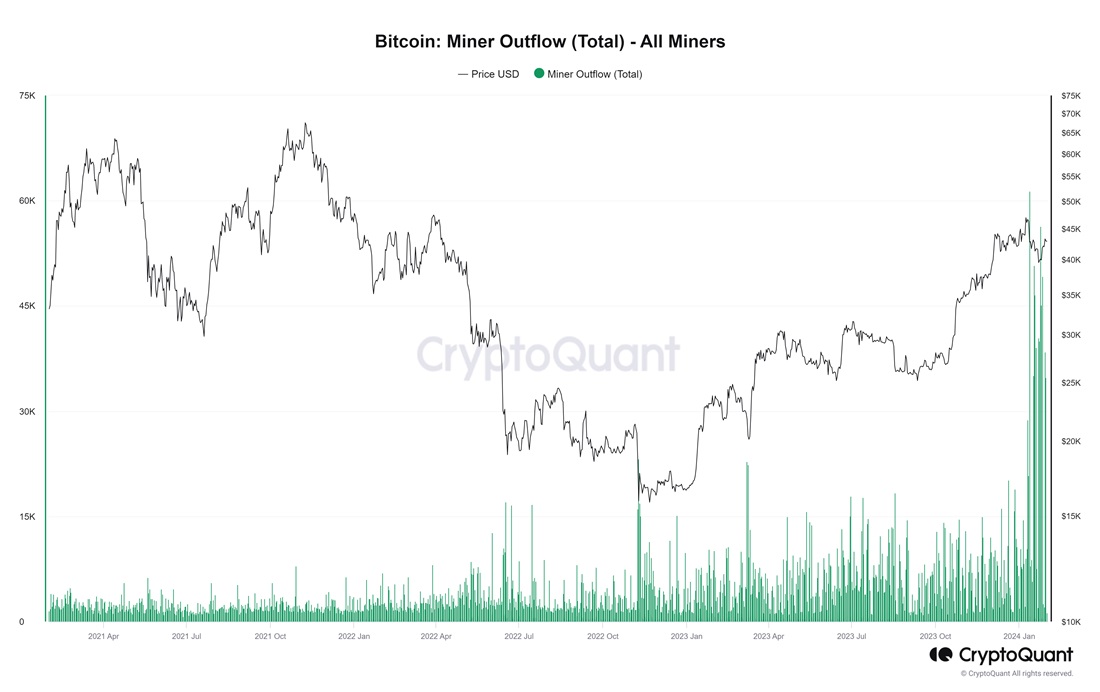

This month, they have already seized on an excuse in the form of spot ETF approvals in the US to send a six-year record 624,000 BTC (~$26 billion) to crypto exchanges from 10 January.

At the moment, miners collectively hold an impressive reserve of 1.8 million BTC, worth $77 billion. If Bitcoin doesn't show growth before the halving, the decline in yields will cause another wave of sell-offs.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.