Bitcoin bears are hit by train again

The desire to catch the reversal from the round level contrary to the main trends sometimes leads traders to significant losses. Over the last day, sellers on the perpetual futures market who were counting on the reversal from $40,000 lost $84 million. Previously, they incurred significant losses when the price surpassed $35,000.

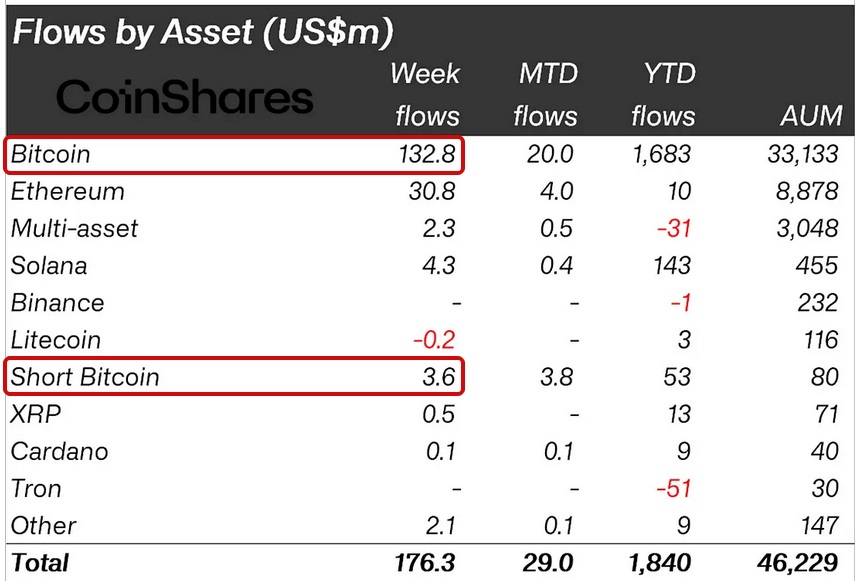

Among institutional investors, there are also desperate players investing in short crypto funds who derive profit when the asset's value decreases. While $0.9 million was withdrawn from such funds two weeks before, the inflow totalled $3.6 million last week.

The share of bears in this group of investors was only 2.7% of the total inflow to Bitcoin funds.

Excluding a possible bounce from the round level and an imbalance in favour of the bulls in margin trading, the only valid arguments for the current sell-off could be the expectation of the SEC's denial to launch ETFs or a sudden rate hike by the Fed.

The probability of the second event is minimal as inflation is gradually declining, and an excessively high interest rate may result in a recession. As for the SEC, the regulator may once again move the deadline for approving spot ETFs. However, a complete rejection of the new product launch is nearly off the table due to the SEC's loss on Grayscale's appeal, where the judges deemed the SEC's approach to be "arbitrary and capricious". The case was about transforming the trust fund into a spot Bitcoin ETF, and appeal deadlines have expired. The "automatic" switch will happen in March.

Growing expectations of an upcoming switch have caused the fund's share discount to the underlying asset to drop from 46.1% to 8.7% this year.

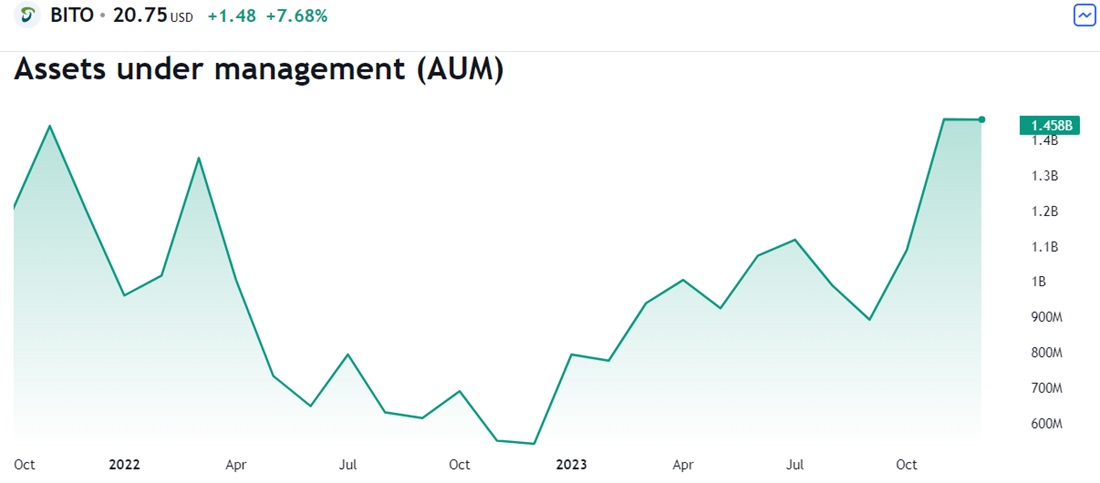

Another example of increased interest from institutional investors (who have been the leading investment force for Bitcoin since 2020) is the setting of a new high in inflows into the largest BITO futures ETF and the tripling of shares of leading cryptocurrency companies (e.g., MicroStrategy or Marathon Digital) this year. Due to the lack of an easy-to-operate spot ETF, institutional investors are investing in related products.

In 2023, Bitcoin is going strong with the expectation of positive developments. Investment volumes are rising, more people are sending coins to cold wallets, and cryptocurrency exchanges' reserves are continuing to melt away. In these conditions, playing short looks quite risky.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.