Bitcoin fever: skyrocketing fees and suspension of Binance withdrawals

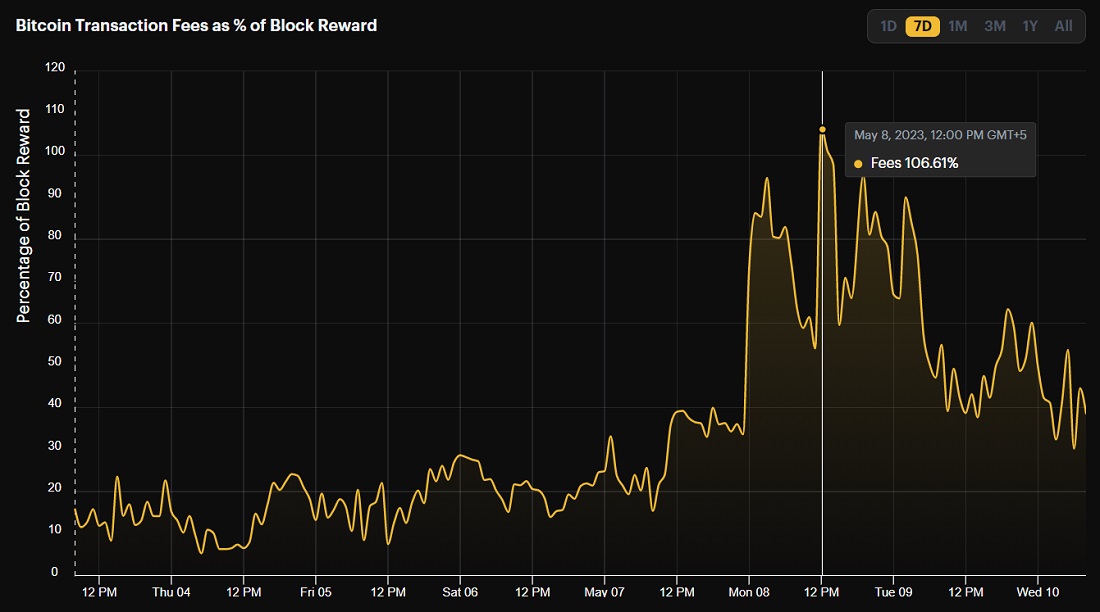

The Bitcoin network overload resulted in a surge in fees, which averaged $31 per transaction on 8 May. Miners were excited by the news because, for the first time since 2017, the fees exceeded the reward for mining a block.

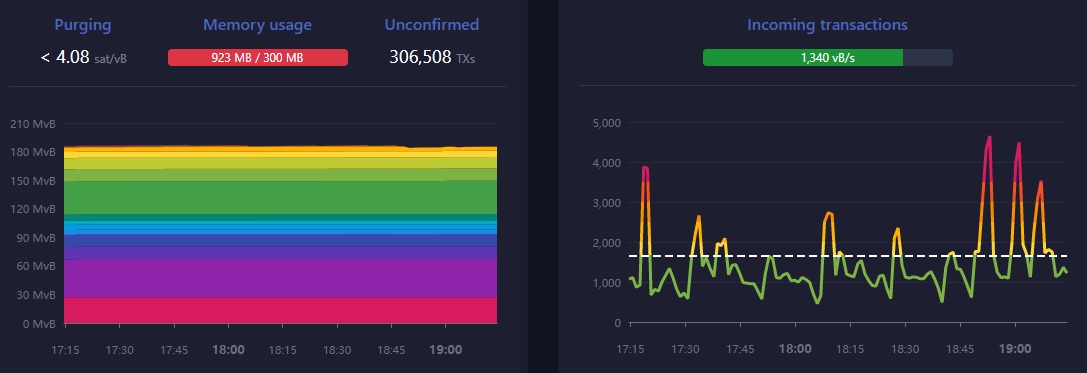

But users have encountered a number of problems. Many transfers are stuck in the mempool because of low fees, as miners choose transactions with the highest fees when forming blocks.

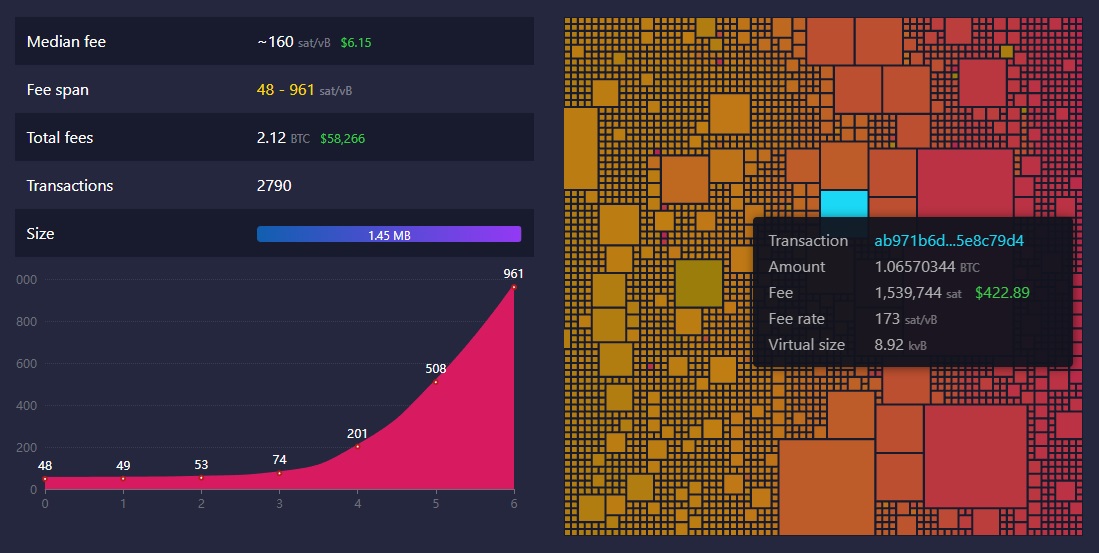

Experienced users have manually set a fee that's higher than the current average. For some transactions with a large number of entry and/or exit points, the fee has reached $1,500.

Some operators, including Binance, were unprepared for the fee increase and didn't raise the rate for users in time. As a result, transactions got stuck in the mempool. The exchange has halted withdrawals twice to raise the transfer fee. The company also announced that it is prioritising the implementation of the Lightning Network, which runs on top of the Bitcoin network and allows fast transactions between LN members at minimal costs.

The situation still remains tense. There are 400,000 unconfirmed transactions in the mempool, which will take 24 hours to process. And, despite the increased fees, demand is high.

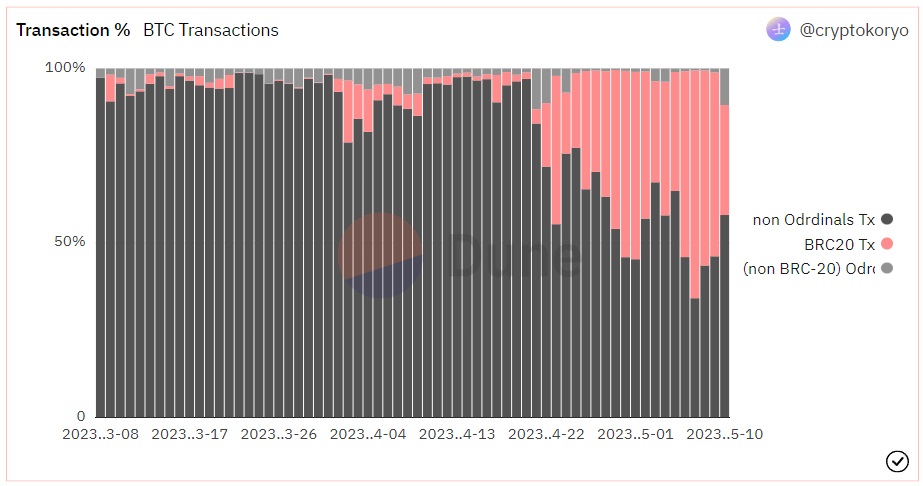

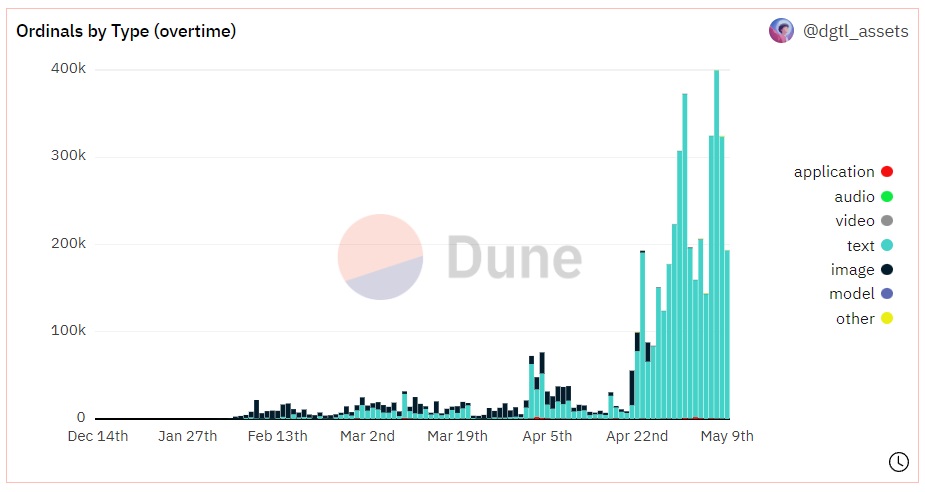

The main pressure on the network comes from the Ordinals protocol and BRC-20 tokens based on it that appeared in 2023. Ordinals allowed the numbering of mined satoshi, which led first to the emergence of NFT analogues and then to coins (ERC-20 analogues). Half of all transactions are currently linked to Ordinals.

A closer look at the Ordinals shows that the boom in new coins overshadowed the demand for NFTs. ORDI, NALS and PEPE are among the most sensational ones. This is good news for those who use Bitcoin solely as a payment network, as it speaks to the temporary nature of the excitement. If over 20,000 images were minted on some days in April, less than 1,000 images are released now.

The hype around the BRC-20 coins will likely cool down soon, with the fee returning to its lower rates.

Despite the difficulties, this is a positive development for Bitcoin. First, miners will only have to rely on fees when the last coin is mined. The new application of the network is to support their engagement and keep security and decentralisation at a high level. Second, the emerging crisis encourages the rise of second-tier networks and the development of additional services. Third, the growing demand for Ordinals leads to an increasing demand for Bitcoin. So if Biden follows Trump in minting his own collection, only with Ordinals, it'll increase the investment appeal of Bitcoin among Democrats.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.