Another stablecoin bites the dust. Is Tether next?

The cryptocurrency space is facing an institutional crisis as a result of crumbling faith in stablecoins. And while few heads might have been turned by the collapse of a few minor projects, the decline of UST (Terra) — the third stablecoin by market cap — caused quite the furore, indeed. UST's capitalisation plummeted from $18.7 billion to $1.4 billion, while its balancer coin LUNA was totally devalued. For more info, see our previous articles.

Stable coins are the central interface between fiat and cryptocurrency, facilitating the movement of digital assets and the establishment of corresponding exchange rates. It's difficult to overestimate their influence. The overwhelming majority of cryptocurrency exchanges use stablecoins as a base currency for quoting the prices of various instruments.

After UST fell under pressure from sellers looking to protect their savings, DEUS Finance's DEI stablecoin was unable to hold on. Like UST, DEI is an algorithmic stablecoin.

If Tron's USDD network had launched earlier and managed to attract enough investment, it would have been the next to get wiped out. USDD was built on the basis of UST and uses the same algorithmic mechanism. In a bid to attract investors, Justin Sun is offering an annual staking return of 30%, whereas UST only offered 20%. USDD's capitalisation currently stands at a total of $300 million.

A loss of faith in stablecoins was always bound to impact Tether, the clear leader in this particular asset class. Over the last week, its capitalisation has steadily dropped to reach a total of -9%.

In contrast to the other coins mentioned above, Tether is a centralised stablecoin whose stability is guaranteed by the company's own reserves. The company could have rested easy if it had only kept its initial promises to hold bank reserves in USD equal to the volume of USDT issued.

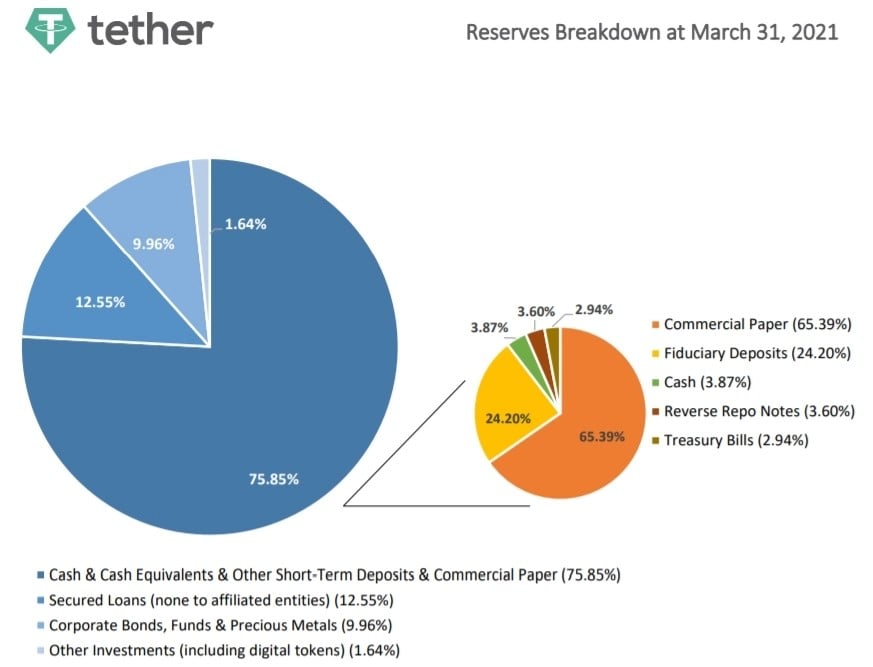

Under pressure from the New York Attorney General's Office, Tether conducted an audit that revealed the state of its reserves: only 5% of USDT was guaranteed by fiat, with over half backed only by corporate bonds.

In other words, when it issues Tether, the company is investing in other crypto projects, too. It's impossible to say for sure whether or not some of these funds were also invested in Terra. The probability of this being the case is slashing USDT's value and threatening the liquidity of the $76 billion market cap stablecoin. Investors are also feeling discouraged by the fact that Tether has made multiple requests to regulators to waive its obligation to publish its reserves status.

There is effectively no way for us to judge the quality of the corporate bonds held in Tether's reserves as their contents are hidden from the public. Investor concerns explain the outflow of funds from USDT to USDC, with the capitalisation of this latter rising from $48 billion to $52 billion over the past week alone.

USDC is much more attractive to investors since its parent company, Circle, is registered in the US and its accounting records on the status of its reserves are published monthly by independent auditor Grant Thornton LLP. On 13 May, Circle's financial director, Jeremy Fox-Geen, confirmed that 23% of the USDC in circulation is backed by fiat, with the other 77% covered by short-term US Treasury bonds.

StormGain analytical group

(cryptocurrency trading, exchange and storage platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.