Why institutional investors are pulling out of Bitcoin

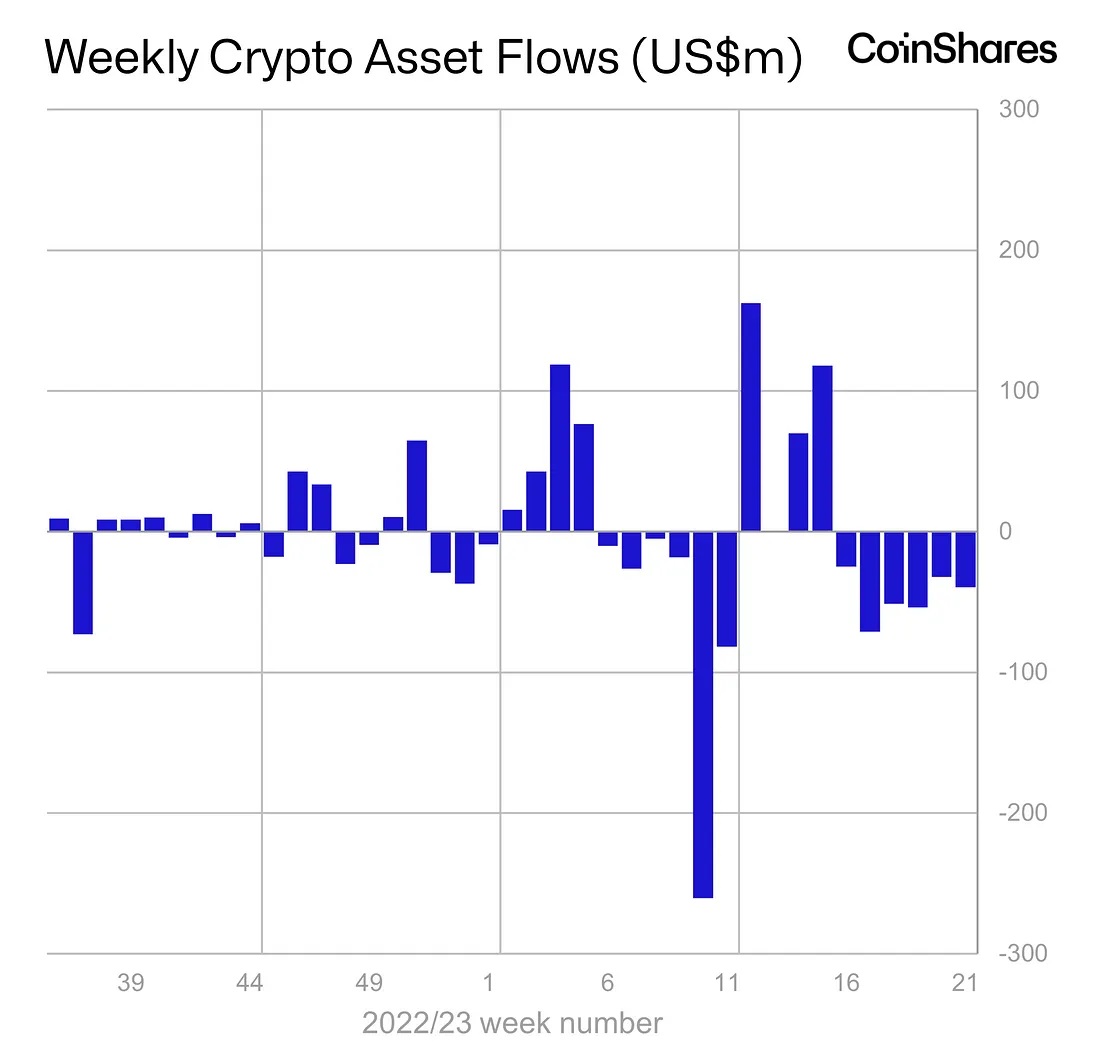

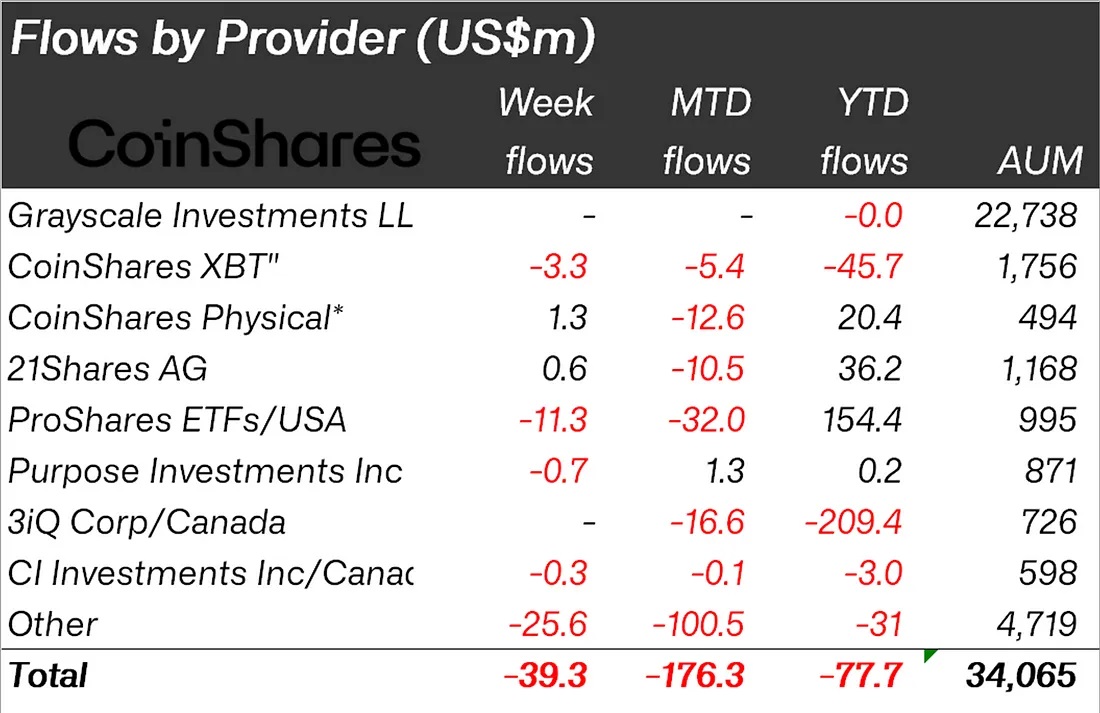

Cryptocurrency funds have been facing a month-and-a-half of investment outflows. In the past week, $39 million was pulled out, and in the past six weeks, the total amounted to $200 million. Among crypto coins, Bitcoin has seen the largest outflow, with the US leading by country.

Applications for an exchange-traded fund (ETF) for spot Bitcoin are still being rejected by regulators. Only ETFs for cryptocurrency futures contracts are allowed. The first and largest such fund in the US is ProShares (BITO), and it has seen the biggest investment outflows.

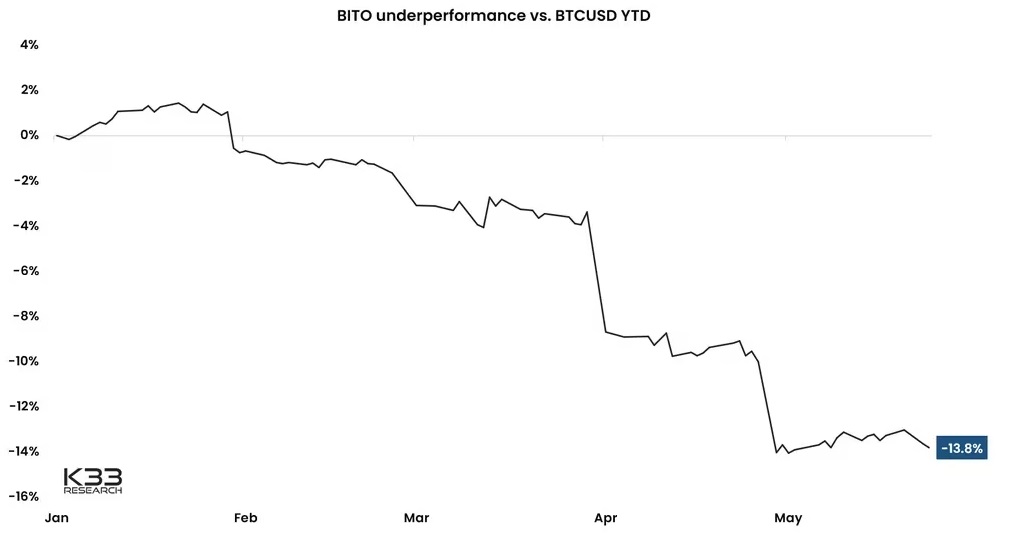

More specifically, it's due to the particular features of how futures contracts work. As the contracts expire, the fund buys new ones, with the difference being traded between them. Contracts with a later date are now more expensive than those that expire earlier. This phenomenon is called contango.

In such a case, when switching from one contract to another, the fund buys a new one at a premium, thereby creating a loss. This 'contango leak' has resulted in investments via ETFs lagging Bitcoin by 14% year-to-date.

Thanks to last year's bearish trends, BITO lagged behind Bitcoin by just 1.8%, a number that seemed fairly acceptable. However, the cryptocurrency's resumption of upward momentum in its price has led to an increase in contango and a dip in investor returns.

K33 Research analyst Vetle Lunde warned in a note to investors that the high contango situation is likely to continue in light of the cryptocurrency's expected price growth. That said, long-term investments in Bitcoin via futures ETFs are looking increasingly less attractive.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.