Bitcoin's price rises despite macro threats

Metrics suggest the coin's price will continue to rise despite the threat of a global recession and increased regulatory pressure on the cryptocurrency market. After hitting a six-month high, Bitcoin may soon test the $30,000 level.

In every bearish cycle, investors incur losses. Some of them leave the market. Historically, Bitcoin finds a bottom when the largest number of long-term holders (LTHs) give up their positions. This cycle was the most painful for LTHs, as their share of coins sold reached 58% at its peak.

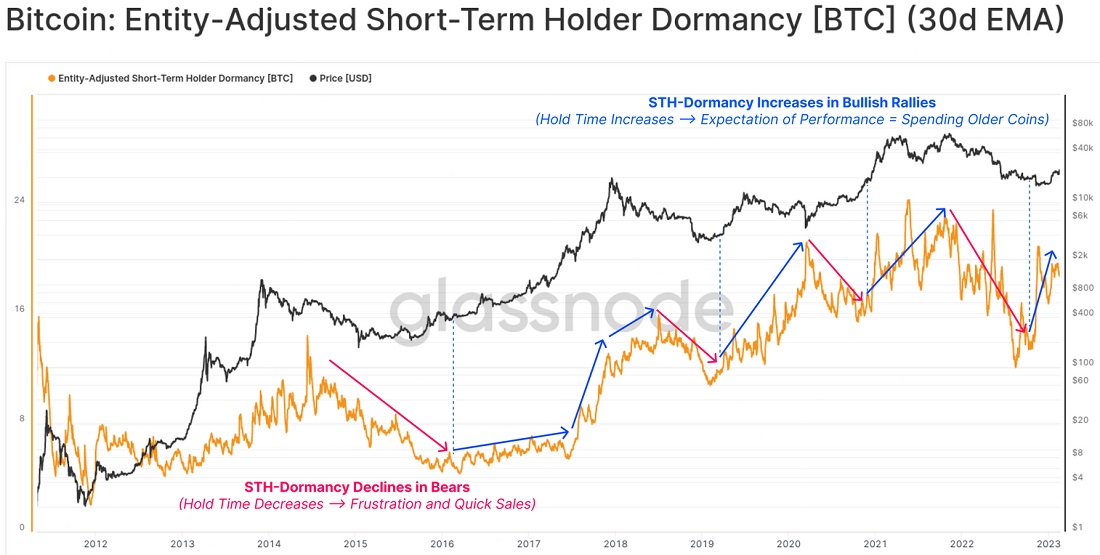

Tell-tale changes are seen in how short-term holders (STH) behave. In a bearish market, they're more likely to get burned, and the coins don't stay in the wallet for long (red arrows). On the contrary, speculators try to maximise their profits by grabbing coins at the lowest prices in a rising market (blue arrows). The STH group considered Bitcoin to be oversold several months before returning to growth.

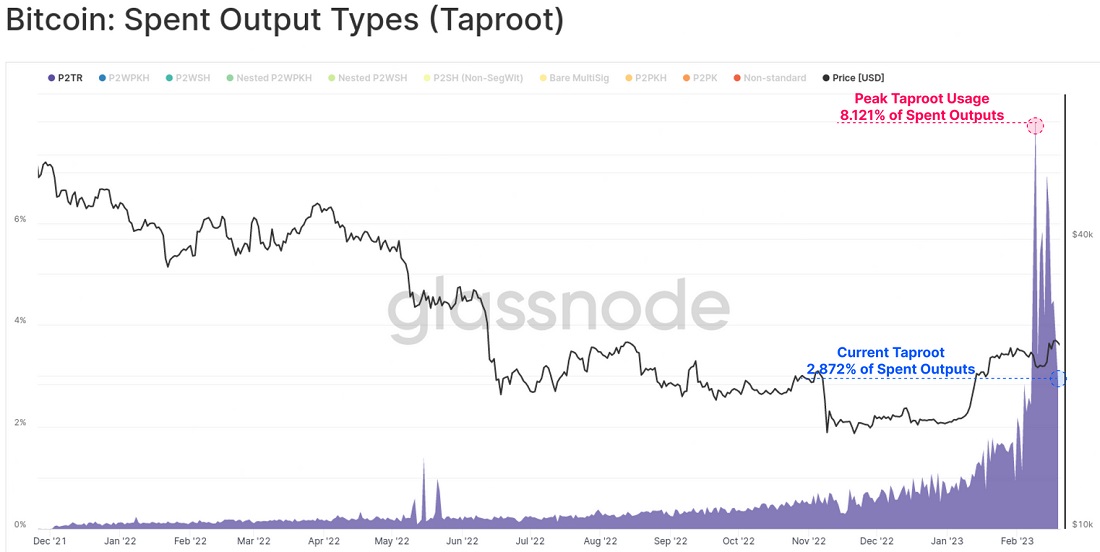

Ordinals have been the main driver for Bitcoin for the past month (we covered this new technology), of which over 150,000 have been minted so far. The increase in demand is clearly demonstrated by the Taproot update, which is needed to handle ordinals. Miners liked the innovation the most, as their additional income exceeded $1 million in less than a month.

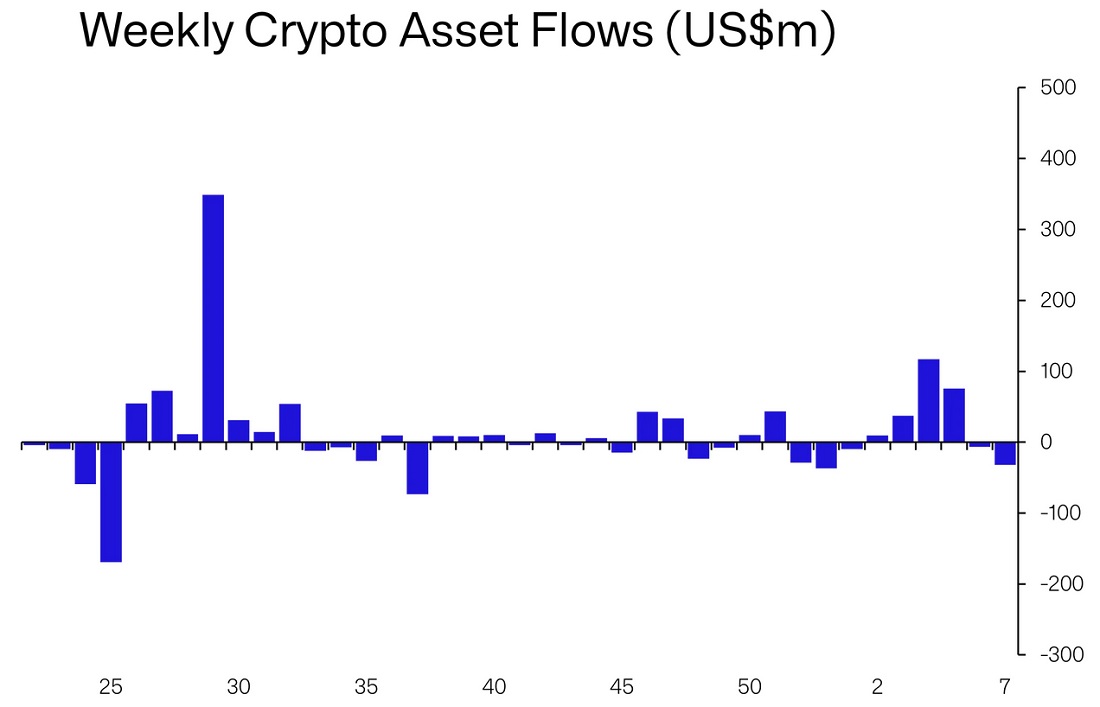

The only group of participants who don't expect the bullish trend to continue in the medium term are institutional investors. The outflow from Bitcoin funds amounted to $35.6 million in the last two weeks.

Major investors' fears relate to the Fed's intention to continue tightening monetary policy as the regulator aims to push inflation down to 2%. Core inflation in the US is currently at 5.6%. A further key rate hike could lead to a recession in the US economy and increased capital outflow from risky assets.

Other indirect counterarguments include stricter crypto regulation forcing US crypto exchanges to refuse to provide staking services, the potential granting of security status to PoS coins, and the imminent arrival of the Stablecoin Trust Act.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.