Bitcoin: Reaching $45,000 by the late May

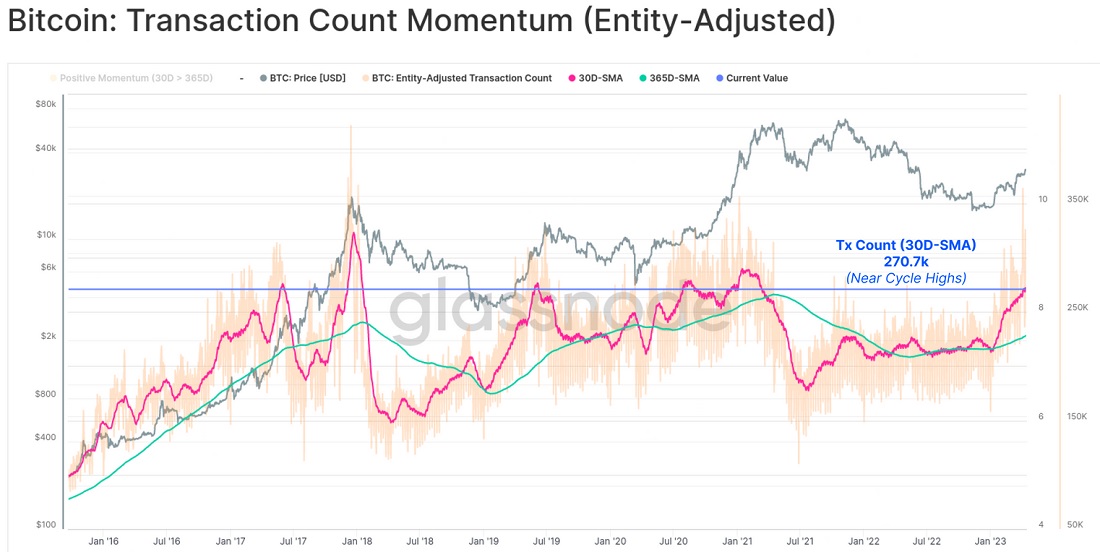

Network metrics are pacing the macroeconomic factors, predicting Bitcoin's continuous rise. And institutional investors, first concerned about tightening crypto regulations, are building up their presence in the market for the fourth week in a row.

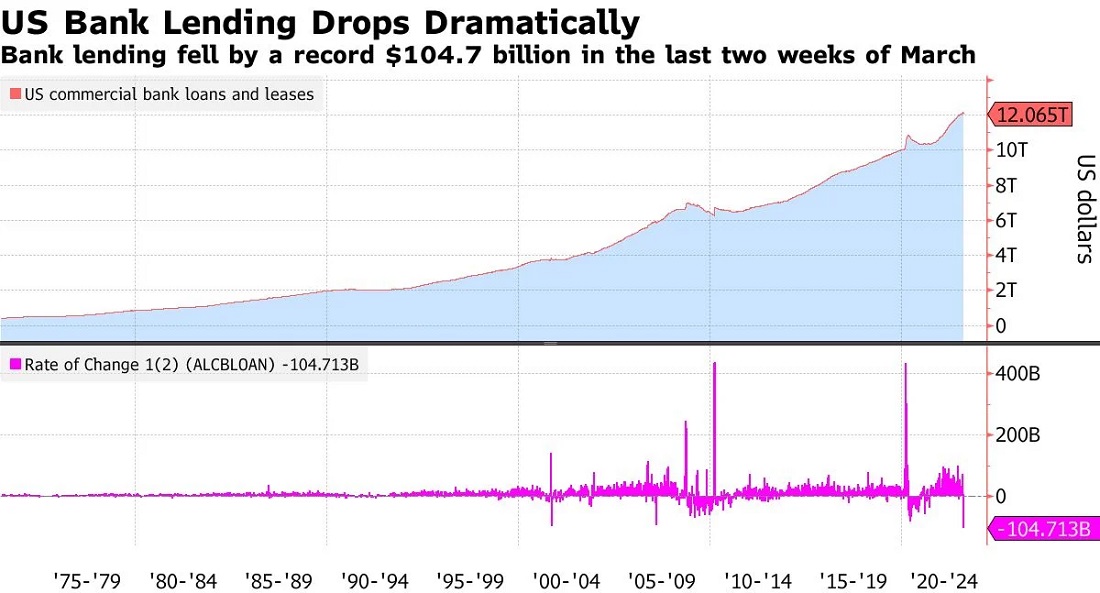

The macroeconomic breeze is being driven by the Fed's monetary policy mess and predictions of an imminent recession. The rise in key interest rates has already caused three US banks to collapse, and the contraction in the US lending market has set a new record of $105 billion in the last two weeks of March. As the Fed promises to further step up its efforts to fight inflation, the likelihood of further shocks to the banking sector is greatly increased.

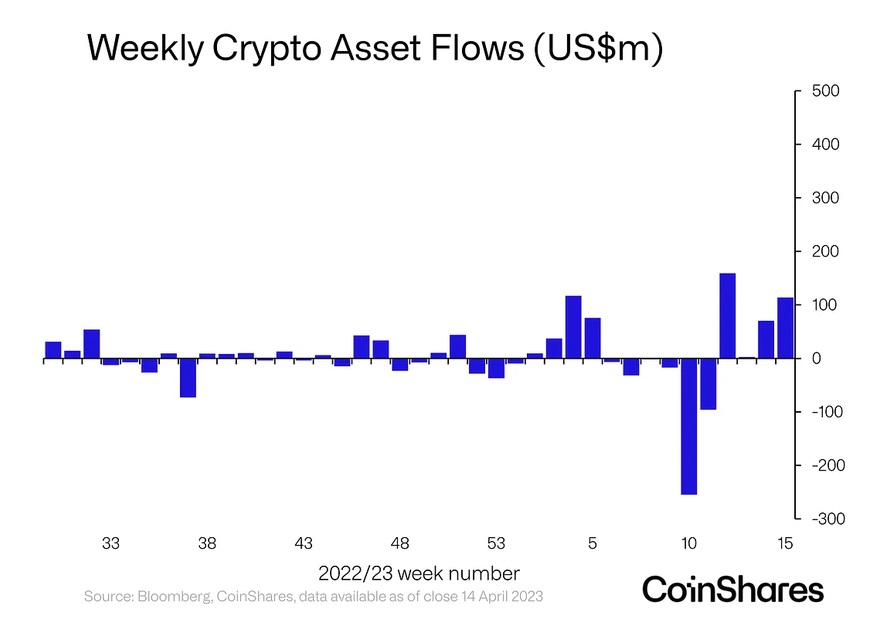

It resulted in an outflow of funds into both cash and cryptocurrency funds. For the fourth week in a row, institutional investors have increased their investments in favour of Bitcoin, pouring $103.8 million into cryptocurrency in the last week alone.

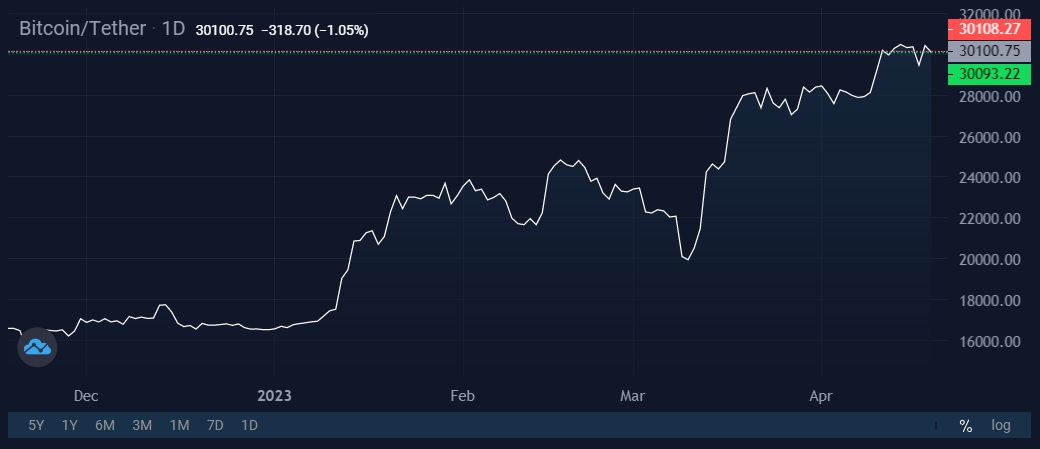

Interest is also fuelled by Bitcoin's good start, showing a 70% quarterly return, leading Goldman Sachs analysts to call it the best-performing financial asset in 2023.

An increase in network activity is signalling support, indicating widespread demand for cryptocurrency. This is not just an oversold asset's correction but a new sustainable trend.

When it comes to price targets, the analytical agency K33 predicts another 50% increase over the next 30 days.

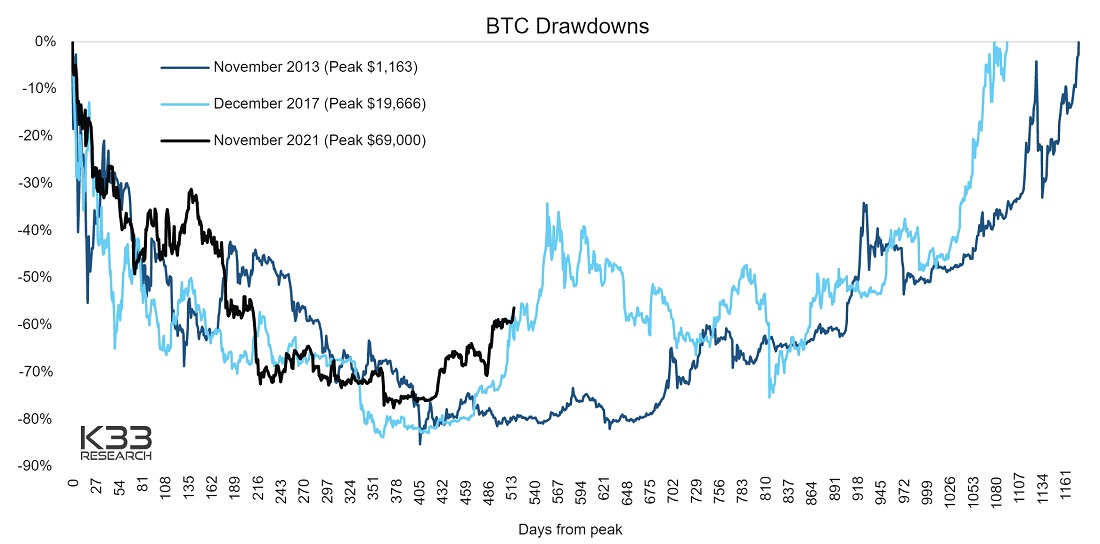

The analysis is based on the striking similarity between the 2018 and 2022 cycles. In both cases, it took around 370 days to drop from the historical high and another 140 days to recover to 60%. Further extrapolation suggests that Bitcoin will trade at $45,000 in late May.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.