Bitcoin: The current consolidation is in line with previous cycles

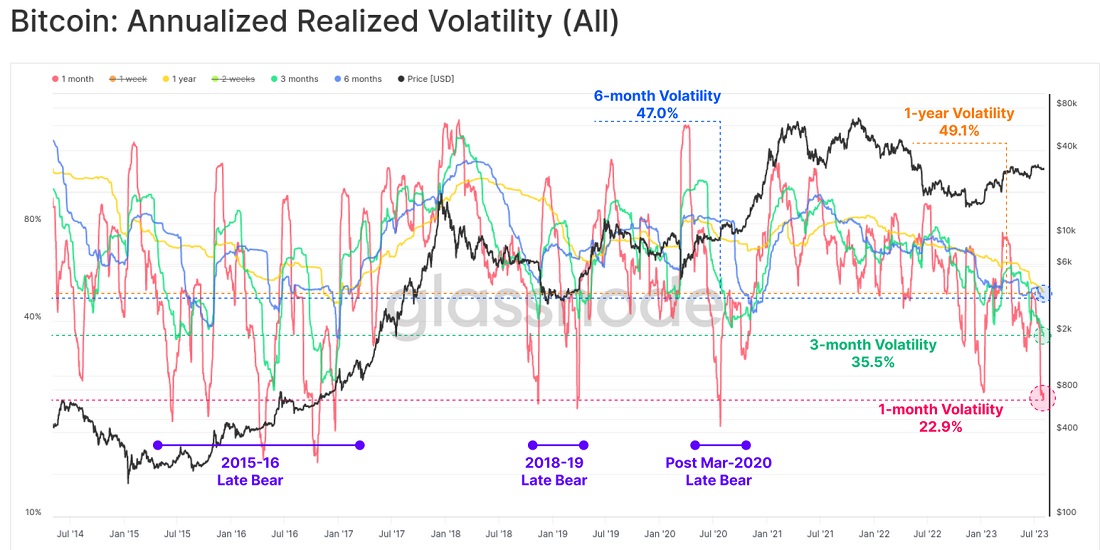

Bitcoin's 1-12 months of volatility is at the lowest point since 2016. In the history of cryptocurrency, which is characterised by large price swings, only a few months have been calmer.

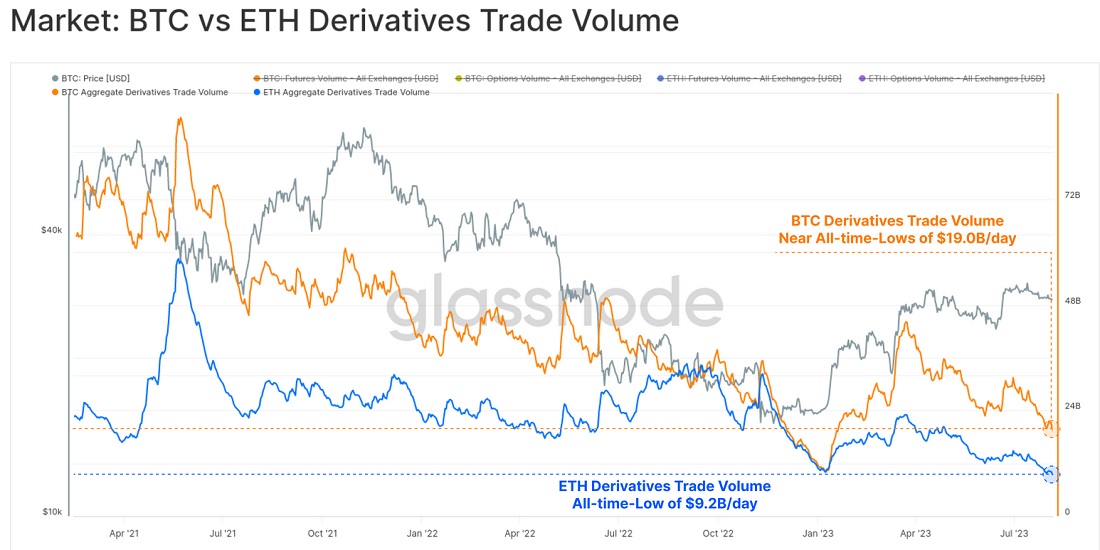

Following the decline in volatility, trading volumes in the derivatives market also dropped. Bitcoin's total volume fell to $19 billion daily, while Ethereum's dropped to $9.2 billion.

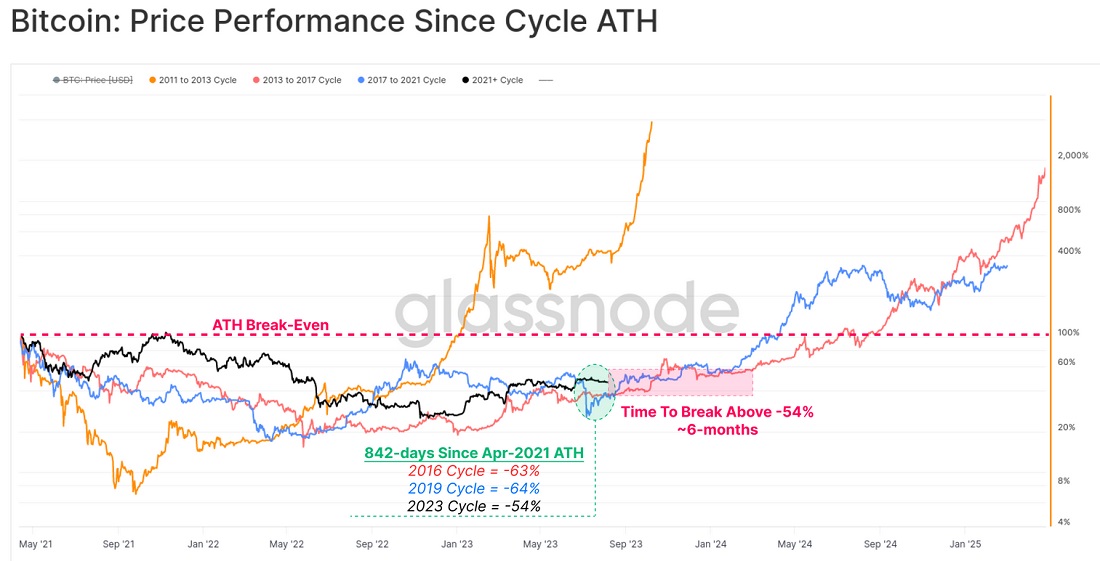

This calm will eventually result in a major price move, but it's not in any way an extraordinary event. After reaching highs during the 2021 rally and 842 days after, the current drawdown is 54% lower.

Note: Glassnode takes April 2021 rather than November as the starting point for the last cycle. According to the agency, the bears started taking control in May 2021.

These numbers are way better than in 2019 (64%) or 2016 (63%). It's also worth noting that in previous cycles, the price was very slow to rise in the six months before the new bull run. So, the current volatility drop is typical for a recovery period and may continue.

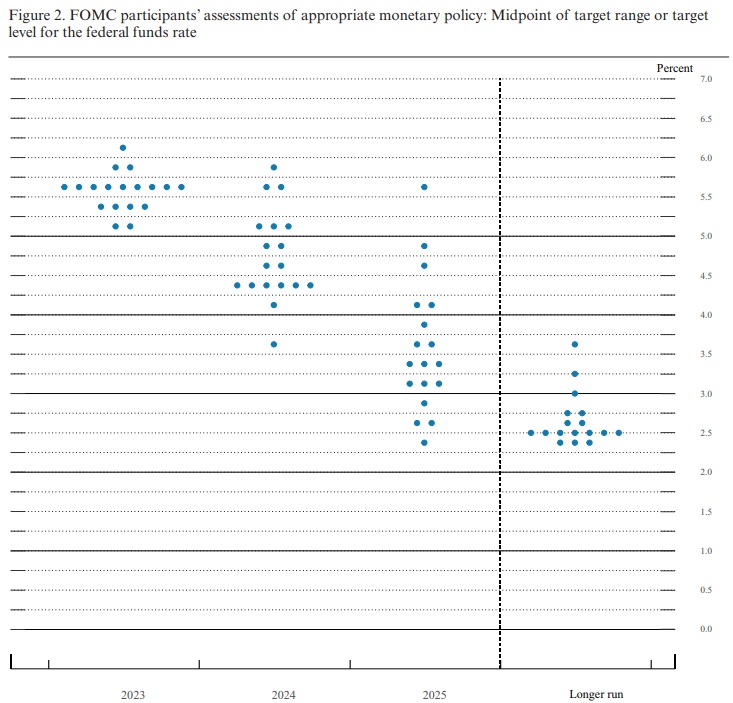

Anticipation of a sideways move correlates well with the Fed's monetary policy. The regulator will probably not raise its key rate again and plans to gradually retreat by 1% or more from current levels (5.5%) in 2024.

However, market turbulence, the US dollar's devaluation and positive changes for Bitcoin are still possible in 2023. For instance, the regulator can do a 180 way earlier due to a continuing banking crisis. Last week, Heartland Tri-State Bank shut down. It was the fifth American bank in 2023 that couldn't meet modern challenges.

Authorisation to launch Bitcoin spot ETFs may be the second driver. Anticipating victory, the SEC has been flooded with applications for Ethereum spot ETFs. Market participants consider the chances to be high since BlackRock, the world's largest investment company by assets under management, is also involved.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.