US banking tensions drive Bitcoin growth

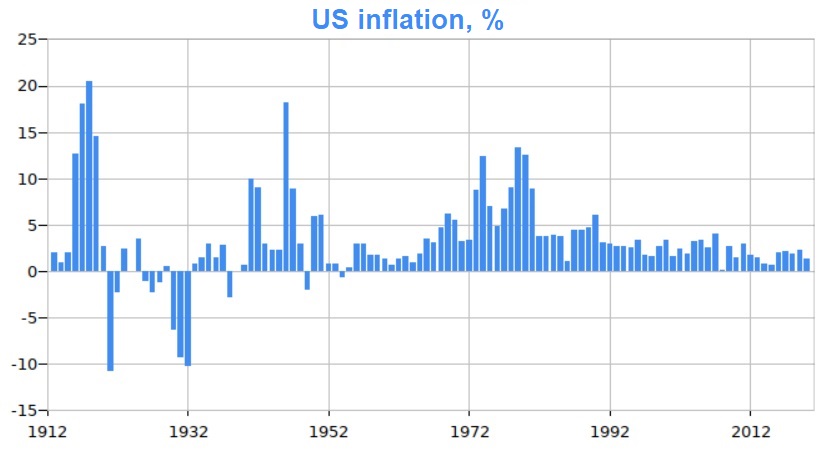

As the next meeting of the Fed approaches, the debate about the need for a further key rate hike is reignited. On the one hand, inflation has not yet reached the desired range of 2.0–2.5%. Trader Peter Brandt is urging the regulator to raise the rate to at least 6.25%, fearing a relapse of events in the 70s.

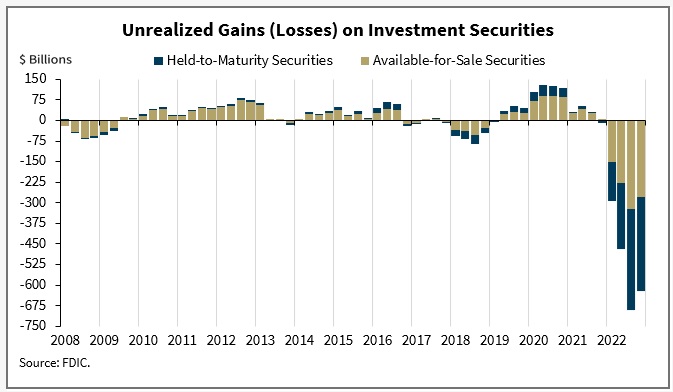

On the other hand, the high rate has already demonstrated weakness in the banking sector. In the midst of the coronavirus pandemic, banks faced a significant influx of deposits due to widespread public and business support and easing of monetary policy.Some of these banks failed to come up with anything better than buying Treasury bonds. The subsequent rate hike has led to a reduction in price of these assets. By Q4 2022, banks had accumulated $620bn in unrealised losses, according to the Federal Deposit Insurance Corporation (FDIC).

This is the reason why SVB sank. For the same reason, Bank of America recently reported unrealised losses of $109bn on its balance sheet.

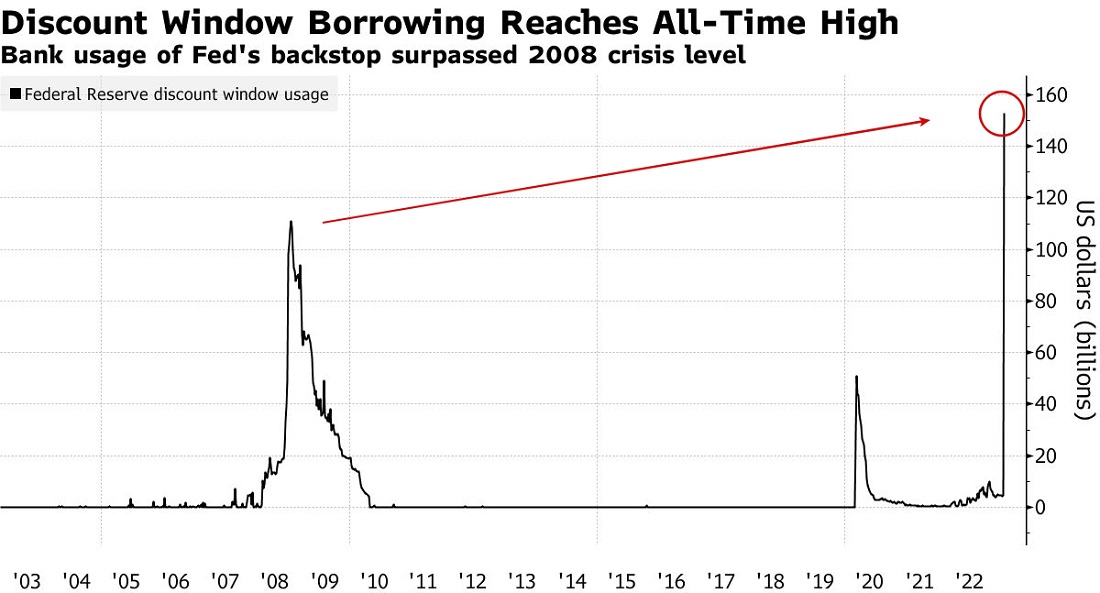

The collapse of SVB prompted the Fed to roll out a bank support programme, under which the regulator is prepared to buy bonds at face value and provide additional injections of capital. The Fed's action has been described by a number of experts as a disguised form of QE because the amount of support given so far has already surpassed that of 2008.

Again, there is a contradiction in the regulator's actions. On the one hand, by raising the rate, it withdraws liquidity from the markets; on the other, it supports the banks by providing them with new credit lines. Since the start of the tightening cycle, the Fed's balance sheet has lost just 6%.

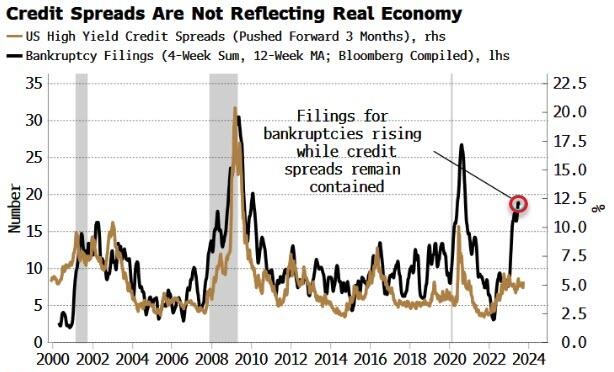

If we look at the whole of corporate America, however, we see a new rise in bankruptcies similar to the 2008 and 2020 crises. Corporate bankruptcies often entail debt forgiveness, which will hit the banking industry from the other side.

A further tightening of monetary policy could lead to a negative chain reaction. Ryan Sweet, Chief US Economist at consultancy firm Oxford Economics, believes there will be no new rate hikes this year.

This is a good sign for Bitcoin, as the Fed's reversal and continued moderate inflation will boost investors' appetite for risk.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.