The average Bitcoin holder returns to profit

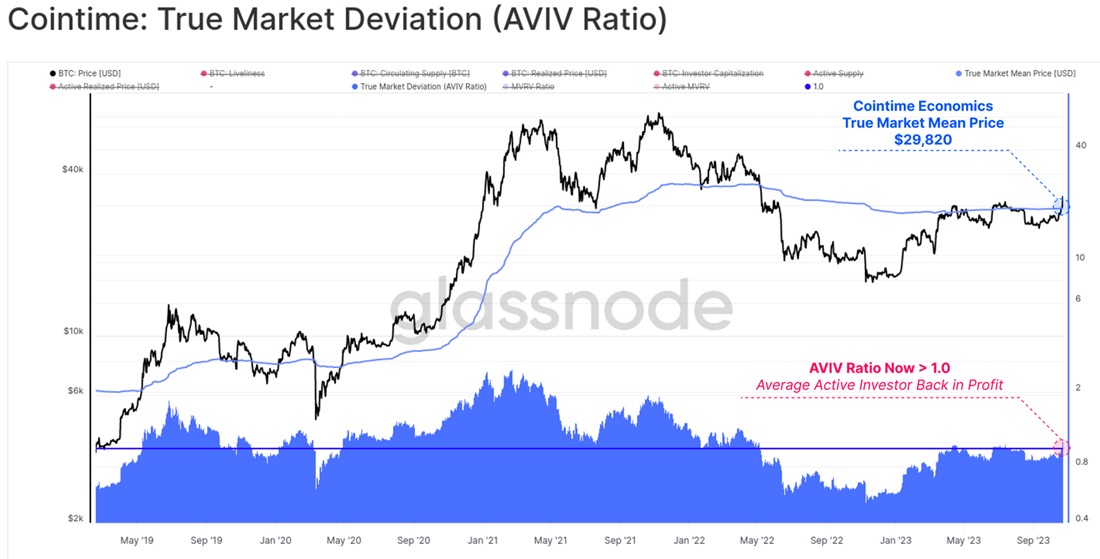

According to Glassnode, investors spent an average of $29,800 to buy one Bitcoin. Breaking through this barrier signals that coin holders, on average, have returned to unrecorded profit.

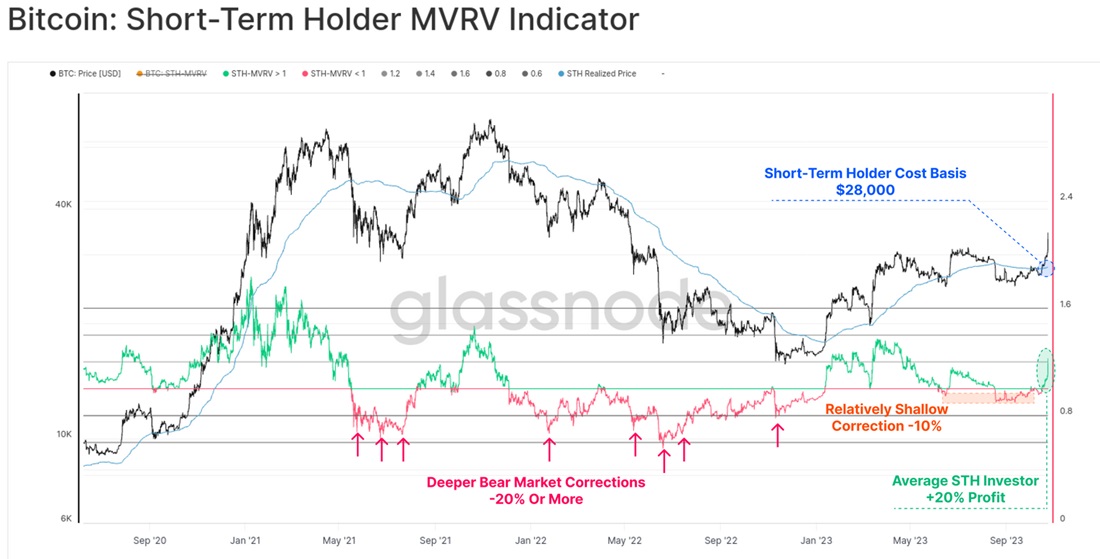

This amount is $28,000 for short-term holders (i.e., those whose coins have been idle for under six months). In other words, each coin buyer from this group holds an average of 20% profit.

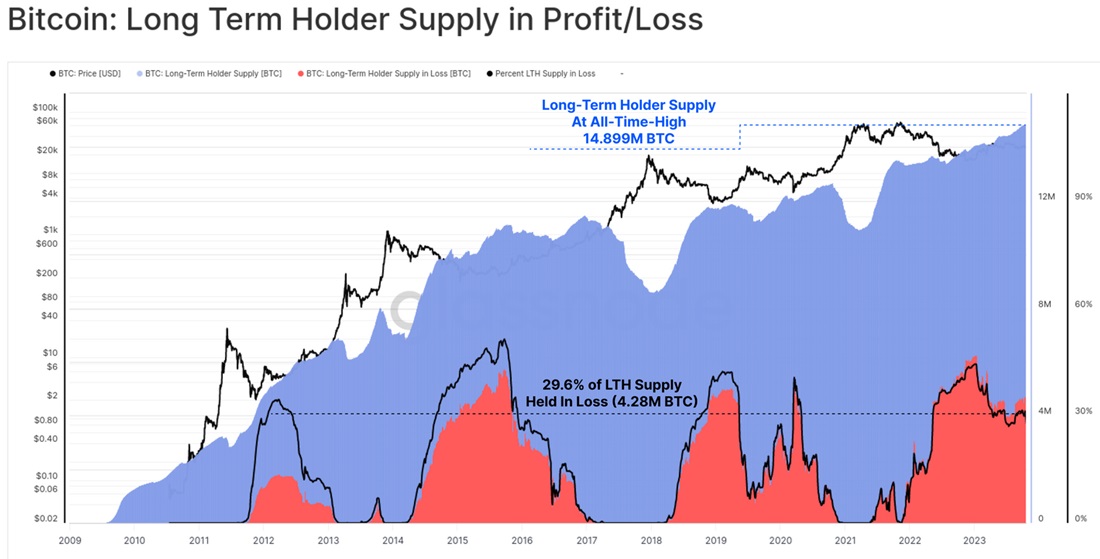

Short-term holders are inclined towards buying when assets are moving up and selling at the first signs of a correction. In contrast, long-term holders are slow to react even to major shocks. In 2023, over 30% of the coins they held were in drawdown, but they continued to add more to their reserves. This group's reserves now amount to a whopping 14.9 million BTC.

Increasingly more metrics are signalling the return of investment and speculative interest in the crypto. The Fear and Greed Indicator is seeing its highest point in 2023 at 71 points. Previously, a similar jump in sentiment from deep fear was seen in mid-2020 and mid-2021, followed by a significant price surge.

This change in sentiment is due to the anticipation of the upcoming approval of Bitcoin spot ETFs that will lead to an inflow of investments from institutional buyers into the crypto. It's also tied to the SEC's failed attempts to stop the emergence of new investment instruments.

According to Paul Brody of Ernst & Young, because of the SEC's refusal to approve ETFs, Bitcoin is seeing major delayed demand. According to various estimates, the interest from large capital amounts to around $15 trillion, while its inflow of funds could cause the price to jump to $200,00 in the long term.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.