Bitcoin ETF trade volume sets new record

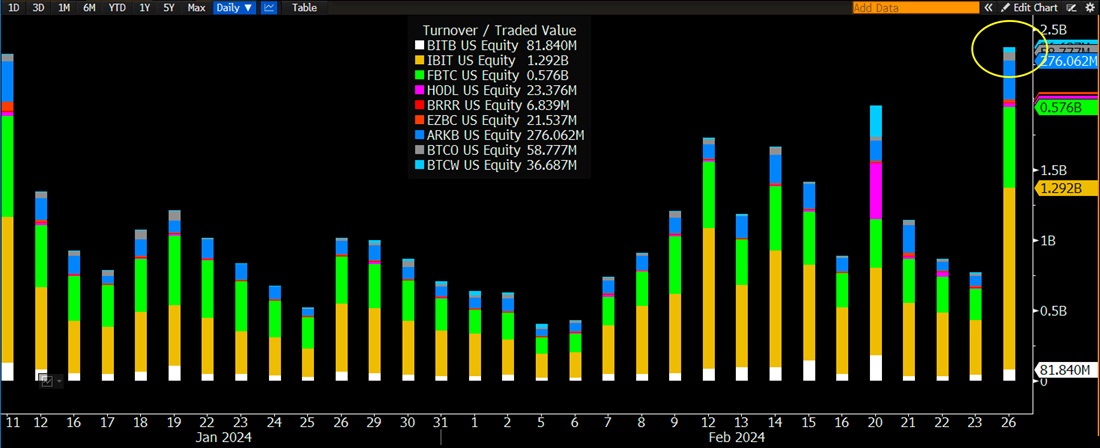

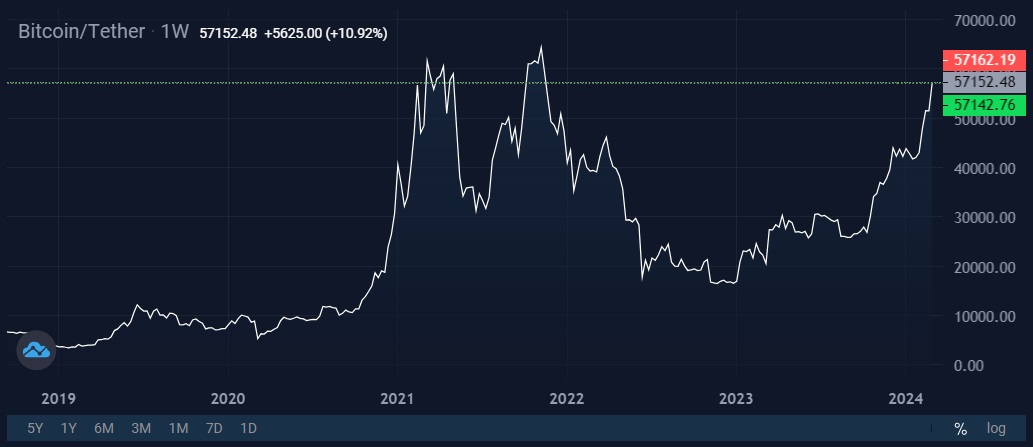

New investment products remain one of the key catalysts for Bitcoin's growth in 2024. On 26 February, a new record was set for daily trade volume, reaching $2.4 billion. Among the ETFs, BlackRock (ticker IBIT) was in the top spot, with a trading volume of $1.3 billion on that day.

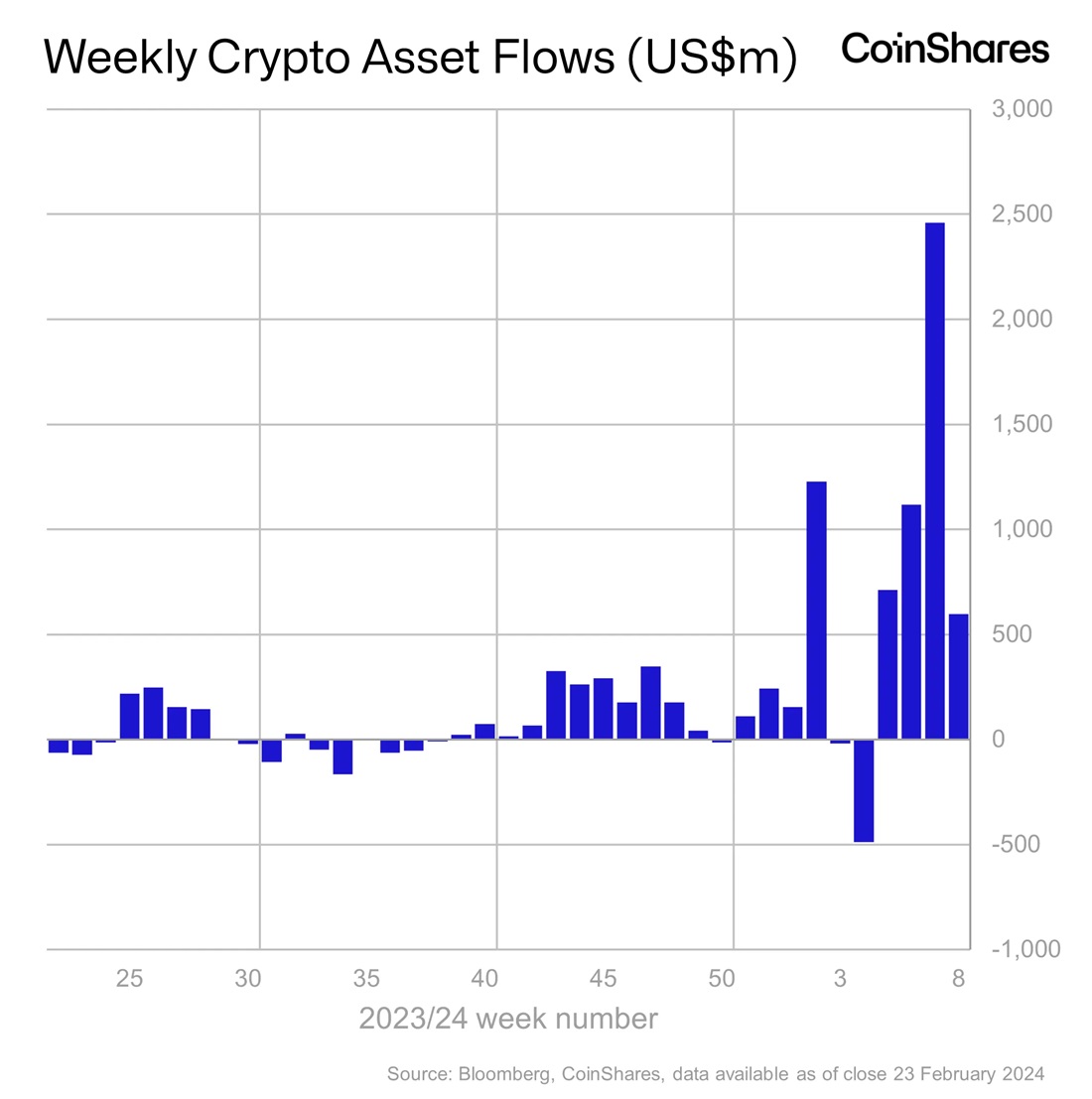

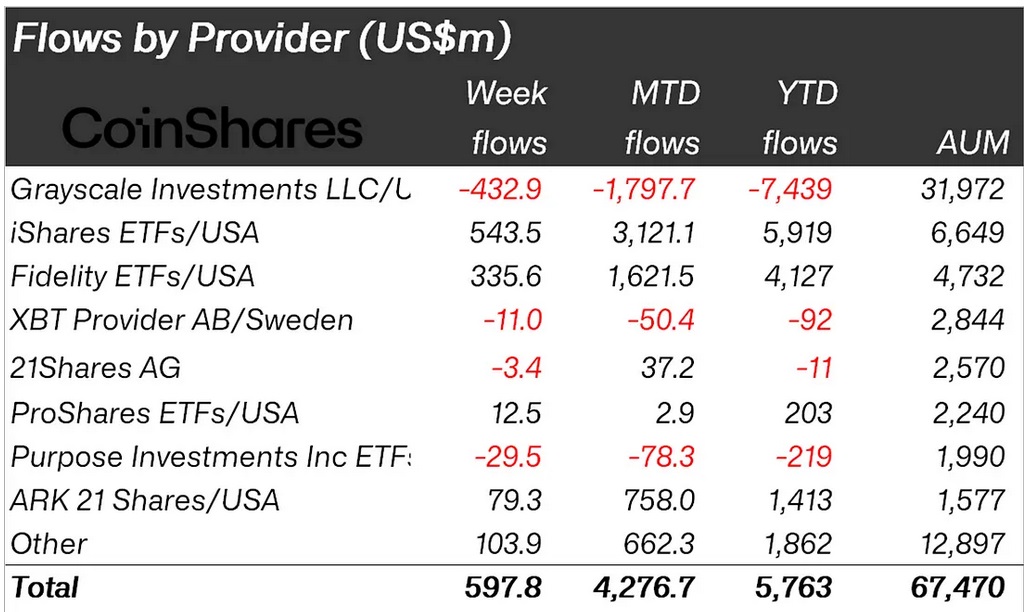

This strong performance from new ETFs suggests high interest in the underlying asset, Bitcoin. To fully appreciate it, it's worth looking at the net capital inflows into crypto ETFs, which attracted $600 million in investments over the past week.

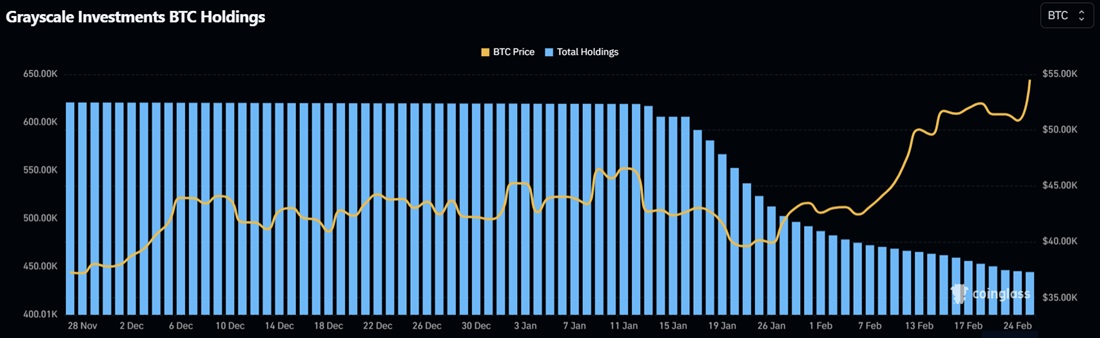

The figure could have stopped at the $1 billion mark were it not for continued outflows from the Grayscale (GBTC) fund. Its negative performance is due to a significant discount on the underlying asset in 2023, which attracted speculators, and a high management fee of 1.5% versus the 0.2% to 0.3% fee offered by other ETFs.

On the positive side of the story, however, the rate of daily outflows from GBTC slowed from an average of $500 million in the first week after it converted from a trust fund to a spot ETF to $50 million in the last two days.

In total, spot ETFs have now accumulated $6 billion in investments. Significant capital inflows have renewed talk of Bitcoin replacing gold among investor preferences. Gold ETFs currently boast $90 billion. Bloomberg analyst Eric Balchunas believes Bitcoin will overtake gold funds in less than two years.

This alone will cause Bitcoin's price to rise above the six-figure level.

Michael Saylor, head of MicroStrategy, the largest public holder of Bitcoin, also thinks the current price is low. On 25 February, MicroStrategy acquired an additional 3,000 BTC at a price of around $51,800. The company now has in its reserves 193,000 BTC purchased at an average purchase price of $31,500, with unrealised gains approaching $5 billion.

In a recent interview with Bloomberg, Saylor said he has no intention of selling assets in the foreseeable future since the cryptocurrency is competing with gold, the S&P index and the real estate market as a means of savings. He clarified that "Bitcoin is technically superior to those asset classes. And that being the case, there's just no reason to sell the winner to buy the losers".

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.