Arguments for Bitcoin's upcoming rush on $80,000

Yesterday, we cited the actions of sharks and whales that have returned to accumulating coins as a source of support for continued growth. Today, we'll look at some more arguments that hint at Bitcoin setting a new price record.

Crypto ETFs

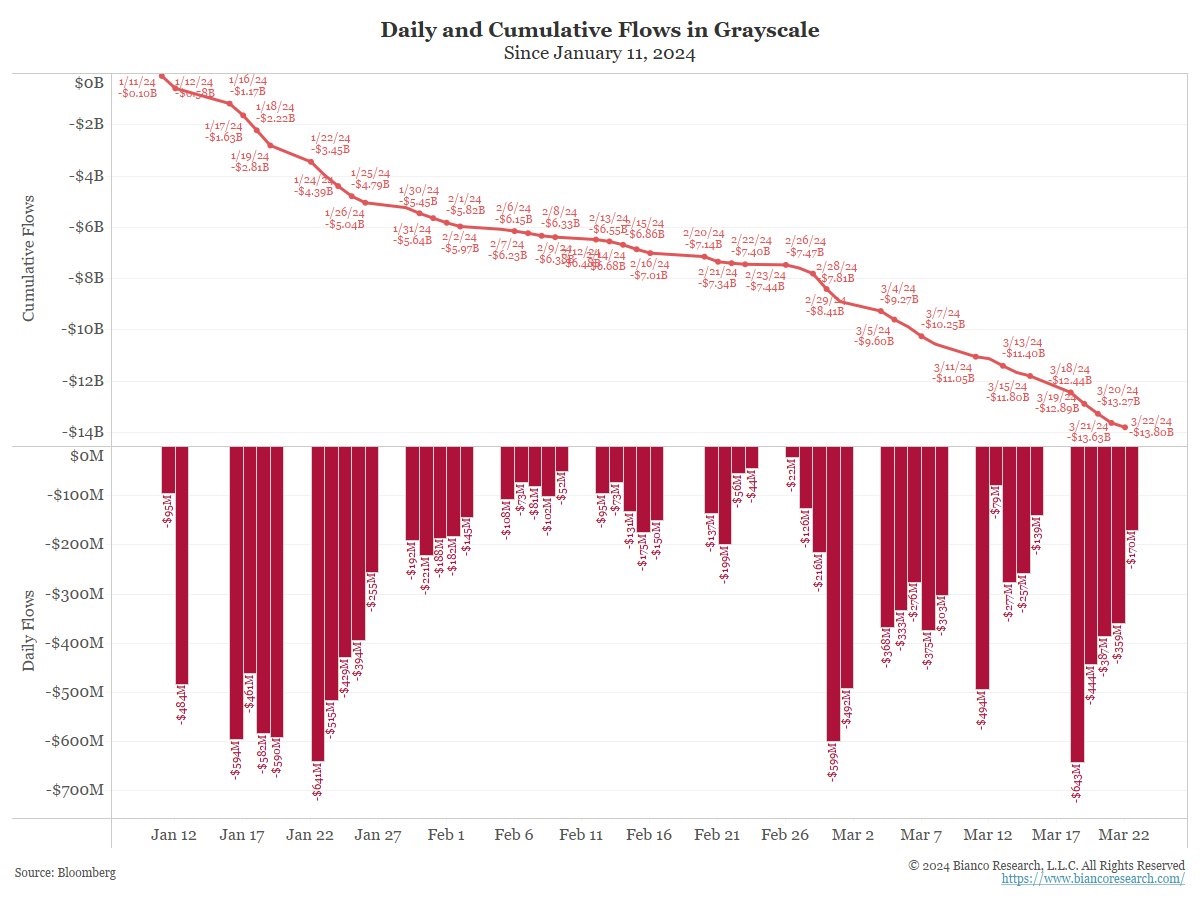

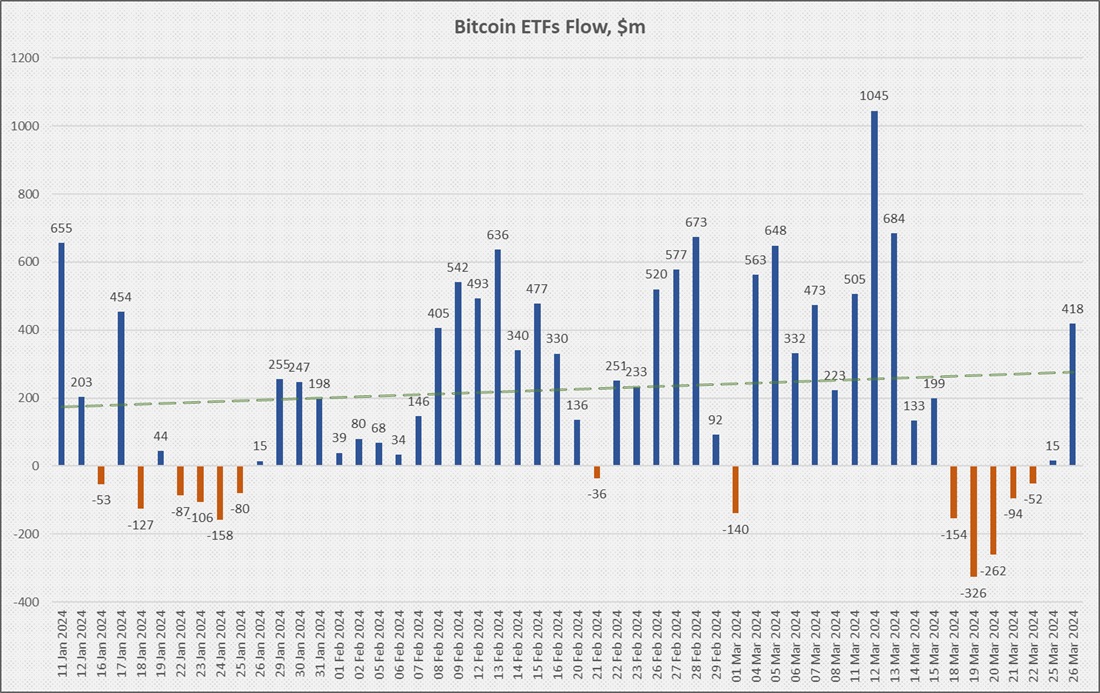

Last week, spot ETFs saw net outflows of $888 million. The reason was increased withdrawals from the Grayscale fund due to high management fees and lower inflows into the other funds.

However, yesterday, interest in Bitcoin from ETF buyers returned with renewed vigour at $418 million. This is significantly better than the average of $225 million. Most analysts believe that the trend will intensify over time since institutional players still haven't begun trading in the new instruments, and the main flow of funds is coming from retail investors.

Low activity on the spot market

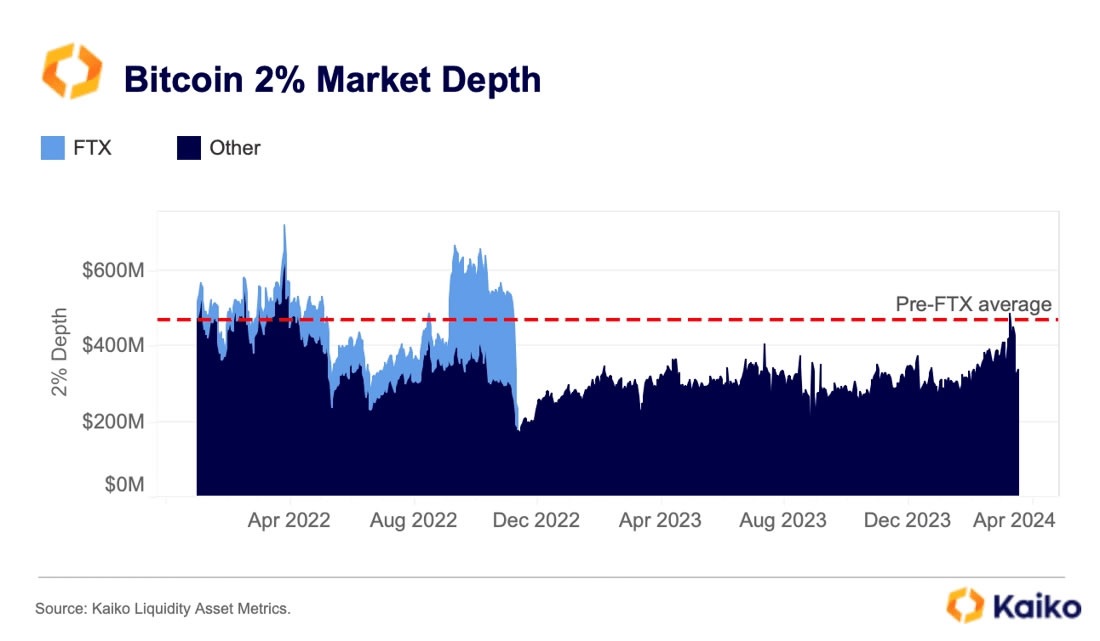

The main battles between bulls and bears are taking place in the derivative contracts market, which accounts for 70% of total trading volume. The market depth (the volume of placed orders on both sides of the price) on Bitcoin has finally approached the pre-crisis level.

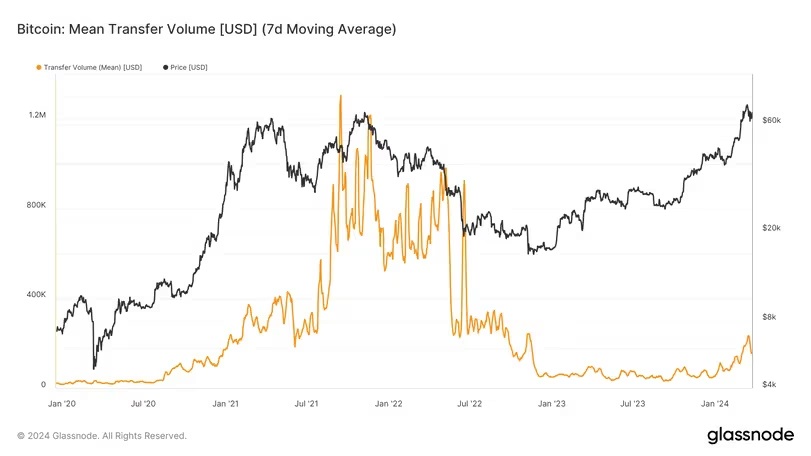

That said, of those who directly own Bitcoin, there are still few people willing to part with the coins at current prices. This is clearly seen by the volume of transfers within the network. If it exceeded $1 million on average per week in the previous bull cycle, it now doesn't even reach $200,000.

Lack of response to negativity

Bitcoin's institutionalisation has proved to inoculate it against the problems of individual market participants. The arrest of Binance's top managers in Nigeria and yesterday's indictment of the KuCoin crypto exchange and executives (the exchange's annual volume exceeds $1 trillion) by the US Department of Justice for criminal offences did not affect the price.

In the world's largest economy, Bitcoin is now an investment asset and a commodity that investors can access through licensed exchange-traded products. This made the connection to cryptocurrency exchanges more indirect.

Long-term factors

At its last meeting, the Fed reaffirmed its intention to cut its key interest rate by 0.75% in three rounds this year. The first adjustment could take place as early as June. This will reduce demand for Treasury bonds and increase interest in risky assets such as Bitcoin.

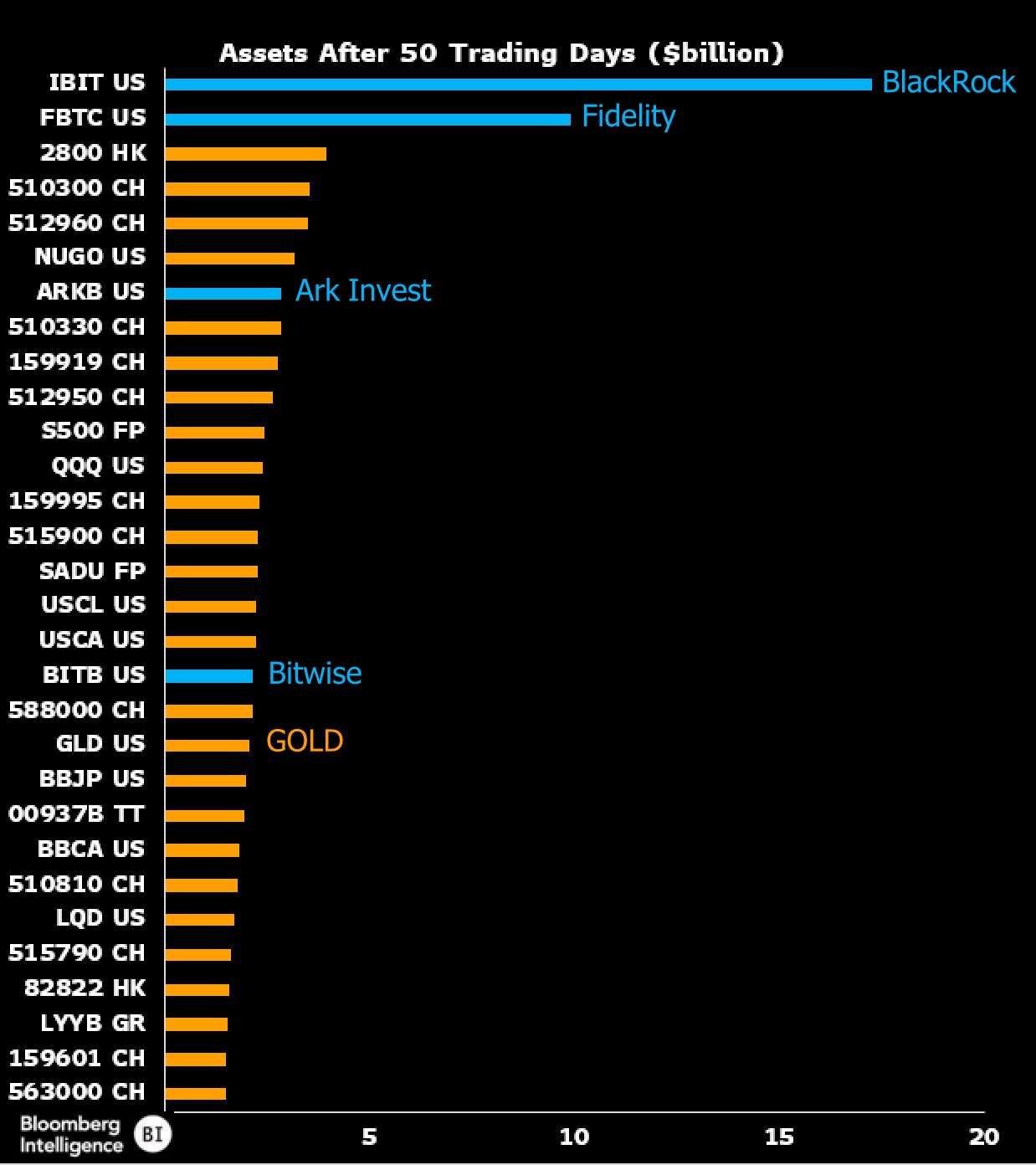

In mid-March, JPMorgan reported that volatility-adjusted Bitcoin was already outperforming gold in investors' portfolios by 3.7 times. This clearly demonstrates the outperformance of the two Bitcoin ETFs over the gold (and any other) ETF in terms of investment volume in the first 50 days of trading since launch.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.