Bitcoin liquidity hits new lows

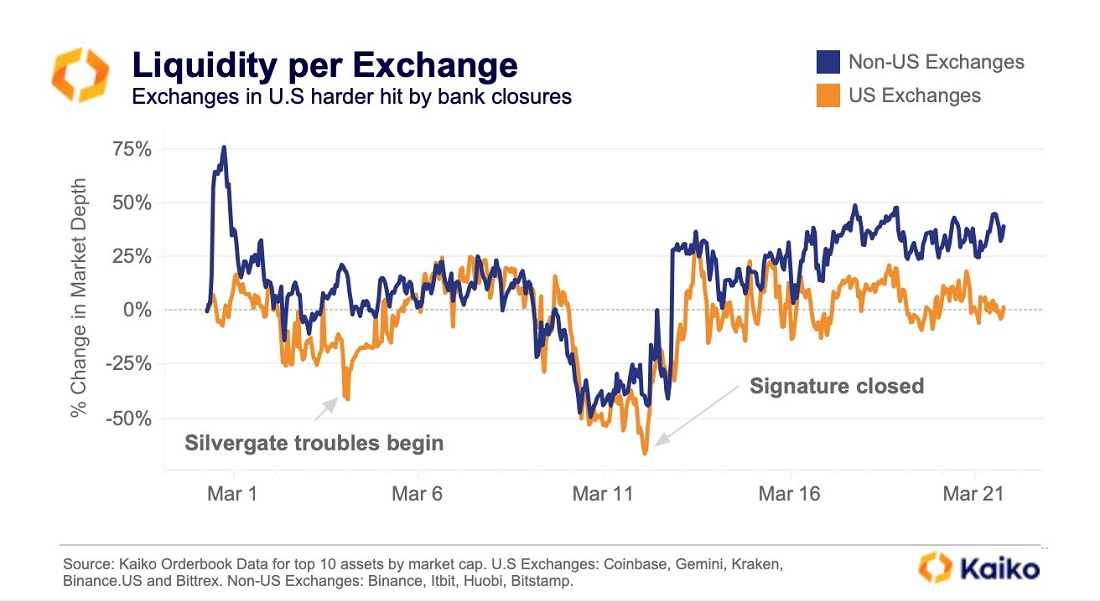

The bankruptcy of leading cryptocurrency banks (Silvergate, SVB, Signature) and the hidden displacement of the crypto industry from the financial system in the US have driven Bitcoin liquidity down to a 10-month low.

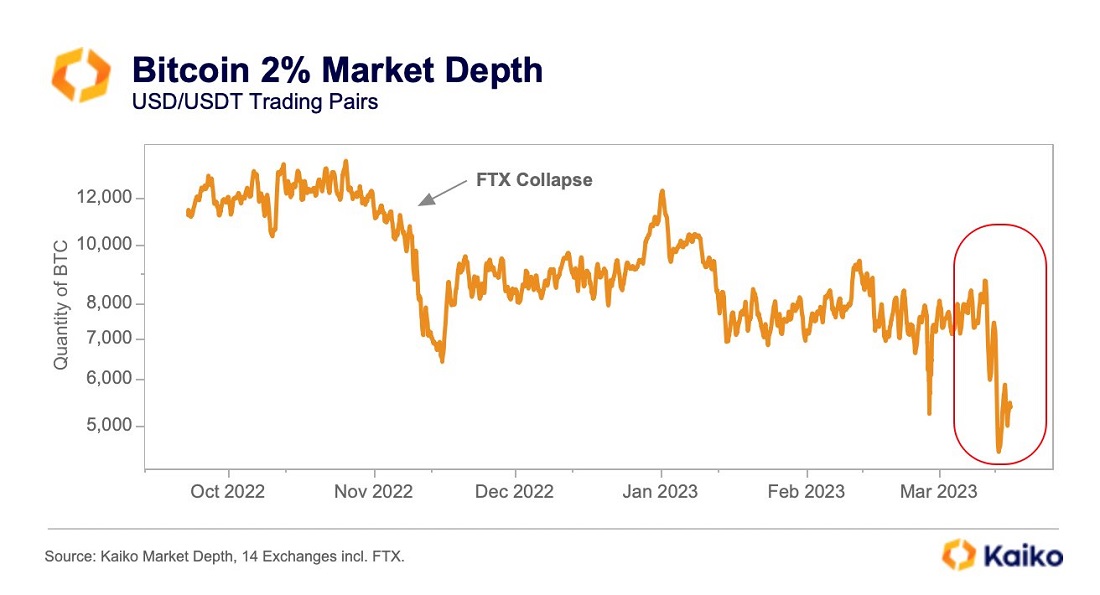

In this case, liquidity is measured by the volume of buy and sell orders within a 2% price range. Simply put, the more buyers and sellers there are, the more efficiently the market processes orders. With high liquidity, it's more difficult for a large participant to influence an asset's price, which reduces the risk of manipulation, And price volatility goes down correspondingly.

Bank collapses and a series of regulatory hurdles have reduced the presence of market makers, resulting in Bitcoin's liquidity being worse than during the collapse of FTX, the third-largest cryptocurrency exchange Liquidity on US crypto exchanges has also declined relative to other market participants, and the slippage rate for $100,000 in volume has increased 2.5 times on Coinbase in a month.

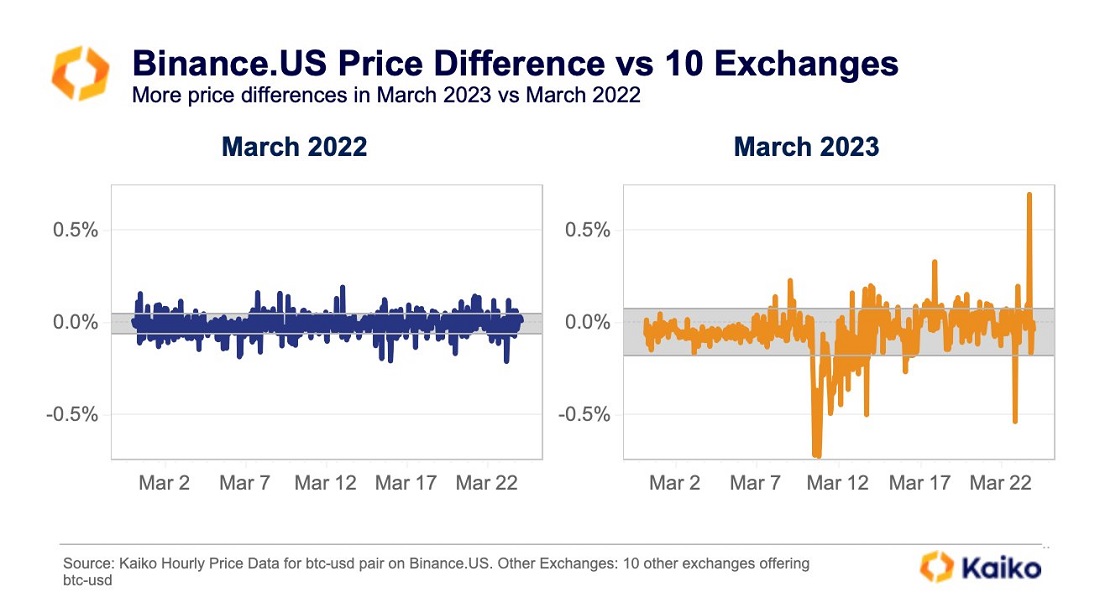

Binance's US unit has faced the same problems, with volatility in the BTC/USD pair increasing several times over compared to March 2022.

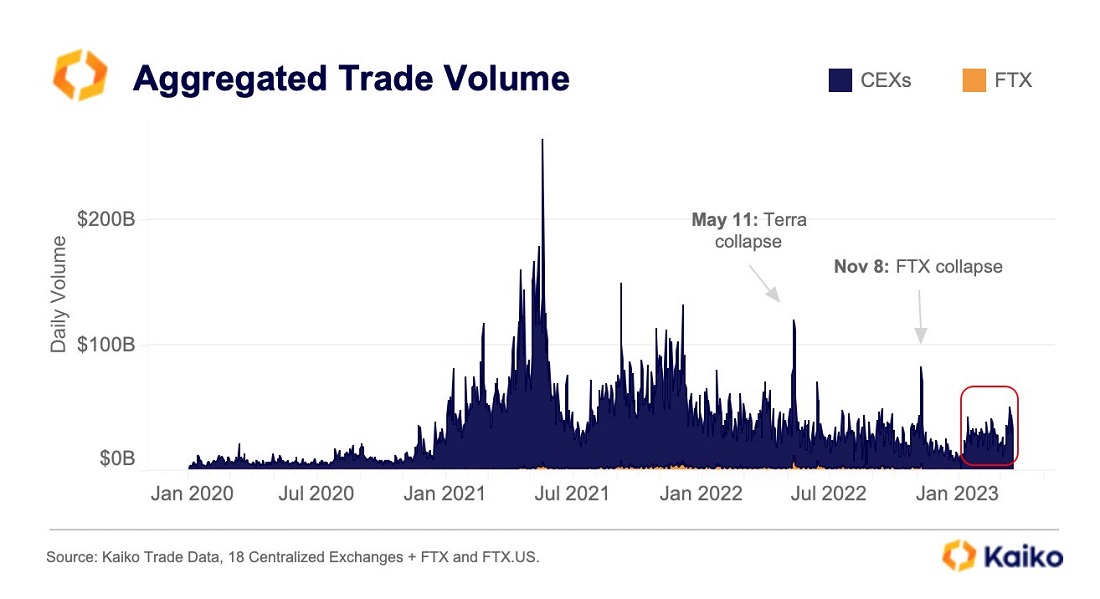

Conor Ryder, a research analyst at Kaiko, believes that liquidity levels will soon recover since trading volumes have returned to growth in 2023.

Increased interest in cryptocurrencies, especially Bitcoin, has been driven by the worsening macroeconomic environment and the US banking crisis.

Economist Nouriel Roubini believes that the actual unrecorded losses of US banks aren't $620 billion (as reported by the FDIC) but $1.8 trillion. In other words, 80% of banks' capital is under water due to the tightening of its monetary policy, which has led to a number of instruments on banks' balance sheets losing part of their value. In the event of increased deposit outflows, everyone will face a liquidity crisis, and new bankruptcies could trigger a chain reaction in the industry.

"In fact, judging by the quality of their capital, most US banks are technically near insolvency, and hundreds are already fully insolvent," Marketwatch quotes Roubini.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)

Tags

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.

Try our Bitcoin Cloud Miner and get additional crypto rewards based on your trading volume. It's immediately available upon registration.