Curve Finance hacker agrees to a deal

Last week, we covered the hack of the Curve decentralised exchange and the risk that put the entire DeFi sector in due to cross-lending. For a quick resolution, the hacker was offered a 10% reward and a waiver of legal claims for returning the stolen $70 million by 6 August. Otherwise, the Curve team promised this amount as a reward to others for identifying the hacker.

One of the Curve pools affected by the hack, the JPEG'd project, has already confirmed the return of the stolen 5494.4 WETH (~$10 million). JPEG'd said it considers the event to be a resolution and is ending its search for the hacker. The project is providing a reward of 610.6 WETH (~$1.1 million).

The Alchemix project, which lost $13.6 million due to the attack, is also reporting the full return of funds.

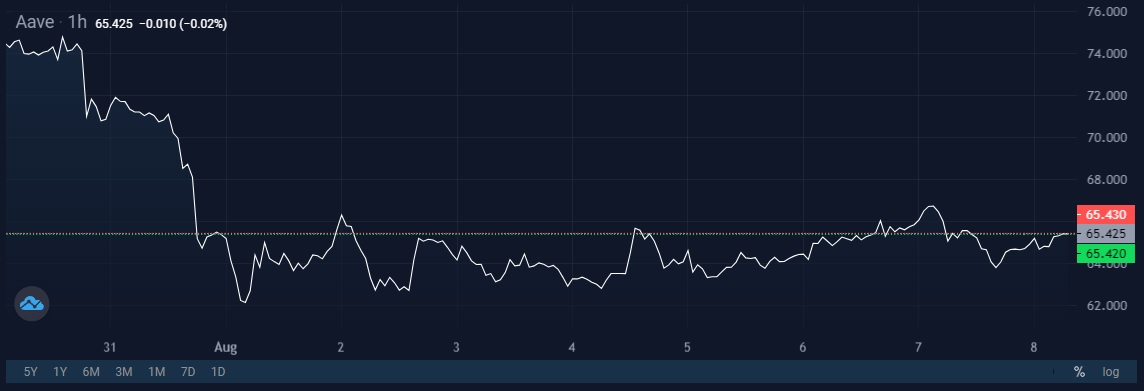

On the back of positive conflict resolution, the crvUSD stablecoin has returned to parity with USDT, with the DeFi sector seeing blockchain coins rise 2% to $40.9 billion. The AAVE token recovers as the risk of liquidating the credit position of Curve CEO Michael Egorov, who borrowed $63 million worth of stablecoins from AAVE under CRV, fades away.

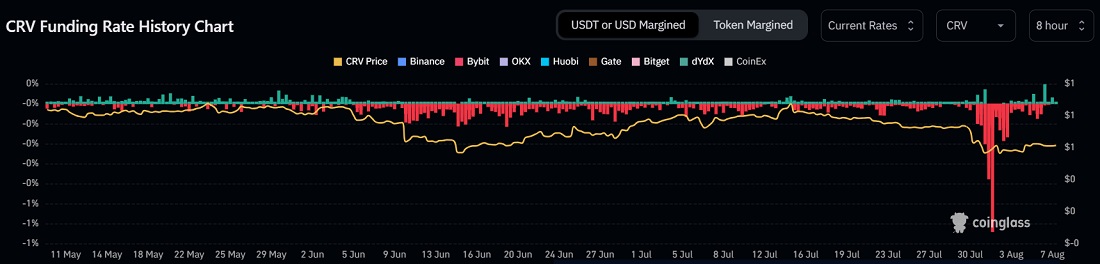

Traders who were expecting a Curve rout are pulling back as the funding rate has returned to neutral. This indicates that there's no longer a dominance of sellers in futures contract trading.

Unfortunately, not all crypto hacking stories have a happy ending.

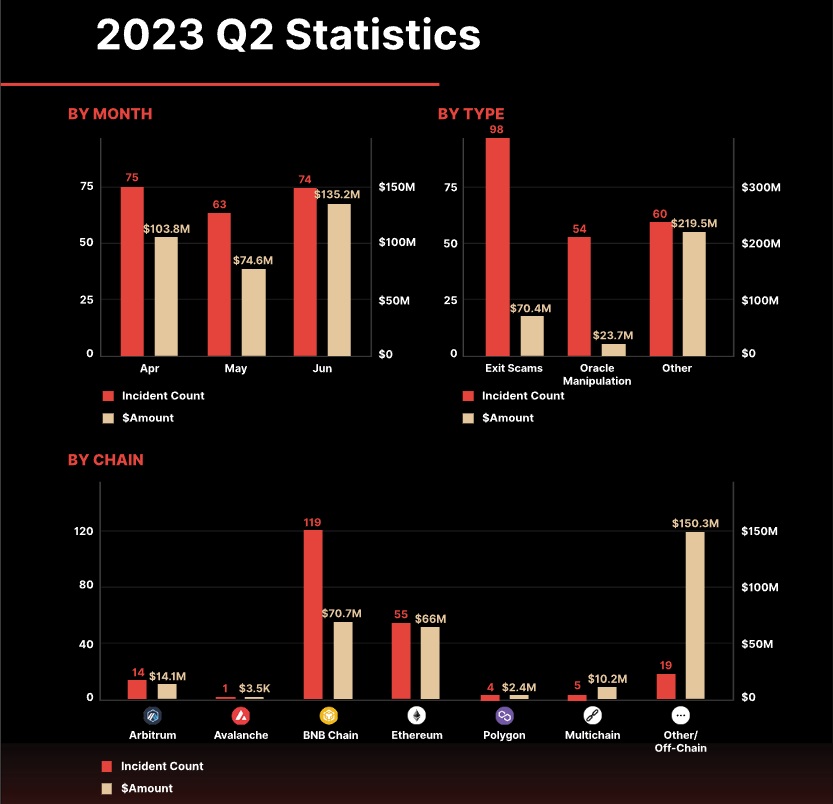

According to Certik, there were $313.6 million in thefts in Q2 2023 alone. Less than half of those funds were returned, with most cases remaining unsolved.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.