Altcoins' troubles don't affect hodlers' mood

Last week, altcoins dropped by around 20%. Among the major projects, massive damage was taken by those the SEC declared securities in lawsuits against Binance and Coinbase. As a result of the legal action by the SEC, Solana is trading 29% lower, and Cardano has seen a 28% decline.

In one of his latest interviews, SEC Chairman Gary Gensler claimed that all altcoins are securities. This explains the broad decline in the market despite the narrow list of coins mentioned in lawsuits brought by the SEC and Bitcoin's resilience amidst current events.

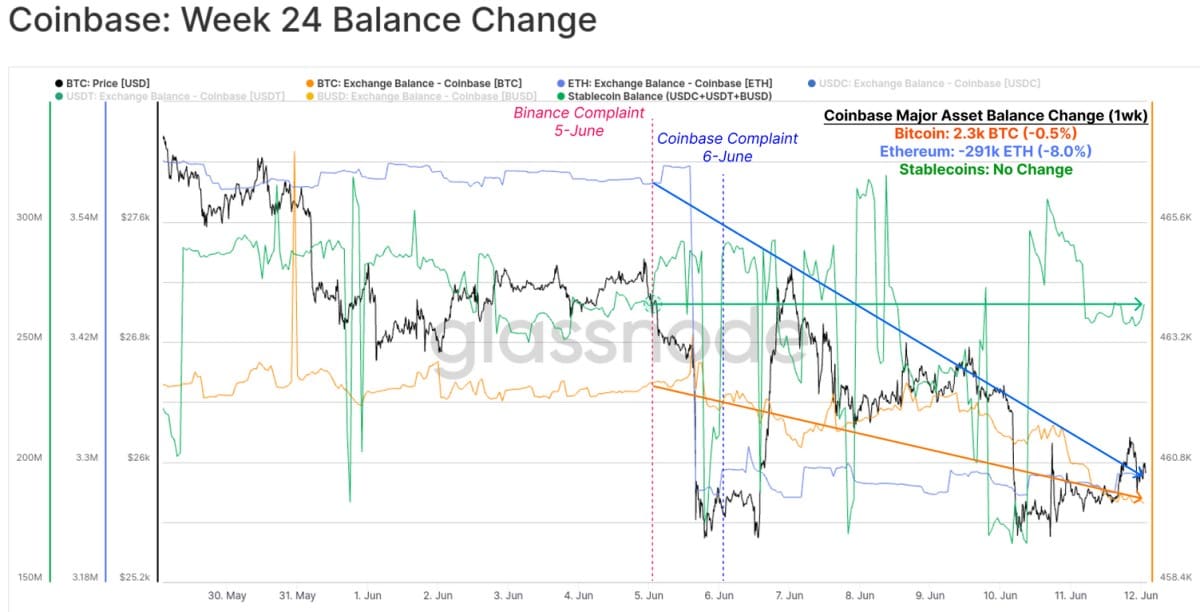

Since Coinbase was sued, reserves in Ethereum have fallen by 8% or 291,000 ETH. Meanwhile, users' presence in Bitcoin and stablecoins has remained almost unchanged.

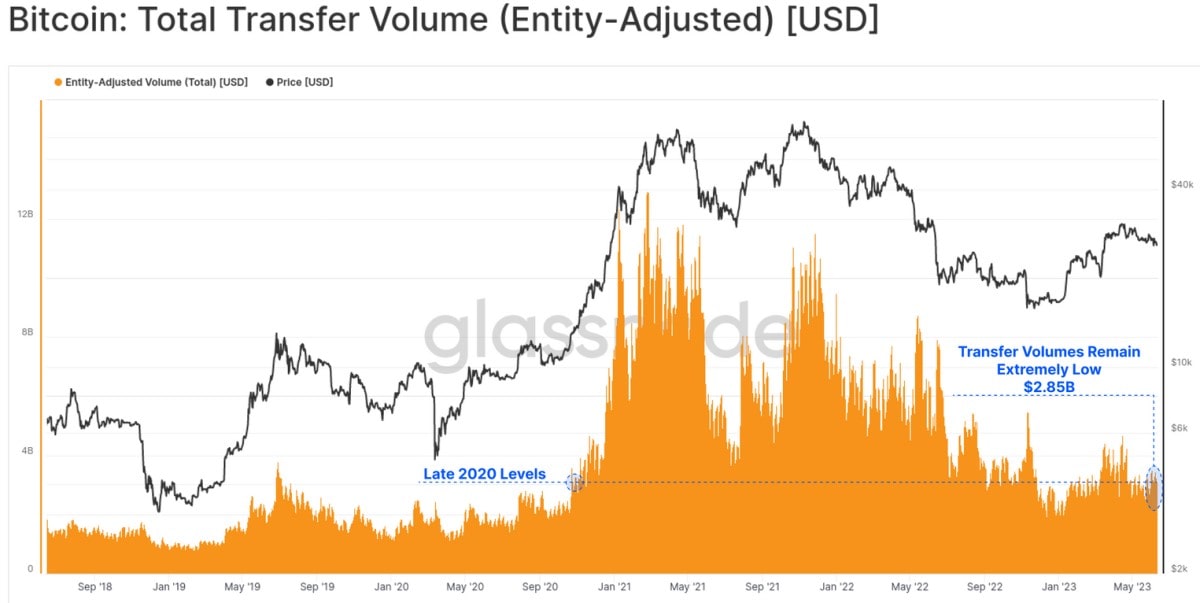

The bad news resulted in higher interactions with the affected crypto exchanges. The outflow and inflow have grown by 70% to $845 million a month, with the volume of outflow 10% higher than that of inflow. However, the figures aren't that impressive. Total transfer volume remains at cyclical lows, with a turnover of $2.9 billion a day.

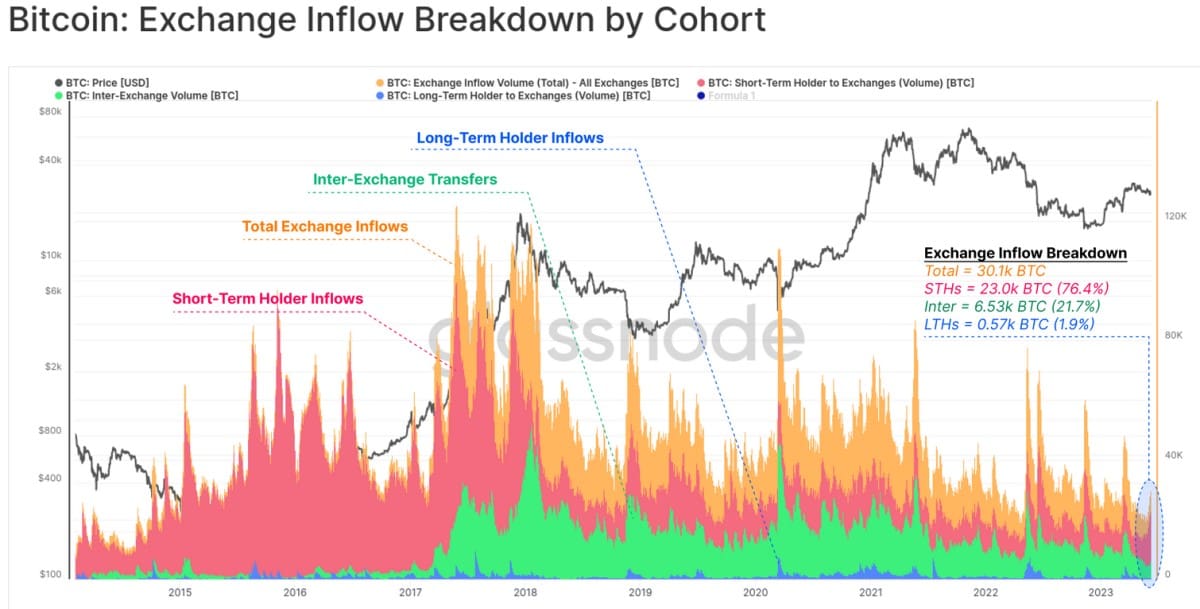

The main reaction to the negative developments came from short-term holders (STHs), whose share of coin inflows to cryptocurrencies jumped to 76.4%. STHs are primarily represented by traders trying to profit from the short-term growth or decline of assets. The share of interexchange transfers fell to 21.7%, while long-term holders (LTH) showed little to no reaction (1.9%).

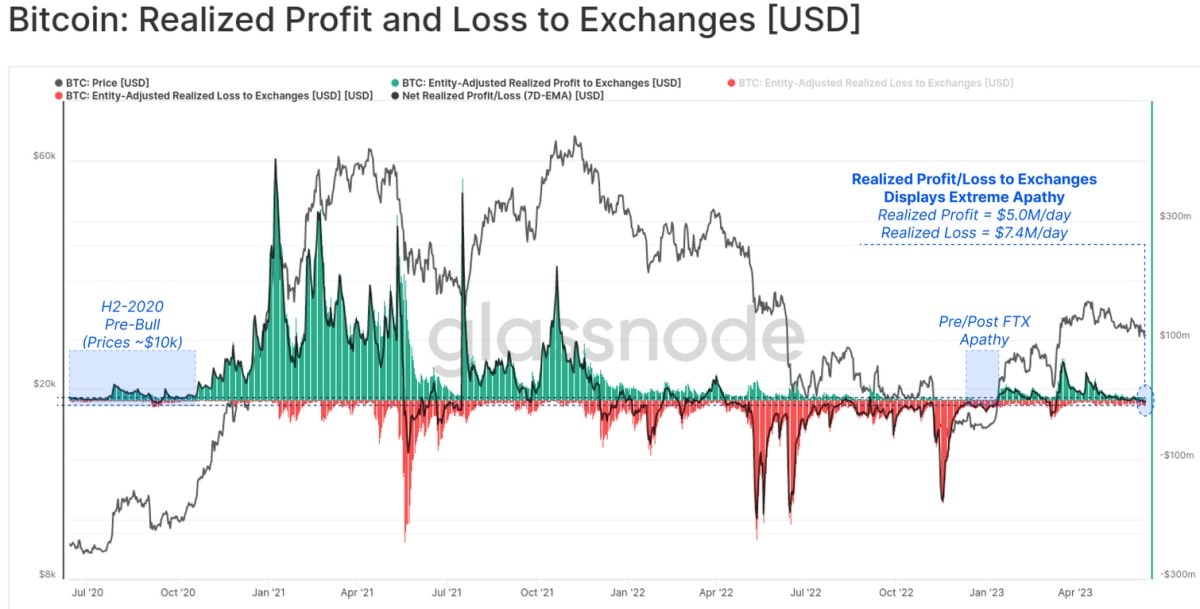

Since STHs held positions for less than six months, they've mostly exited at the same prices they bought the cryptocurrency (the so-called breakeven level). This is clearly demonstrated by the realised profit and loss indicator remaining at minimum levels.

Traders have strongly reacted to negative developments by getting rid of some altcoins. That said, investors and long-term hodlers (LTHs) remained indifferent to the situation.

First, recognising altcoins as securities via lawsuits is a difficult task, as proved by the SEC's lawsuit against Ripple that's been in motion since 2020. XRP hasn't even participated in the latest sale since some participants are absolutely certain that 2023 will be a good year for the company.

Second, the court case is likely to be heavily delayed, and risky assets could get a boost as early as this week if the Fed pauses its rate hike tomorrow. For the last year, the US dollar has been losing positions on the international stage, showing a decline in global reserves and payments. Some analysts consider this chaotic tightening of crypto regulations to be a sign of desperation.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.