Tether being pushed out of the Global North

Tether's outward signs of prosperity, i.e., rising capitalisation and revenue, hide unfavourable trends. They've culminated in increased criticism and a gradual abandonment of USDT by major market participants.

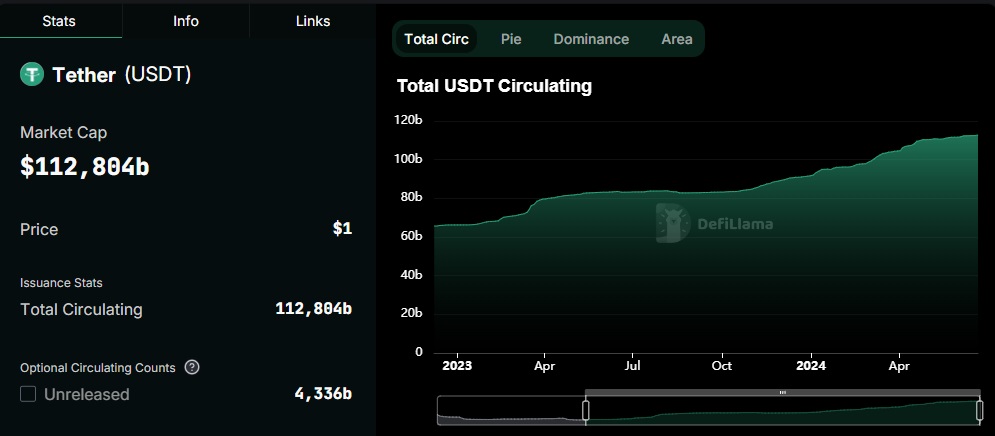

USDT's capitalisation has nearly doubled in the last year and a half, reaching a record-high $112.8 billion. Tether's share of the stablecoin market grew from 48% to 69% during the same time.

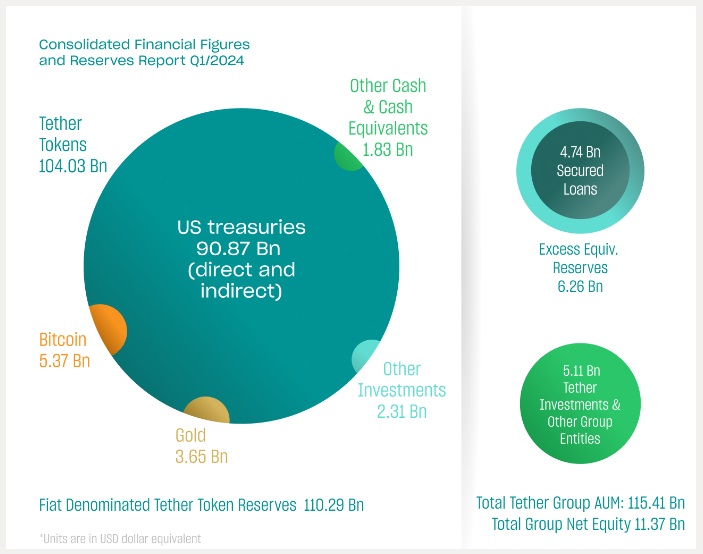

The company posted record profits of $4.5 billion in Q1 2024 and left the biggest tech giants far behind in terms of revenue per employee. The stated excess of assets over liabilities continues to grow and now stands at $6.3 billion.

However, the company still hasn't solved its key tasks: increasing the transparency of its reserves, conducting a full audit, and obtaining licenses in the US and Europe. Even elementary information about correspondent banks where reserves are located is still a huge mystery. The stablecoin law in place in Europe (and coming soon to the United States) puts an end to USDT's circulation in these regions.

This year, the Markets in Crypto-Assets Regulation (MiCA) bill will come into force across the EU. To be compliant, Binance, OKX and Uphold have already announced that they're moving away from or restricting the use of USDT in Europe.

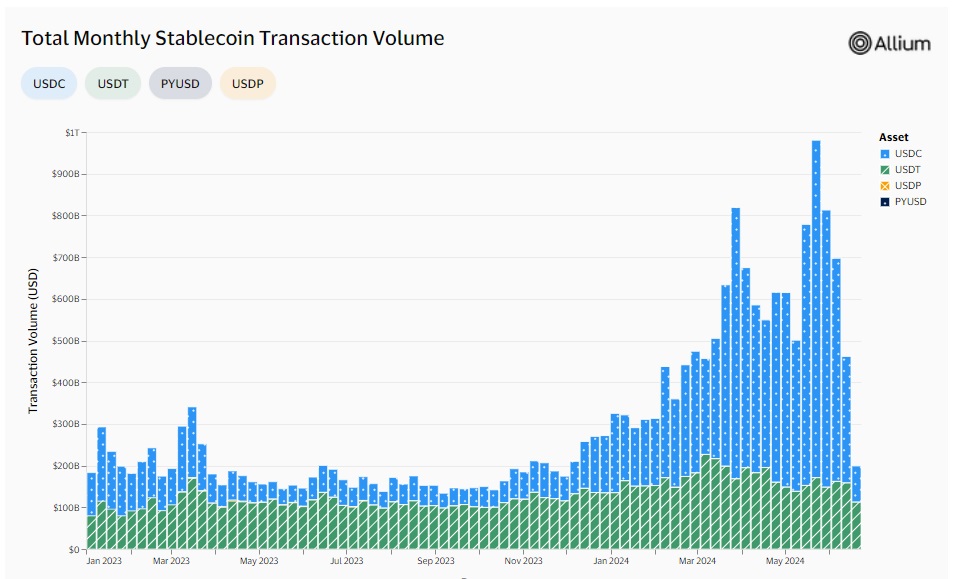

This and related trends have led to USDC overtaking USDT in terms of transaction volume by a wide margin in 2024.

USDC is issued by the US-based Circle, which has the necessary licence and level of transparency. The company's reserves are 100% backed by short-term government bonds and dollars in bank accounts. Unlike Tether, it doesn't have Bitcoin, credit commitments or commercial paper.

As cryptocurrencies become institutionalised, Tether will be increasingly displaced from the Global North to the South. In regions such as Latin America, USDT still maintains a leading role, overtaking even Bitcoin.

The widespread use of Tether, along with the problems, outlined carries systemic risk. In May, Ripple CEO Brad Garlinghouse called Tether a potential black swan for the crypto market. And in June, Consumer's Protection, a US non-profit consumer protection organisation, launched a full-fledged media campaign against Tether, asking the question,

...Tether may very well be the next FTX. Consumers should be wary of any so-called stablecoin that refuses to properly certify that they actually hold the assets they claim.

StormGain Analytics Team

(the cryptocurrency trading, exchange and storing platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.