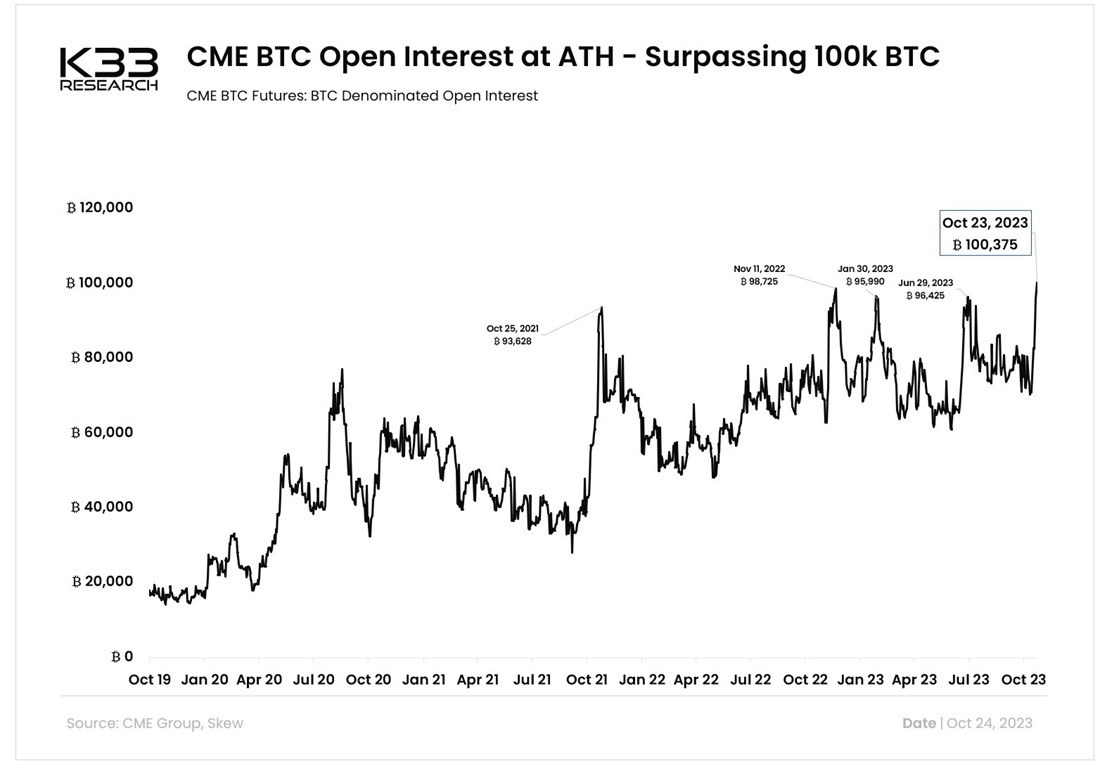

Open interest on the CME sets a record of 100,000 BTC

The anticipation that a spot Bitcoin ETF will soon appear in the United States is fuelling investment interest in the cryptocurrency. Both retail traders and institutional investors are showing signs of renewed activity. Open interest in futures on the Chicago Mercantile Exchange (CME) exceeded the previously unseen level of 100,000 BTC, and daily trading volume reached $1.8 billion.

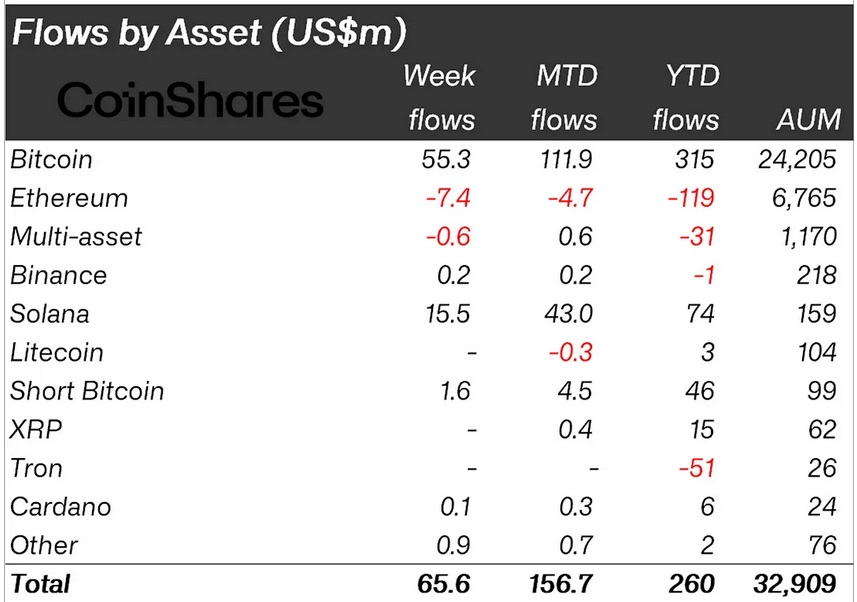

The activation of institutional players can also be seen in the inflow of investments into various ETFs around the world. Last week, $55 million was invested in Bitcoin, and a more significant jump is expected to be seen in this week's totals.

This has been brought on by two recent events. The first is that the SEC refused to respond to Grayscale's appeal, which significantly increases the chances of converting the trust fund into a spot ETF. The second event is the emergency of preliminary information about a new ETF from BlackRock, which was assigned the ticker symbol IBTC and appeared on the website of the Depository Trust and Clearing Corporation (DTCC). Investors interpreted this news as a sign that spot ETFs would be quickly approved, after which Bitcoin's price reached $35,000.

Traders on crypto exchanges holding short positions were caught off guard. Over the course of 24 October, their total losses exceeded $300 million.

Now, few are risking a move towards selling, which is why the financing rate has moved into positive territory. Some analysts even cautioned against opening new buy trades since market makers could be exposed to possible price manipulation when futures positions are skewed in the absence of significant trading volume.

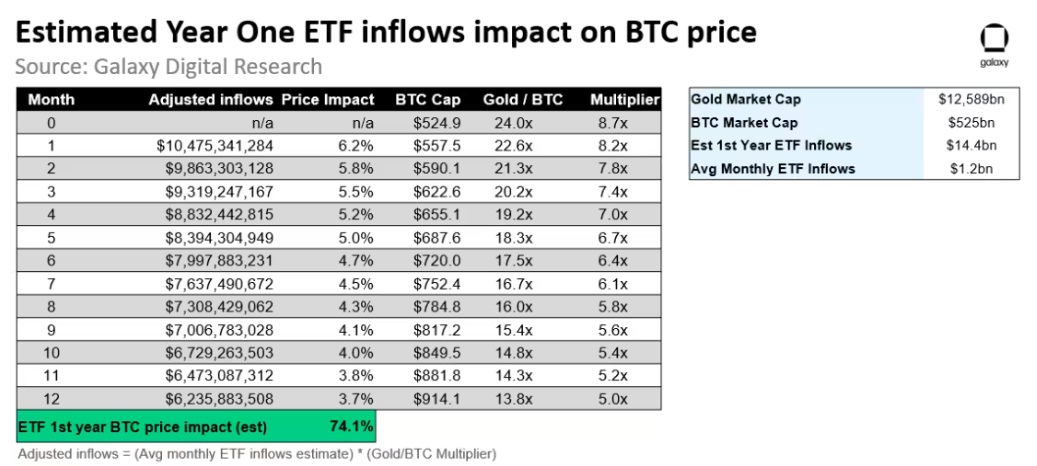

However, everyone sees a positive scenario in the long term, assuming that ETFs are approved. For example, Charles Yu of Galaxy Digital Research used the dynamics of the inflow of investments in gold ETFs for his forecast but adjusted for the difference in capitalisation. According to his calculations, in one year, Bitcoin's capitalisation will approach $1 trillion, and the price per coin will reach $59,000.

The nearest approval deadline for the launch of a spot Bitcoin ETF is 10 January 2024.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.