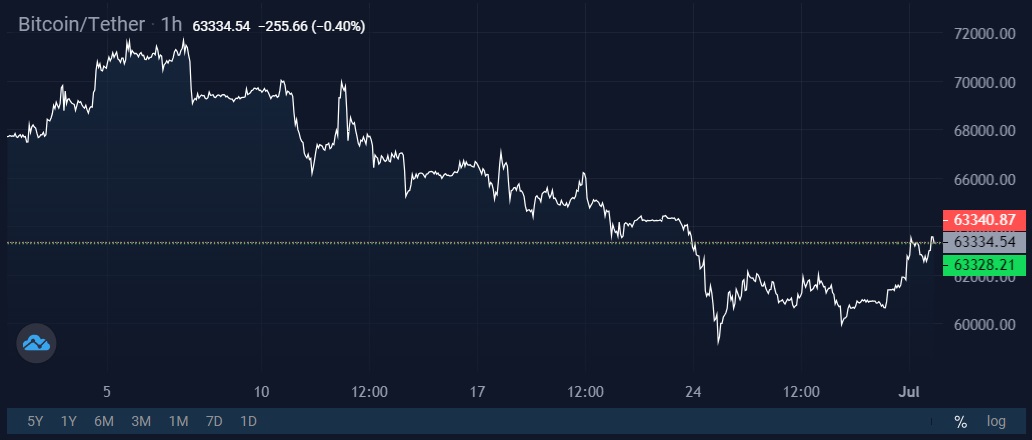

Bitcoin's correction driven by hedge funds and the long squeeze

The $10 billion repayment to former Mt.Gox customers was the most talked about news in crypto this week. Leaning on the impact of Mt.Gox, opponents of cryptocurrency rushed to declare the beginning of bear season. Economist Peter Schiff sneered at ETF buyers who favoured Bitcoin:

Mt.Gox Bitcoins haven't even been returned yet, and Bitcoin ETF buyers are already recording a 24% drop against gold... How long will it be before they realise they have made a mistake?

However, this is based on a superficial view of the nature of pricing. We explained why refunding Mt.Gox customers will not have long-term negative consequences. Today, we'll explain the reasons for the correction.

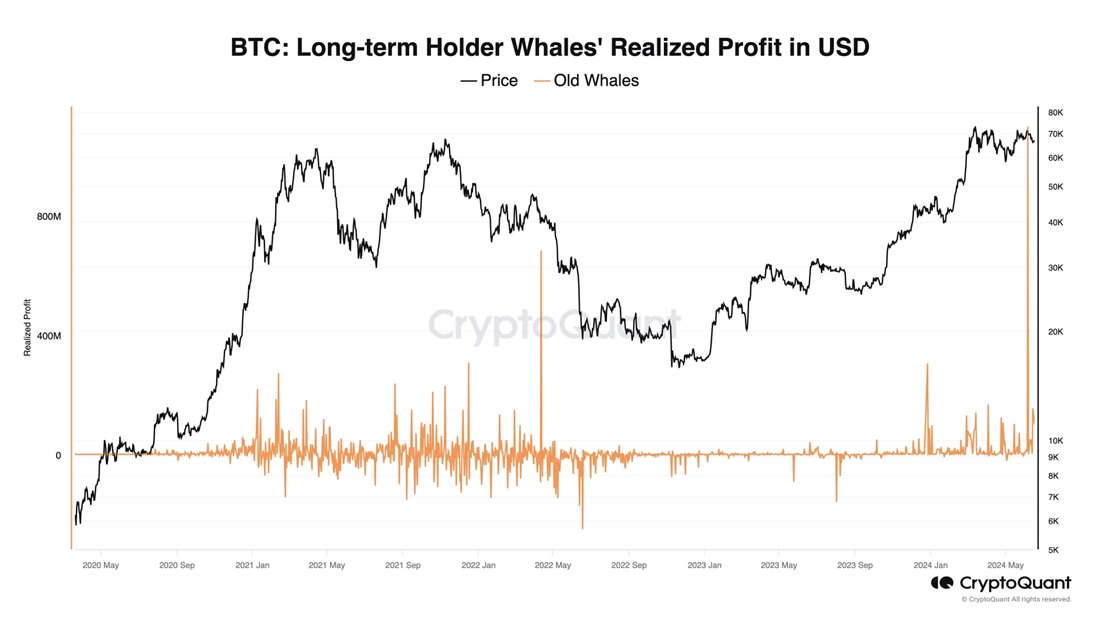

The first, which is to be expected, is profit-taking when a new record-high price is reached. For example, long-term holder whales set a record by selling $1.2 billion worth of coins over two weeks in June.

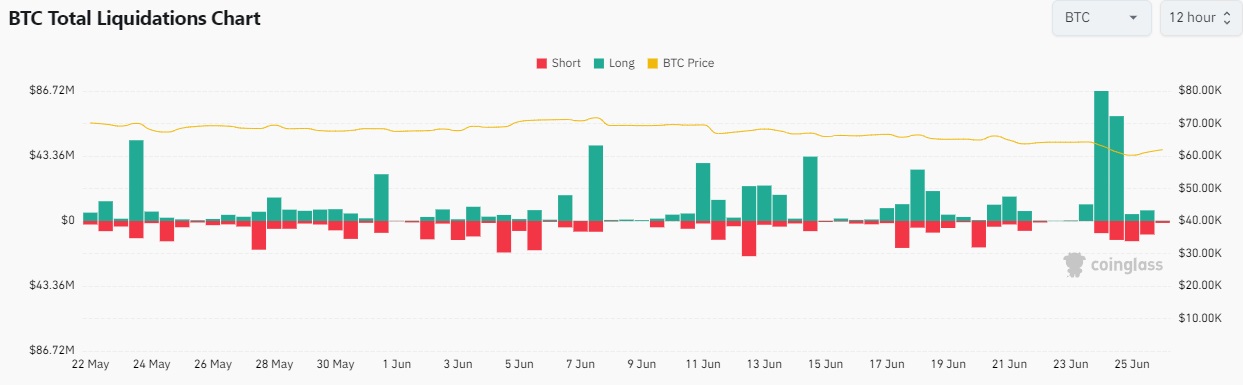

The second reason lies in the 'long squeeze,' where excessive optimism in the derivatives market leads to an overabundance of long margin positions (and an increase in the funding rate), and a drop in price triggers a cascade of liquidations. Over the past day, $157 million worth of bullish positions were forcibly liquidated.

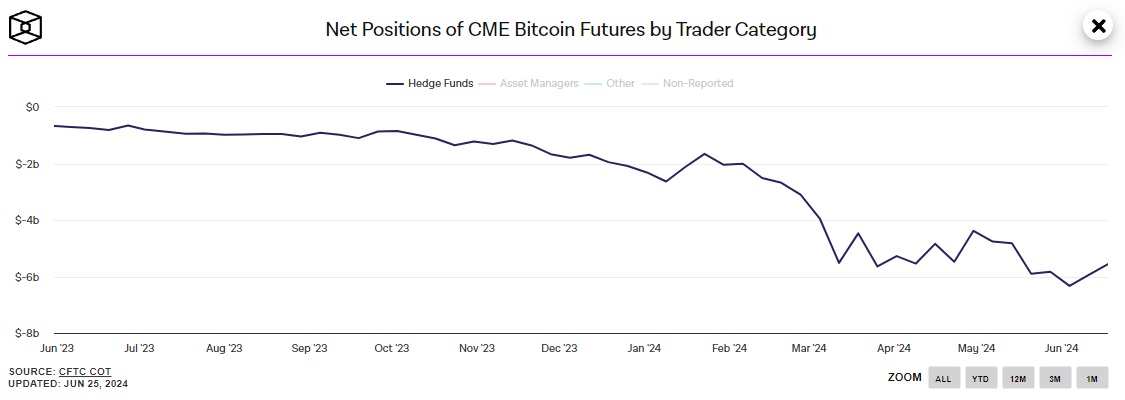

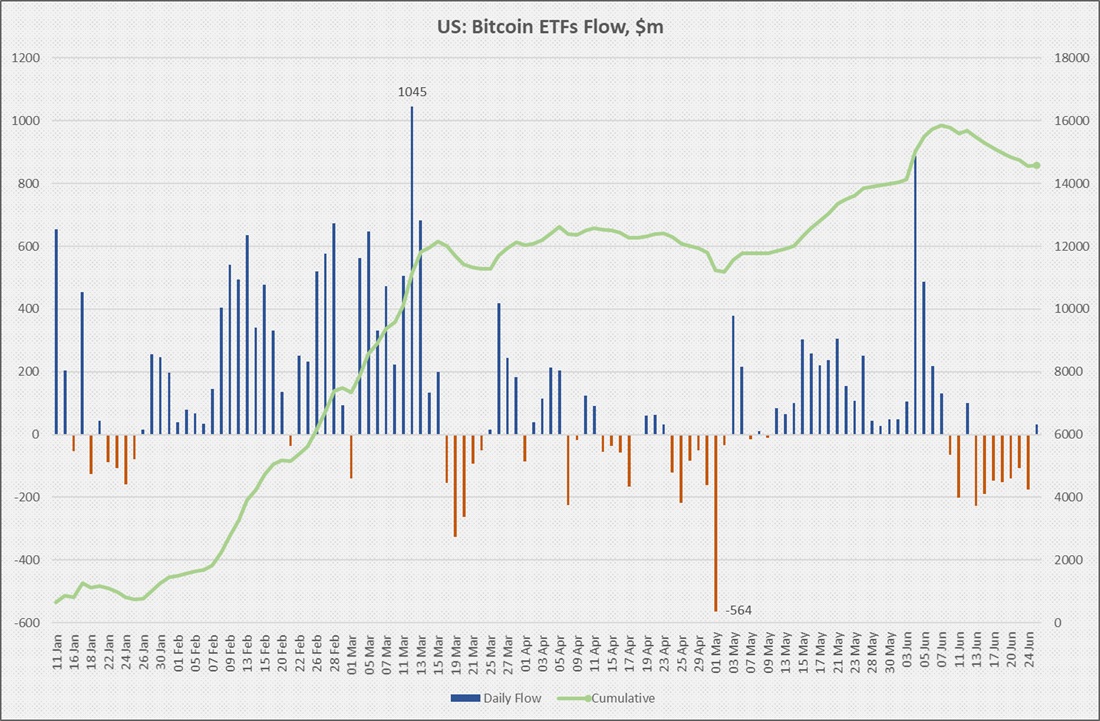

The third is driven by hedge funds selling Bitcoin on the spot market. As long as the price remained near highs and traders predominantly opened long positions, arbitrage trading flourished. Hedge funds sold futures contracts on the CME and bought coins on the spot market (including through ETFs) for the same amount. The positive funding rate (the difference in value between the contract and the underlying asset) generated the income.

As soon as the funding rate reverted to neutral, hedge funds began rebalancing positions (closing futures contracts and selling Bitcoin on the spot market).

Now the market is returning to equilibrium, as long-term holders have reduced profit-taking, overheating in the derivatives market is no longer an issue, hedge funds have reduced their spot market sales, and scared investors have 'digested' the news of Mt.Gox's impact.

After a protracted seven-day sell-off, Bitcoin ETFs saw an inflow of $31 million on 25 June.

StormGain Analytics Group

(a platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.