What do Bid, Ask, Spread and Depth of Market mean?

Bid, Ask, Spread and Depth of Market in trading

Every beginner trader comes across the need to study the basics of market trading terminology. The sooner the beginner does this, the sooner they can get into the market and gain confidence in trading. The terms used by traders in the Forex, stock and options markets worldwide also apply to cryptocurrency trading. In this article, we'll review the concepts of Bid, Ask, Spread and Depth of Market to make trading easier for beginners. We'll also review the latest updates to StormGain's web platform and mobile app. Please read our article on StormGain's new look: what's changing and why.

Thanks to feedback from our clients and testing new designs and tools, StormGain has implemented important changes in its update to its web platform and mobile app. The newly integrated Order Book and revamped Bid and Ask order execution provide users with more information and control when trading.

In previous versions of StormGain, orders were executed at the average price of the quoted Bid and Ask prices, also known as the Mid Price. Some might say that Mid Prices are beneficial for both sides of a trade, whether long or short. In fact, a Mid Price order is not displayed, and users have to pay a hard-to-notice fee for setting a price. That's why StormGain has rolled out Bid and Ask price order execution to create a transparent and convenient trading environment.

Let's take a detailed dive into what Bid, Ask, Spread and Depth of Market mean in the trading world. Сonsider the meaning of these concepts in the newly launched Order Book.

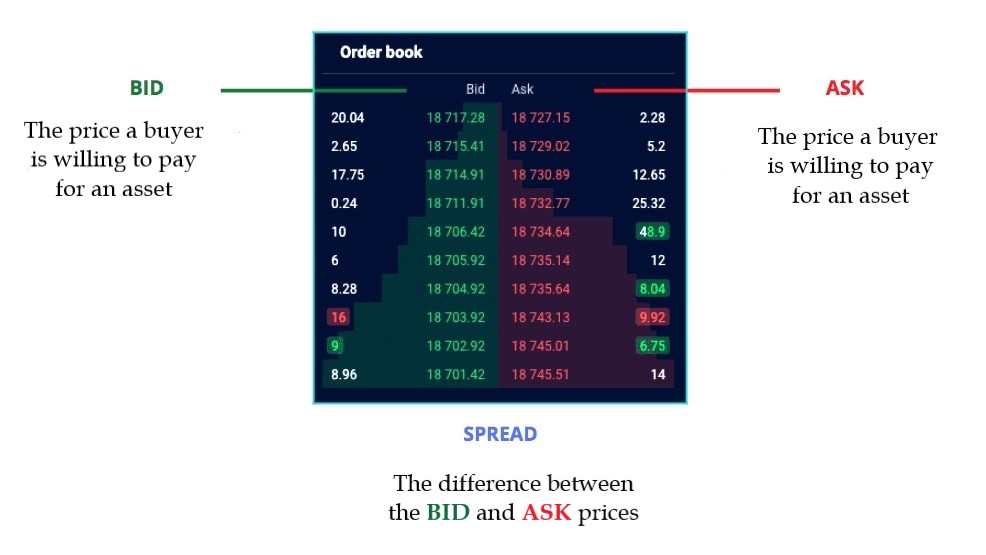

What does Bid mean in trading?

The Bid is the buy price or maximum price that buyers on the exchange are willing to pay for an asset.The size of the Bid and Ask prices is highly dependent on the law of supply and demand. The higher the demand for an asset is, the higher the Bid price is. Therefore, when demand falls, the number of Bids decreases as well. An order opened at the Bid price closes at the Ask price.

What does Ask mean in trading?

The Ask is the opposite of the Bid. The price offered by the seller is the lowest price at which they're willing to sell an asset. Sellers don't want to sell cheap, so the law of supply and demand applies here, as well. As soon as the asset's price rises and becomes attractive for sellers, the amount of Ask offers grows. And when the asset's price drops, the number of Asks decreases. An order opened at the Ask price closes at the Bid price.

What does Spread mean in trading?

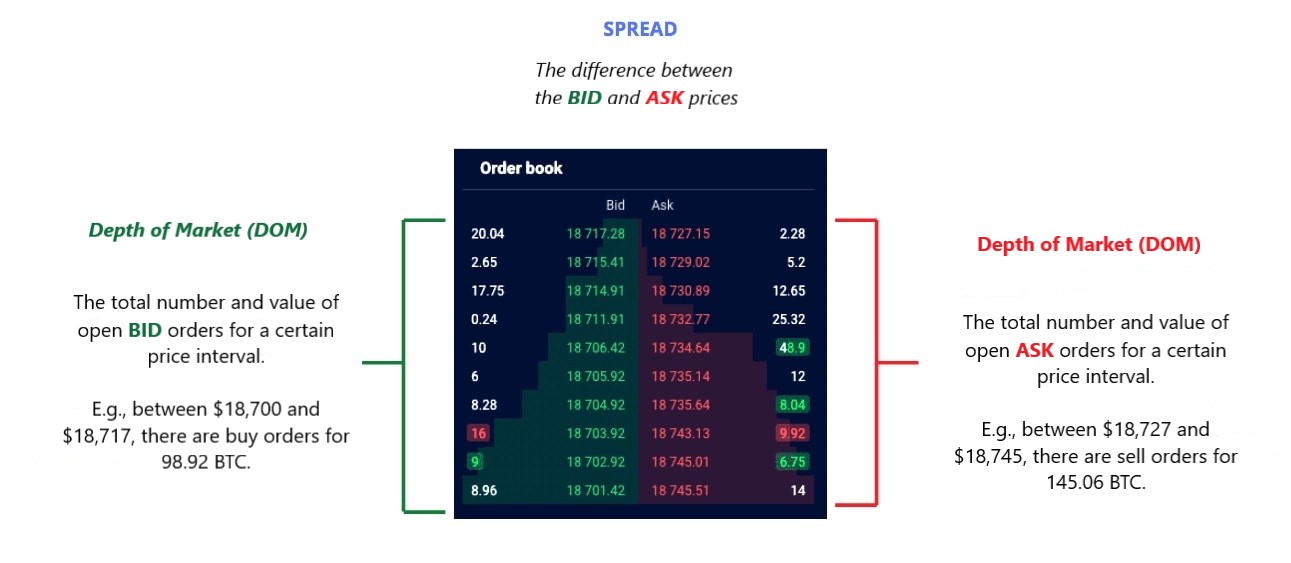

The Spread is directly related to the Bid and Ask prices. Simply put, it's the difference between them. The distance between orders in the Order Book is also called a Spread.

The Spread also determines an asset's liquidity, i.e., the ability to sell it without quickly losing value. The narrower the Spread is, the more liquid the instrument is, and the more attractive it is for trading. To read more about the importance of liquidity in trading, please read our article on the Top 5 traded cryptocurrencies.

The Spread depends on the number of orders. If an asset is attractive for speculation, it's bought and sold a lot because there are always enough Bid and Ask orders on the market. That means that sellers and buyers can find each other easily.

If the asset is unpopular, it isn't easy to execute orders. Neither the seller nor the buyer wants to give ground on the price. The spread between the Bid and Ask prices increases, and liquidity decreases. As you can see, everything is interconnected.

The Spread plays an important role in market analysis. It's taken into account as a mandatory variable in Volume and Spread Analysis (VSA analysis) and bar analysis.

When it comes to trading, the Spread should be looked at because the wider it is, the more additional costs the trader will incur. It's better to trade liquid assets and use pending orders to avoid those extra costs.

What does Depth of Market (DOM) mean in trading?

Depth of Market (DOM) is a measure of the supply and demand for liquid and tradable assets. It's derived from the number of open Bid and Ask orders for a particular asset, an exchange order or a futures contract. The more orders like this there are, the deeper or more liquid the market is. Depth of Market data is also called the Order Book because it represents a list of pending orders for a tradable asset.

A transaction on the market occurs only when the value satisfies both the seller and the buyer. However, there are no negotiations between the parties on financial platforms. All transactions are concluded with the help of the market and Bid/Ask orders. How do they work?

The Depth of Market, or Order Book, displays the current Ask and Bid market prices. As soon as an order for the required amount of an asset finds matching Ask and Bid prices, the transaction executes.

In StormGain's Order Book, users can view current market orders, Ask as the buy price and Bid as the sell price. Institutional market makers provide liquidity in the Order Book, but in future updates, our clients will also be able to see their own liquidity.

Transactions are automatic on limit orders. For example, a trader wants to fix losses and sets a limit order for sale (Stop Loss) at a certain price level. If the price reaches this level, the trader's order is automatically executed. StormGain will add a Recent Trades section that displays real-time executed orders in future updates.

How to apply Bid, Ask, Spread, and Depth of Market (DOM) in crypto trading

If a trader has a clear understanding of the concepts of Bid and Ask, they've already taken a big step towards understanding how financial markets work. Why? Because Bid and Ask orders clearly illustrate the key market principle of supply and demand.

Understanding the relationship between Bid and Ask also helps traders analyse the market and forecast price reversals. When looking at StormGain's Order Book, which displays Bid and Ask orders with Recent Trades, users can analyse the price action.

The prevalence of purchases at Bid orders helps build confidence that the asset's value will rise because this is a sign of buyers' predominance in the market. If Ask orders dominate, it's easy to conclude that bears rule the market, and the price is likely to continue to fall.

When traders pay attention to the volumes traded at Ask and Bid prices, it's easy to determine the direction of the trend and when it's on the threshold of reversal. By combining this knowledge with VSA, traders can achieve significant trading success.

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.