Bitcoin's cyclicity: $1m in 2026

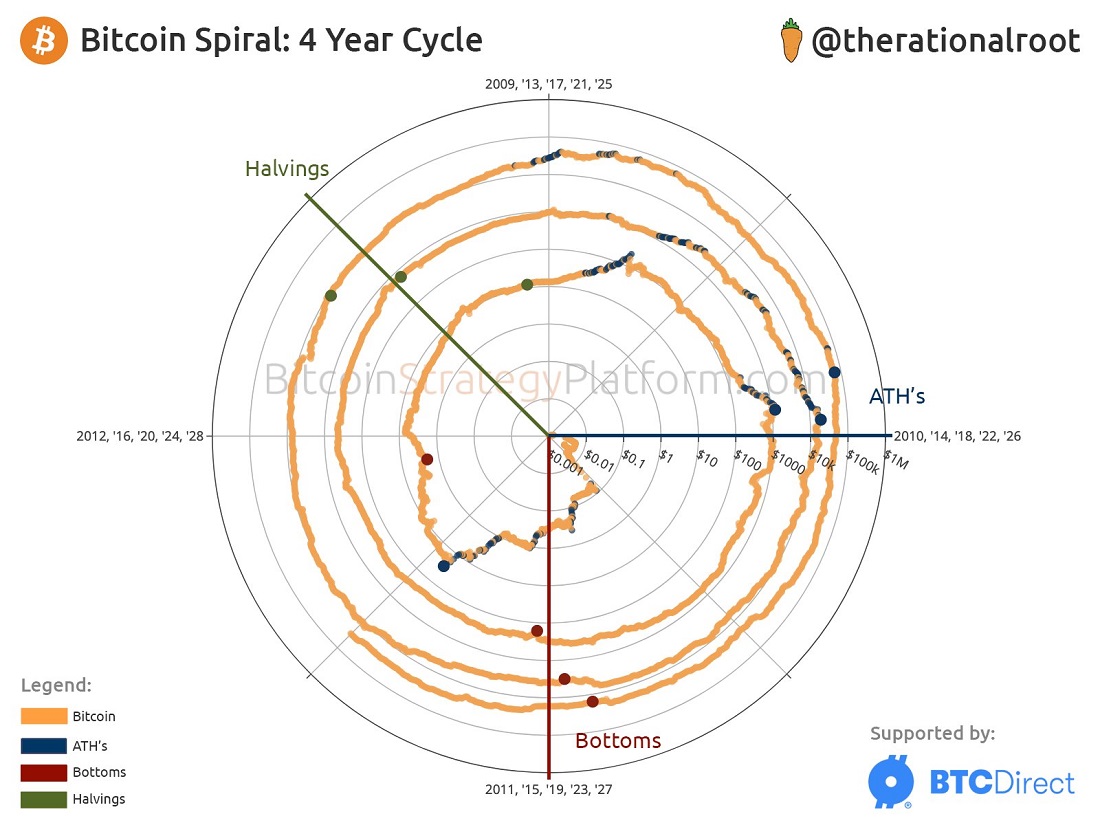

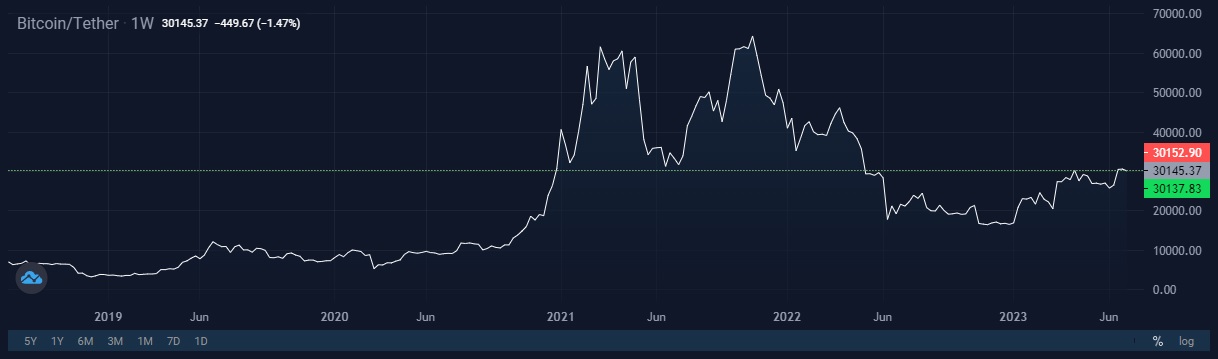

Bitcoin remains committed to a four-year cycle, which resonates with the halving where the profits from block mining are halved in value. An illustrative radial chart was presented by an analyst under the nickname "Root". Going round in four-year cycles, the price forms highs and lows in the same sectors of the cycle. Having hit bottom in 2023, Bitcoin is expected to reach $1m in 2026.

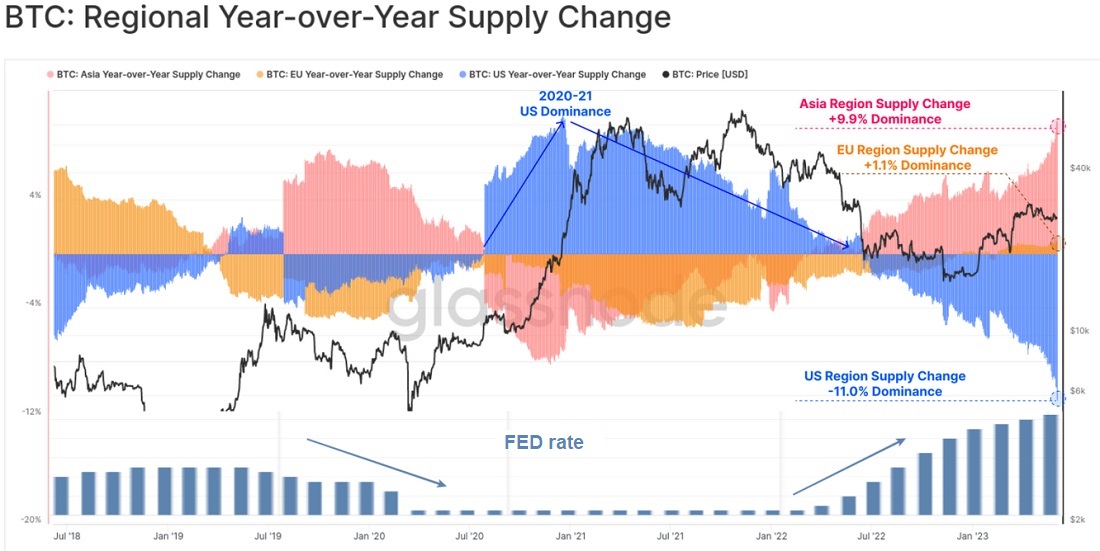

The coming bull market is indicated not only by mathematical extrapolation, but also by shifts in macroeconomics. We covered the direct impact of monetary policy in the article "How the Fed is manipulating the crypto market". This summer, the regulator is preparing to give the final chord in a cycle of key rate hikes with a reversal in 2024. After which, risky assets (in the absence of a deep recession in the economy) are set to experience an influx of investment.

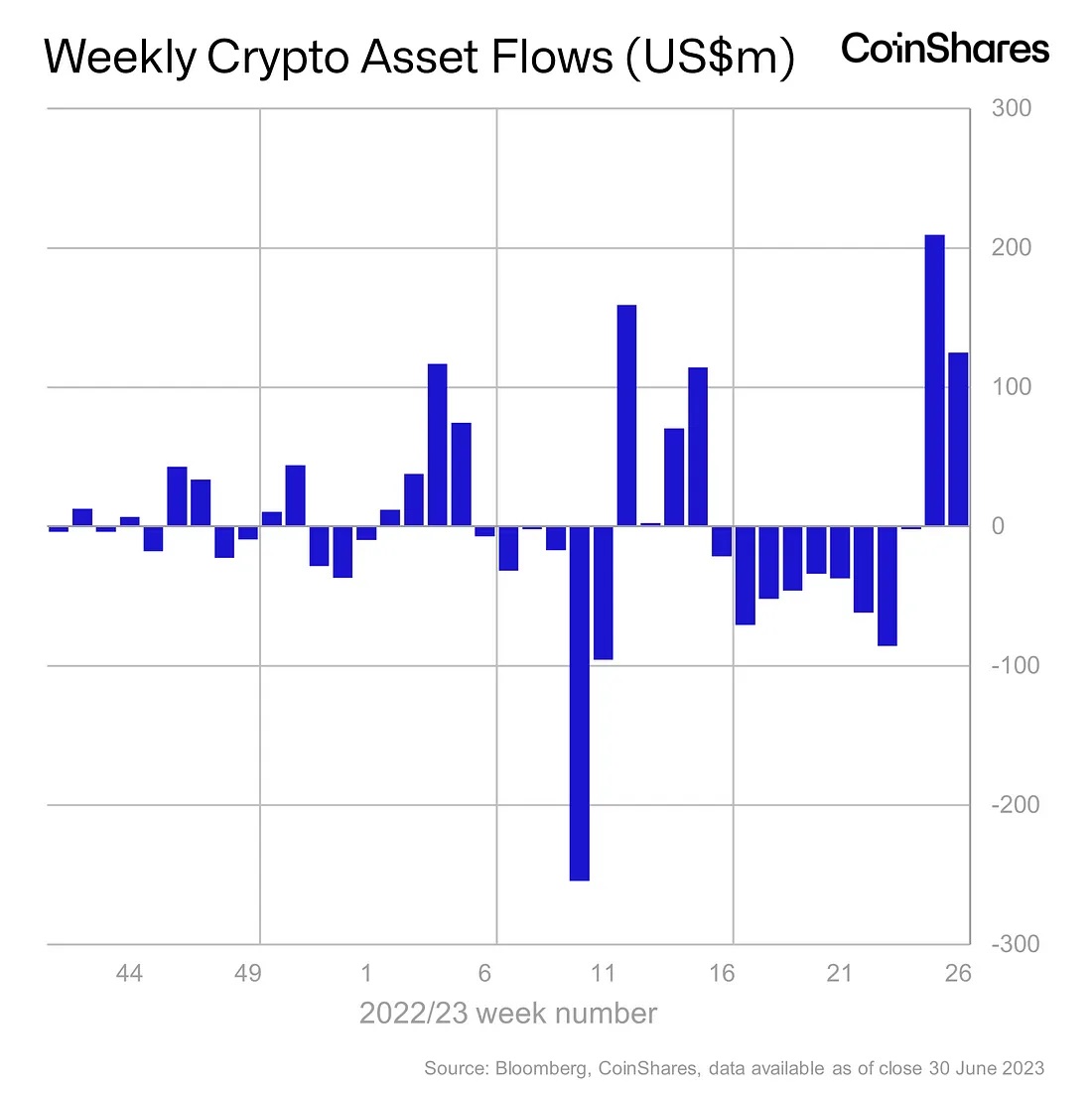

Institutional investors and fund managers are already showing appetite for risk. The SEC was inundated with new applications for Bitcoin ETFs in June. The market sharks do not want to miss out on the coming bull cycle. Among the applicants, Black Rock, the world's largest asset management investment company, is worth mentioning. Note: The SEC flagged up shortcomings in the applications and companies have already submitted redacted versions.

ETFs on futures contracts and other exchange-traded funds in other countries collectively also saw inflows for the second week in a row. This contrasts strongly with the apathy reflected in the first half of the year.

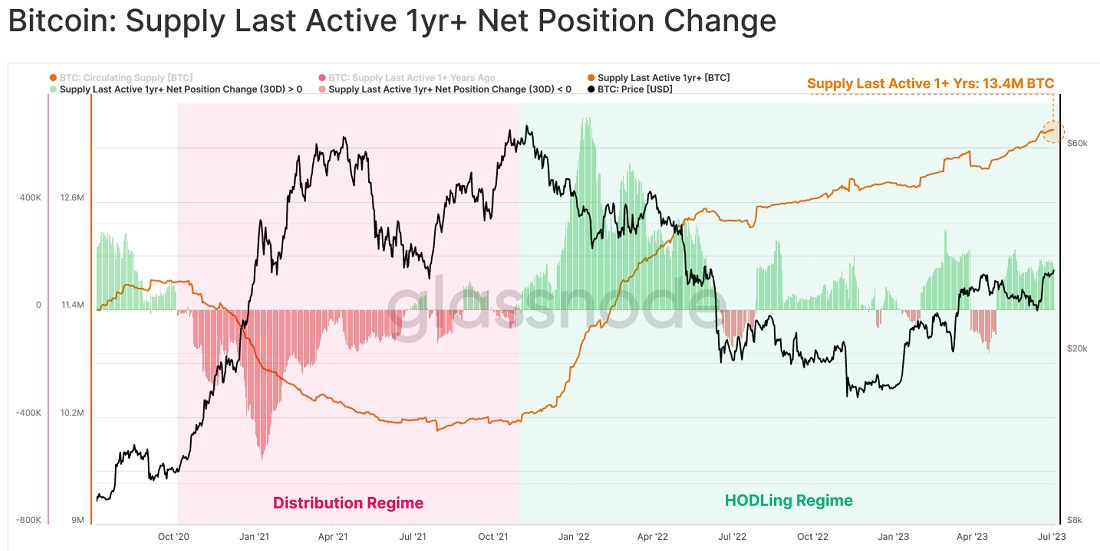

Accumulation sentiment among long-term holders has reached a new historic high of 13.4m BTC, with cryptocurrency exchanges recording a decline in supply. Investors are holding on to the coins in anticipation of further price growth.

Another halving will take place next year, which traditionally has a stimulating effect on BTC price. This, combined with the Fed's rate cut, will give a strong boost to Bitcoin.

However, it's worth bearing in mind that cyclical models do not guarantee anything and any predictions should be treated with a healthy dose of scepticism.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.