Bitcoin set for increased turbulence with a slump of 35% to 70%

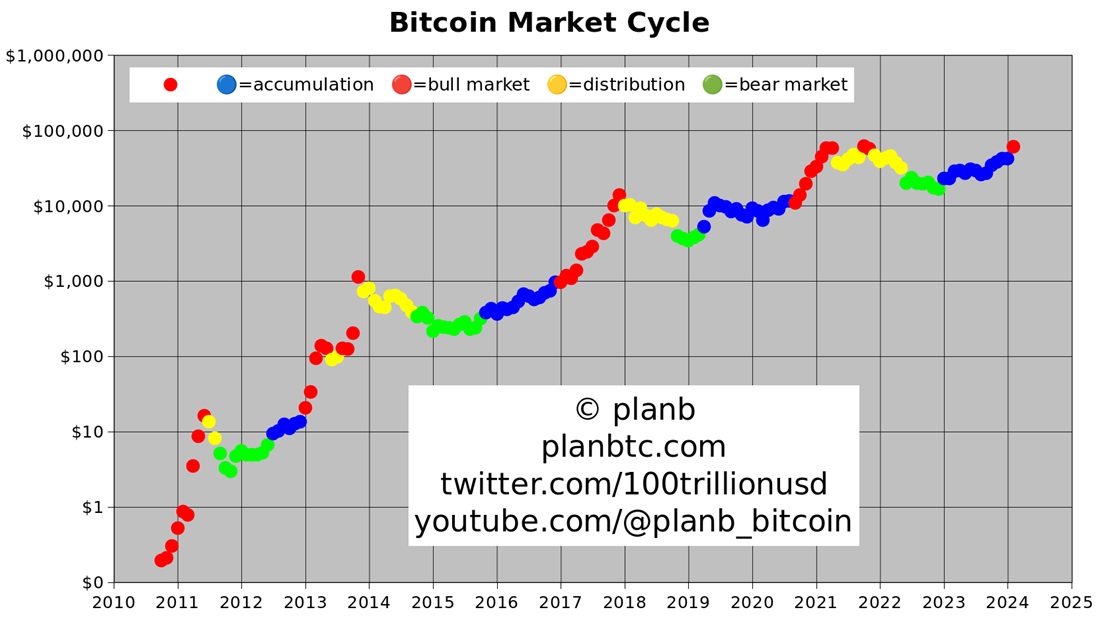

Since 2023, Bitcoin has been in an accumulation phase characterized by a steady rise, relatively low volatility and modest corrections. Now, according to the Stock-to-Flow model, the cryptocurrency has entered a growth phase.

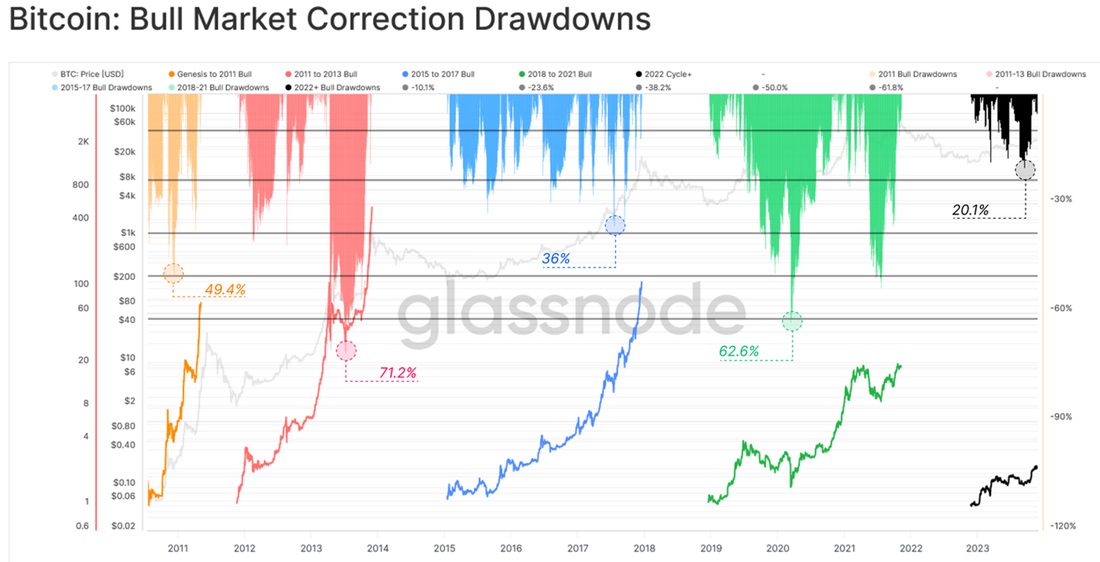

In the accumulation phase of the current bull cycle the coin price fell by no more than 22%. As we move into the growth phase, this situation will change. Historically at this stage, we have seen corrections of 36% to 71% before the price reached new heights.

The upcoming halving holds potential to trigger a slump. Pressure will come from both miners, whose revenues will be cut in half, and whales, who prefer to unload stocks on big news. A similar combination of factors played out following the approval of spot ETFs, when Bitcoin fell by 18% instead of the expected rise from the much-anticipated news.

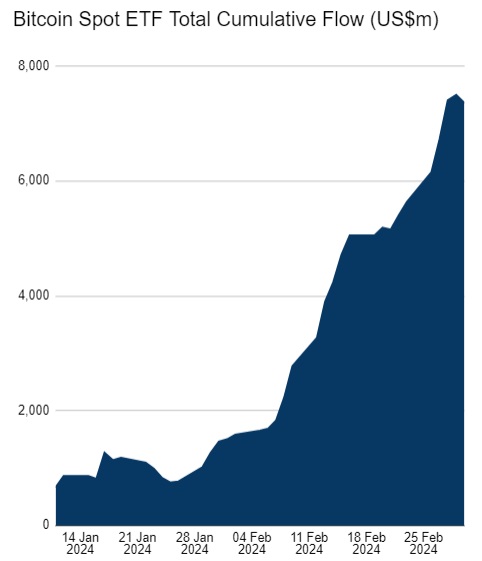

Compounding the situation is the fact that spot ETFs account for 75% of all Bitcoin investments over the past two months. As of March 1, Bitcoin ETFs had recorded more than $7.3 billion in net inflows.

There are two reasons for the problem with ETFs. First, investors gained free access to the market who had never gained exposure to the cryptocurrency before. They are now buying under the influence of FOMO (fear of missing out on gains). But in the same way, they will rush for the exit when Bitcoin sees a major correction.

Second, the SEC insists that any Bitcoin ETF must operate on a cash-only basis. This means that on the day investors start dumping shares, funds will sell a similar amount of Bitcoin on the crypto exchange. This has the potential to set off a chain reaction, as a sudden large influx of sellers will push the price down further.

JPMorgan has cautioned investors that the price of bitcoin could fall to $42,000 after the halving event. At the current price, this is a drop of more than 30%, or 40% if the high is updated and hits $70,000. Such a correction is typical of the growth phase.

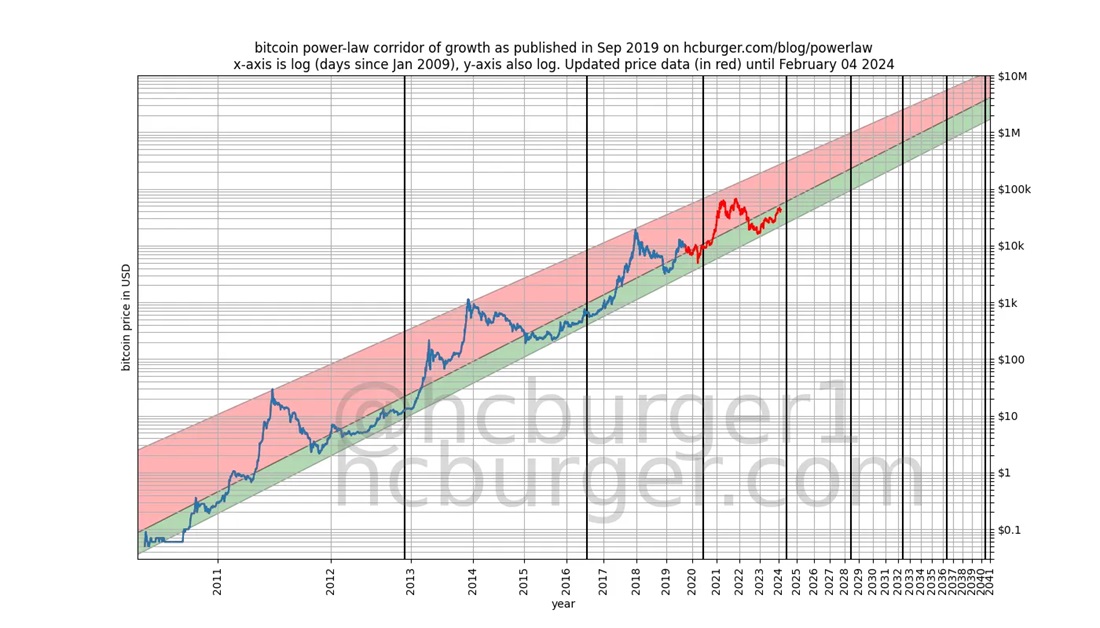

That said, on a longer-term basis, Bitcoin has re-established its long-term uptrend, which is clearly illustrated by the following chart.

It is not a given that the reaction to halving will be negative. The general message, however, is that major corrections for Bitcoin are both inevitable and natural. Investors should prepare for sharp negative fluctuations typical of the growth phase. This comes despite the positive factors that include the approval of spot ETFs and Bitcoin halving.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.