Bitcoin inflow to crypto exchanges hits 10-year low

While some analysts are predicting that Bitcoin will drop to $40,000 per coin and others are talking about the end of the bull cycle after hitting a new all-time high, network metrics are showing growing pressure from the demand side.

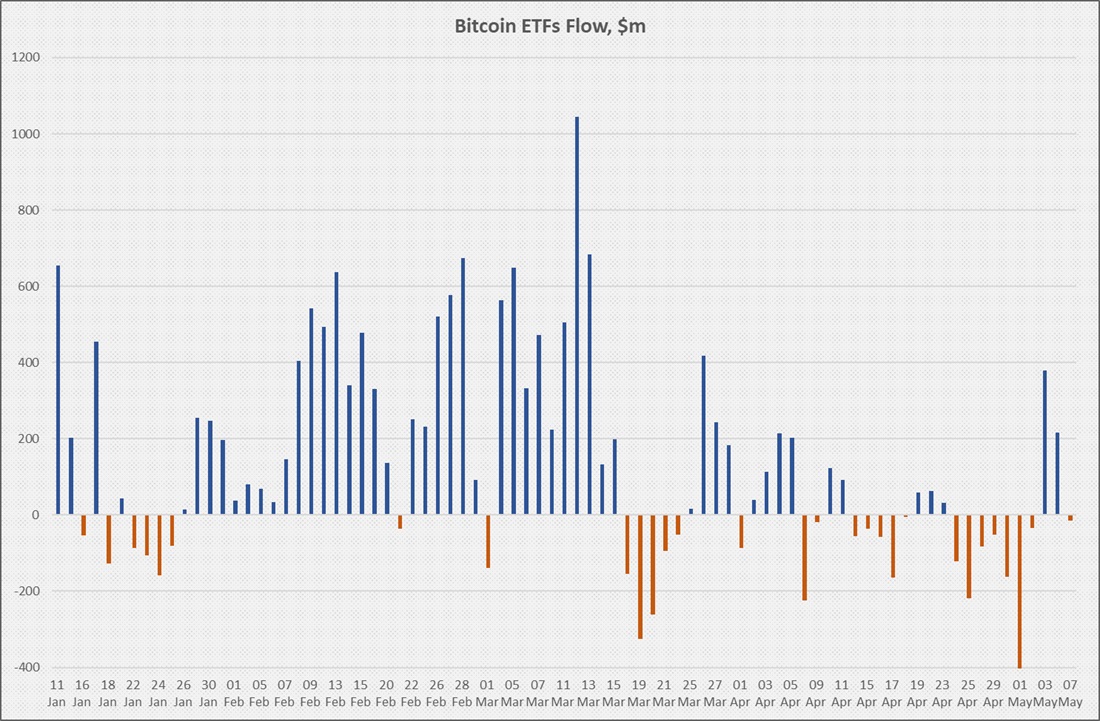

The current cycle is diverging from how things usually go since a new all-time-high price was set before the halving event. This was due to a significant influx of capital as a result of spot Bitcoin ETFs being allowed to go to market in the United States. In the past three weeks, inflows have given way to outflows, confirming the hypothesis about the end of the momentum and a potential reversal.

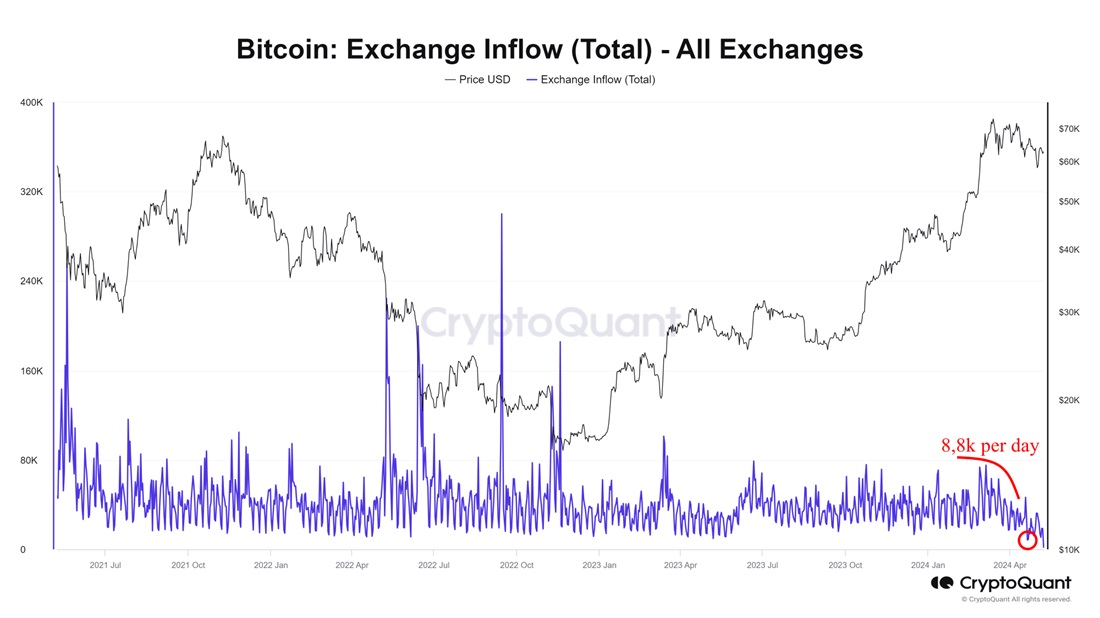

ETFs have been a strong mover in 2024, but they're far from the only one. Hodlers' sentiment and market participants' long-term assessments continue to play a leading role. One key metric is the inflow of Bitcoin onto crypto exchanges. The more people there are who want to exchange BTC for stable coins or fiat currency, the greater the influx is.

At the end of April, this figure fell below 10,000 BTC per day, hitting a 10-year low.

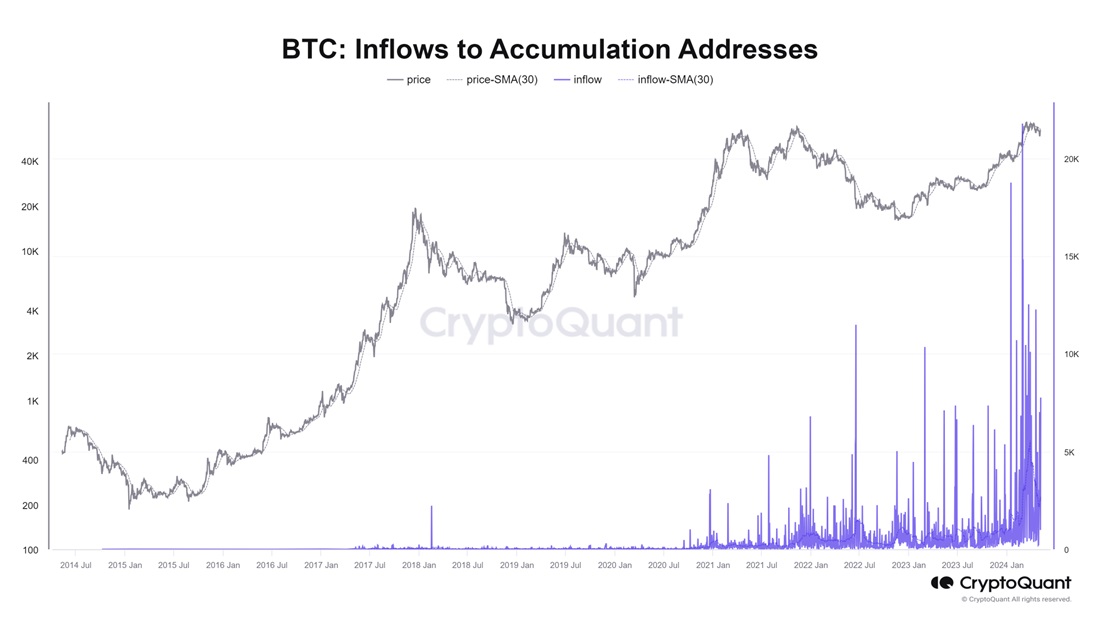

The high interest in savings is also indicated by the continued rapid influx of coins to savings addresses. These include addresses where two or more incoming transactions have been recorded and where there is no outflow of funds.

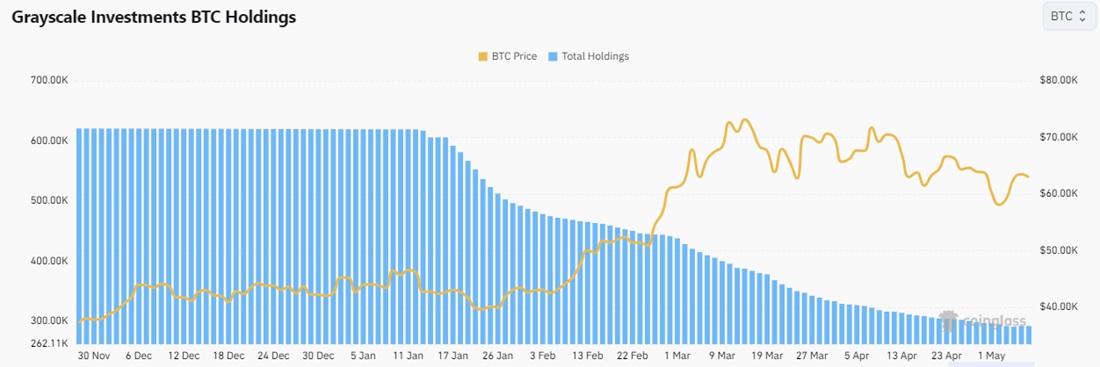

The overall picture is spoiled by a decrease in the share of coins that have remained idle for more than a year. That figure has dropped from 70.8% at the end of November to the current level of 65.8%. However, it must be kept in mind that nearly half of this trend was provided by the conversion of the Grayscale trust fund into a spot ETF. Some investors rushed to take profits, while others transferred their investments to similar ETFs with lower management fees.

Since it converted to a spot ETF, this fund has more than halved to 292,000 BTC.

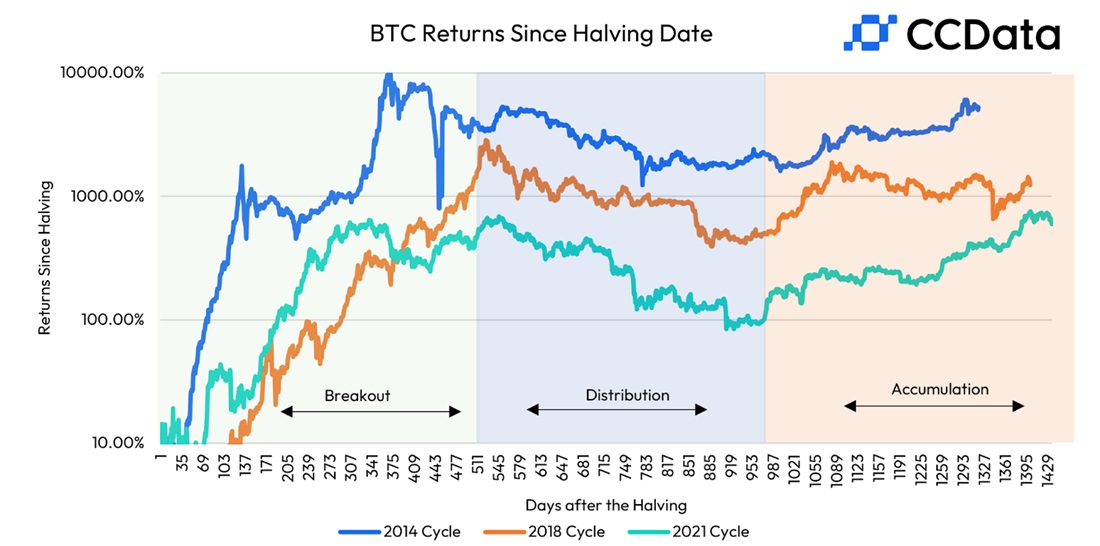

If we talk about time intervals and expectations for setting new all-time highs, the post-halving price rise lasts from 350 to 500 days.

Moreover, in the first two months, there has always been a consolidation with minor price fluctuations.

Only about 20 days have passed since the halving event took place, so it's too early to summarise the new cycle's results, and investors should be patient.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.