Problems for Ethereum

After Ethereum transitioned to a Proof-of-Stake (PoS) network, it gained both internal and external problems. On the one hand, the uncontrolled growth of over-staked ETH creates systemic risks, while on the other hand, the SEC is seeking to deem the altcoin a security.

The PoS network offered coin holders the opportunity to receive passive income. However, the threshold of 32 ETH (~$100,000) to connect on one's own turned out to be too high for most participants. This led to a rise in the popularity of such services as Lido that make it possible to stake any amount. Moreover, in return, Lido issues a stETH token, which can also be sold or pledged on other platforms.

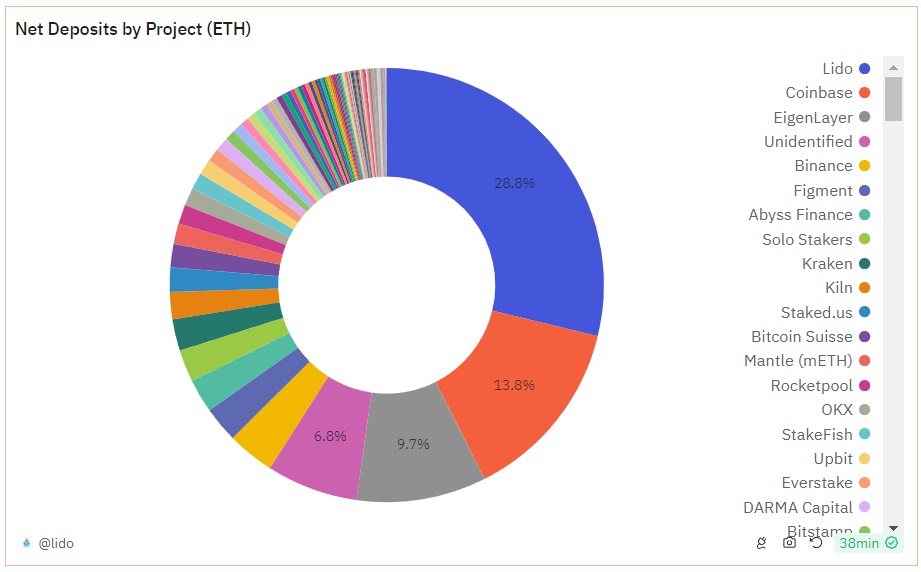

Lido accounts for 20% of all staked coins and 8% of the total Ethereum supply. The high significance of a single project creates systemic risks.

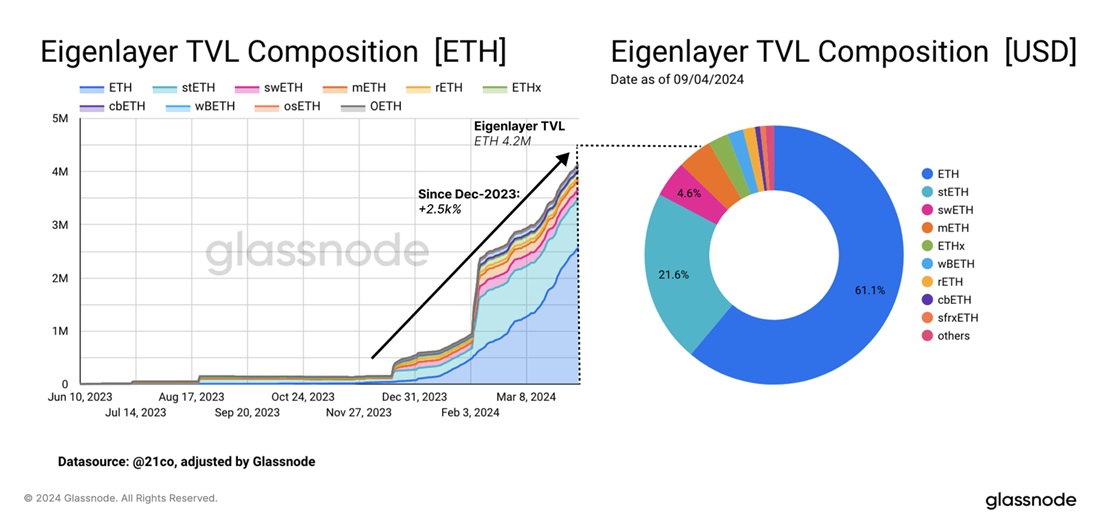

Last year, the liquid staking market saw the emergence of the EigenLayer platform, which allows coins derived from staking ETH to be re-staked. This year, the amount of funds staked in the project rose from $1 billion to $15 billion.

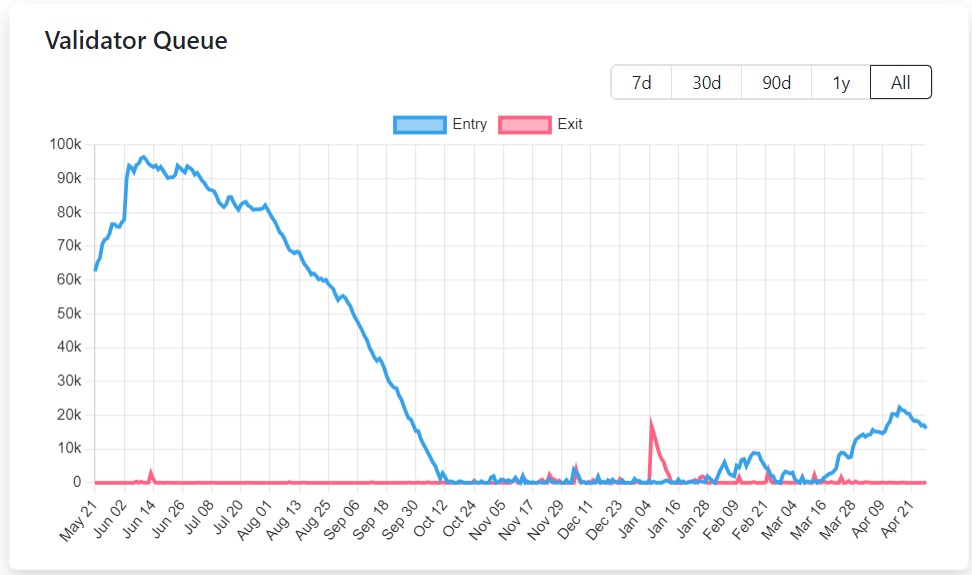

The ability to re-stake funds significantly increases the basic yield from staking, which is why the queue of people wanting to freeze ETH has grown again. This is also thanks to the announcement of the upcoming airdrop in EigenLayer.

The number of validators is now approaching 1 million, which is more than enough to ensure the network's security and functionality. Moreover, their continued growth will inevitably lead to network congestion.

Ethereum has a mechanism for reducing yield from a higher number of validators. However, re-staking platforms make it ineffective. In upcoming updates, developers are considering the option of including additional restrictions, but the community was hostile to this news.

In addition to the increasing network load and the emergence of systemic risks, the staking craze could trigger an increase in inflation when payments for staking exceed the volume of coins burned from transactions. Additionally, the growing interest in derivatives is undermining ETH's role as a medium of exchange and store of value.

In May, Ethereum will face more disappointing news when the SEC will likely deny applications to launch spot ETFs. This will cause another wave of altcoin declines against Bitcoin.

The reason for believing so is that SEC representatives aren't meeting with managers. In contrast, before the launch of Bitcoin ETFs, they held weekly meetings. Secondly, the SEC has filed new pre-trial actions against market participants that use Ethereum. In particular, Uniswap Labs received a Wells Notice this April. All this speaks to the regulator's desire to go all the way in its attempt to limit investors' access to altcoins as much as possible.

StormGain Analytics Group

(an all-in-one cryptocurrency platform)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.