Binance: fresh investigations, board in hiding, and BNB in decline

Following the lead of US regulators, oversight bodies the world over have launched their own investigations and begun taking action against Binance.

- April: Australia revoked their license and began searching the company's offices days later.

- May: Canada launched an official investigation, following which the crypto exchange announced that it was shutting down its operations in the country.

- June: France started an investigation, while Belgium banned the company from offering its services on the territory of the country.

- July: The Netherlands refused to grant Binance a license, whereupon Binance announced it would be transferring its customers over to a licensed outfit and gradually withdrawing from the market.

The charges against Binance are more or less the same in each country: illegal provision of financial services, laundering monies received by illicit means, mixing of customer and company funds, and investor deception. Bloomberg has published insider information claiming that the US Department of Justice will soon be joining the SEC and NYDFS with a subpoena of its own. The charges could relate to either tax evasion or assisting Russian users in circumventing sanctions.

The pressure from the authorities and the risk of criminal prosecution proved too much for Changpeng Zhao's inner circle. The list of resignations in recent days includes:

- Chief Strategy Officer Patrick Hillmann;

- General Counsel Han Ng;

- Senior Vice President of Compliance Steven Christie;

- Vice President of Marketing and Communications Steve Milton.

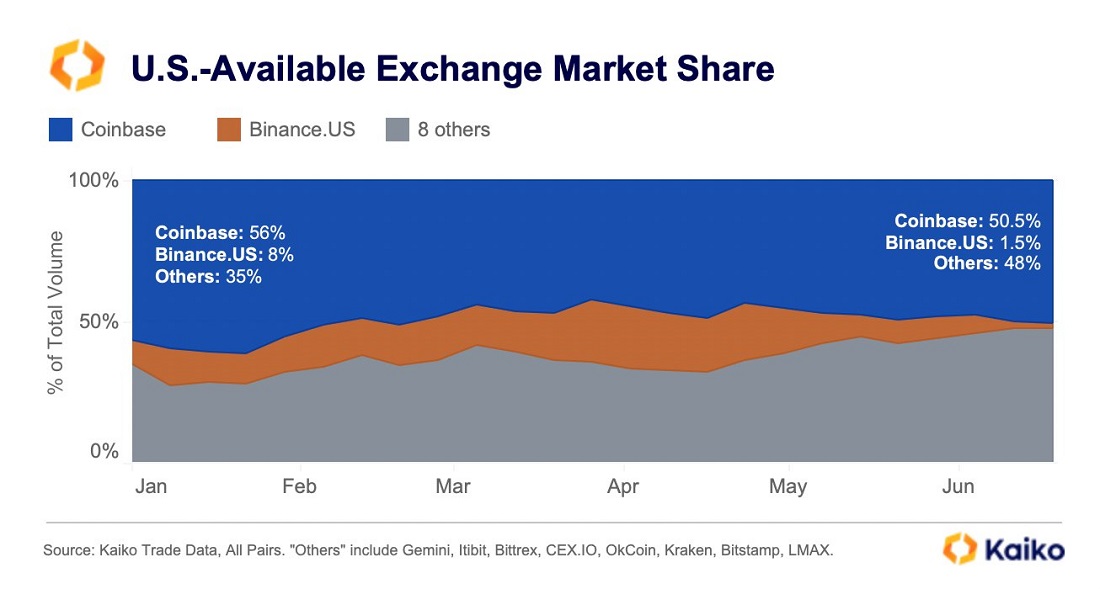

Under the weight of all this pressure, Binance recorded a fourth consecutive month of market share losses as their share of the spot trading market dropped to 41.6% in June. As for the company's US branch, its share of the US market has collapsed from 8% to 1.5% and is still falling.

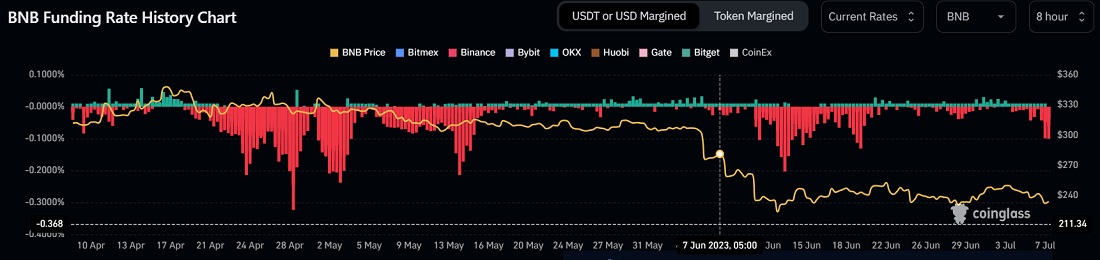

Binance's native coin, BNB, has been trading downward throughout 2023.

Investors should brace for increased volatility since the exodus of key executives suggests the Board feels it could lose the cases against the company.

The market can most likely expect further disruption in the future. Traders of perpetual futures are once again increasing their positions against BNB, which suggests negative returns are ahead.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.